A Powerful Investment Secret That Took Two Decades of Reading and Thinking to Figure Out

In today's essay... a powerful investment secret that took me two decades of reading and thinking to figure out.

This investment secret will show you how to build a portfolio that I believe will make you money in almost any market condition. The ideas in today's essay will allow you to make money in the stock market even when you're bearish or afraid of stocks in general. And here's the best part: These secrets will also show you how to outperform in bull markets. In short, these are the most valuable ideas anyone could give you about investing in stocks...

Trust me, you won't learn these things in school. And while a few great investors could teach you these things, almost no one would. You see, great financial strategies are only valuable if they're relatively unknown. That, of course, raises two important questions we should answer first...

Question No. 1: "Porter, if these strategies really are valuable... why on Earth are you telling anyone about them?"

That's easy. You and I have a fair deal that has made me a wealthy man. I work my hardest to give you the information I would want if our roles were reversed. And you pay me a fair price for the ideas I deliver. Unless I give you valuable ideas that work to deliver profits for you, you won't continue to pay me for my ideas.

If you've followed my work for any length of time, you realize financial research is both my job and my passion. Since the day I left college 20 years ago, this is the only professional work I've done. I have huge incentives to do my best to make sure that our ideas are the best you can find anywhere. What follows below are some of the best ideas I've found about how to safely make a lot of money in the stock market. Put these ideas to work and I have no doubt you will die wealthy.

Question No. 2: "Porter, once you've published these ideas, how do you know they will continue to work? If everyone knows how to use these strategies, won't the markets simply adjust prices in a way that makes it too expensive to follow? Why won't these ideas be 'priced out' of the market?"

This one is a lot less certain. The truth is, if I was doing a great job as a publisher, the value of these ideas would quickly evaporate. That's because more and more investors would begin to favor investments with these qualities, pushing their prices up to levels that would discount their value appropriately. Much like the odds on a horse race, knowing the "favorite" is only an advantage if other investors aren't wise to the advantages I'll describe below. But... I'm not concerned about losing our "edge" anytime soon. As you'll see below, these ideas aren't likely to become popular with the "herd."

First, these strategies require a fair amount of thinking. We can do most of the homework for you, but nobody can make you think. As philosopher Bertrand Russell once said, "Most men would rather die than think; in fact, most do." These ideas also require discipline to implement. Smarts and discipline? Almost no human being can bring those assets to bear when it comes to his money.

So I'm not worried. These ideas should never be popular. The truth is, even after reading this essay and seeing our results over the last decade of using these ideas... almost all of you will continue to invest as you have always invested. In my experience, people will not change their core investment strategies until after they've suffered a disaster.

But there's a way to do well in stocks, even when you're completely wrong about the market or the sector overall. That's what we're covering in today's essay: How to make money even when you're dead wrong about the market as a whole or the sector you're buying.

Consider homebuilder NVR (NVR). Even if you had bought NVR at the worst time possible (at its peak in 2005, just before the housing crisis began) you would still have nearly doubled your money in 10 years.

No, I'm not a rear-facing guru. I wrote an entire issue of my newsletter, Stansberry's Investment Advisory, primarily about why NVR would continue to thrive despite the crisis and why it's the only homebuilder you should ever invest in... and I wrote that issue back in 2007, when the stock was well off its highs.

This is an extreme example of how you could have made money even if you had bought into the worst sector at the worst time imaginable. And by the way, if you really didn't know that real estate and homebuilders were in a bubble by 2005, you must have been living in a cave... or a drug-induced state of euphoria. Even mainstream financial magazines were warning people about the madness in residential real estate.

So what's the secret? How did I know that NVR would thrive despite the crisis? It's simple... and you've seen me write about it for years and years: NVR was (and still is) the most capital-efficient homebuilder in America by a wide margin.

As longtime readers know, a capital-efficient business is able to generate outsized returns without investing heavily in expensive machinery, research and development, or factory maintenance. One of the main symptoms of capital efficiency is the ability to pay large sums of money back to shareholders.

Just consider this: From 2011 to 2014, NVR returned more than $1 billion to shareholders – about 20% of its market cap. I doubt another homebuilder in America has returned that much capital to shareholders ever, in total.

This incredible capital efficiency means that if you own NVR, you don't need to depend on gimmicky "earnings growth" or a "greater fool" who is willing to pay too much for your shares. You can just sit there and earn massive profits year after year because the company is producing huge cash returns for its owners. Yes, you'll certainly make more money if you're able to buy the stock at a low point. But as long as you pay a reasonable price, you're nearly certain to do well... no matter what else happens in the markets.

Even if you had bought this stock at the worst time to buy a housing stock in your entire life, you would have still done OK because of this company's highly capital-efficient business model.

Now... here's the secret. A few types of companies are always capital efficient because of their structures.

Some, which we've written about extensively, are certain kinds of insurance companies. We prefer property and casualty (P&C) insurance companies over life insurance companies for one reason: Everyone dies. It's difficult for life insurance companies to produce excellent underwriting results because they are all working off the same mortality charts.

On the other hand, P&C companies can (and do) have different underwriting strategies. For high-quality underwriters, capital is not merely cheap, it's "less" than free. As you know if you've ever paid for homeowner's insurance and never made a claim, it's the insurance company's customers that provide all of the capital – and more – that's required to operate it.

RLI is a small, high-quality P&C insurance company. The chart above shows you the performance of its stock over a recent 15-year period – an investment lifetime for most people. This gives you some appreciation for what's possible for an investor who can identify truly capital-efficient businesses. We'll help you find them, but it takes thinking to understand their advantages and discipline to stick to only owning companies like these.

Obviously, most investors want some diversification. And we don't recommend only investing in insurance companies. But we do want to note that in 1947, Shelby Davis invested $50,000 in just 12 high-quality P&C companies. He never sold them or traded them. By the 1980s, he was on the Forbes 400 as one of the wealthiest people in the world.

Davis is the only person we know of who became a billionaire simply through passive common-stock investments. Likewise, we know investing legends Ben Graham (perhaps the most famous investor of the last 100 years) and Warren Buffett earned most of their common-stock investment returns through insurance companies. We are certain that sticking with insurance would lead to vastly better investment results for most individual investors.

There's another kind of business that's almost as capital efficient as insurance and that can operate in just about any sector. These firms are the absolute best way to invest in almost any industry or trend. I'm talking about royalty companies. These firms raise capital and then invest in operating businesses. But rather than buying stock or lending on credit, these companies buy a small percentage of the company's future revenue. Royalty rates vary, but they're typically between 5% and 10% of all future revenue. That adds up.

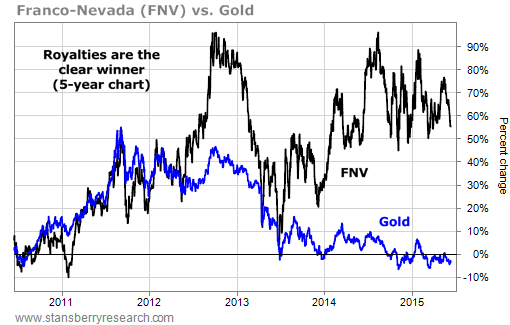

Lots of investors know about resource-focused royalty companies. The most famous (and one of the best) is Franco-Nevada (FNV). Most investors know that owning gold over the last five years hasn't been a great bet. (It's down around 3%.) But even if you bought gold at just about the worst possible time in the last 20 years, if you bought gold via exposure to Franco-Nevada's royalty streams – its stock – you've done well. You were up nearly 60% just a few years later...

Here's the secret: Royalty companies aren't limited to resources. In fact, most of the best companies we cover in terms of capital efficiency and quality are actually "hidden" royalty companies.

Take fast-food giant McDonald's (MCD), for example. Most investors think of McDonald's as a restaurant business and they know that most of the time, investing in a restaurant is a bad idea. But what they don't see is where McDonald's gets most of its revenue. It's not from its restaurants... it's from its franchises. McDonald's earns rich royalties from all of its franchised locations. Meanwhile, it's the storeowners who must put up all of the capital for these restaurants.

Here's another example. Did you know that soft-drink icon Coca-Cola (KO) doesn't generate most of its revenue from the sale of beverages? Nope, most of its revenue comes from the sale of syrup used by bottlers around the world to make canned or bottled soft drinks.

Coke sells syrup for the same reason that McDonald's sells franchises. It's a way of putting most of the capital costs associated with the business on the back of a local partner. It's the bottlers who have to pay for almost all of Coke's capital costs by building the local bottling plants and supplying all of the trucks needed for distribution.

If you think about this idea for a minute, it's simple to grasp. Take two stocks in the same industry. One has zero capital costs. It's a royalty firm, in one form or another. The other is a typical corporation that continues to reinvest its profits in capital projects. After all, almost all companies require capital to grow.

Over time, which business do you think is most likely to have rewarded its shareholders better? The company that has zero (or nearly zero) capital costs or the company that must reinvest 40% to 60% of its profits back into its business to help generate more growth? The answer, of course, is the company that doesn't have capital costs.

One final secret... Why aren't the massive differences in financial performance between capital-efficient companies like NVR, Coke, and McDonald's obvious to investors? It all goes back to the accounting. A few weeks ago, I explained that modern financial accounting was developed by the railroads. These businesses required massive sums of capital. The Pennsylvania Railroad (the biggest U.S. railroad) represented the largest accumulation of capital in human history at its peak in the 1920s. Therefore, financial accounting is mainly designed to measure the earnings and the depreciation of these massive investments in capital.

This kind of accounting is not useful when determining the value of an insurance company's revenues... or a royalty company... or a company like McDonald's, which receives so much of its revenues from capital-free franchise contracts. And yet... Wall Street continues to value all stocks by their reported earnings, which are generated using "railroad accounting" that has remained largely unchanged for more than 100 years. Understanding where there are huge differences between reporting earnings and cash results for shareholders gives us a big advantage over most investors – even most professional investors. I hope it lasts...

Now... what if everything – or mostly everything – that I've written today goes straight over your head? Or what if you understand the concepts but have no desire to figure out which insurance companies are good underwriters... or which operating businesses are capital efficient... or even which stocks in a given sector are royalty collectors?

Well, that's why we're here. In my Investment Advisory, we've been focusing on capital-efficient strategies for a decade. These are companies we believe will do well no matter what happens to the stock market as a whole.

These kinds of businesses offer investors tremendous amounts of what finance geeks call "alpha." That is, they offer higher returns per unit of risk. They generate this alpha because of an obvious advantage – a lack of capital costs.

I believe these ideas can make anyone a vastly more successful investor. I hope they do so for you. And I hope today's essay was helpful to you and helps you understand why we focus on capital-efficient companies.

Regards,

Porter Stansberry