The Hidden Backbone of the Chip Wars – Should Investors Buy ASML (ASML) After Its Tariff Drop?

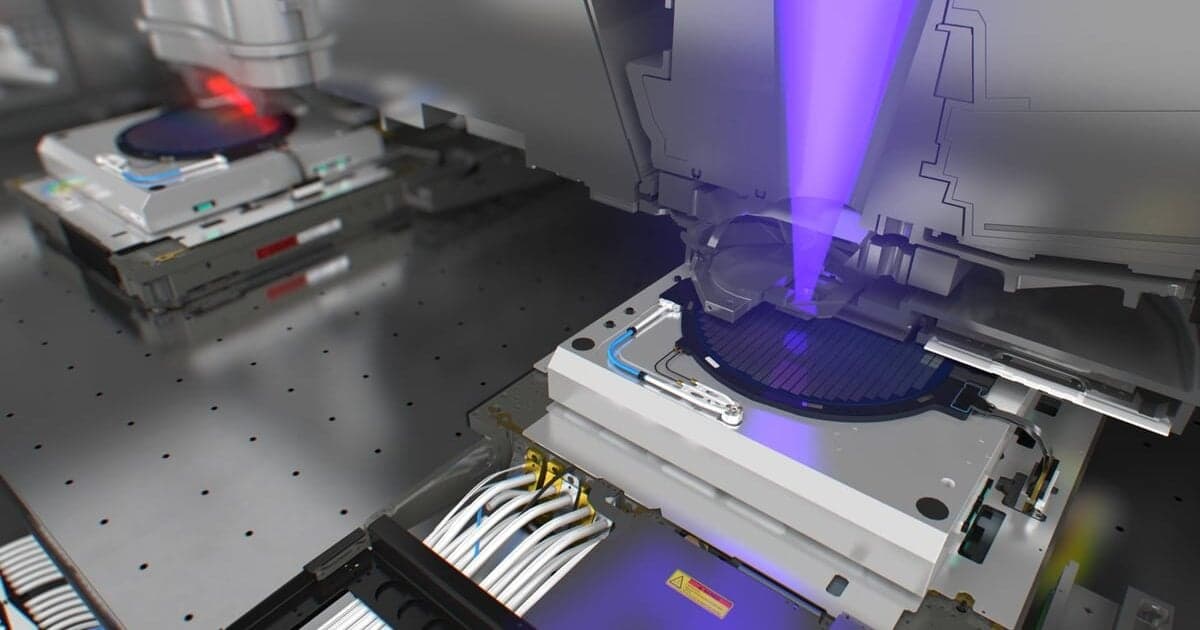

Source: ASML

Dutch chipmaking equipment giant ASML (ASML) is standing in the crosshairs of two forces it can't control...

Tightening export controls on China and the threat of a 30% U.S. tariff on European goods have sent the stock down by double digits this morning.

The company's monopoly on extreme‑ultraviolet ("EUV") lithography – used to make advanced microchips – still delivers strong margins. But management is warning that its sales may not grow at all in 2026 if customers keep postponing orders until after the tariff smoke clears.

This type of short-term panic could be an opportunity...

Practically Everything Today Relies on Chips

It's hard to overstate the importance of chips in our modern world... It's no coincidence that the world's most valuable company, recently crossing $4 trillion for the first time, is chip giant Nvidia (NVDA).

And chipmaking at even smaller scales, with ever-increasing transistor densities, is one of mankind's greatest scientific achievements.

- Intel released the 4004, its first microprocessor, in 1971. It had 2,300 transistors.

- Intel's first Pentium processor, introduced in 1993, had 3.1 million transistors.

- Apple's A17 Pro, the main chip that powers the iPhone 15 Pro, has about 19 billion

And of course, chips have been key for economic prosperity. Chips are in all our electronic devices – like our smartphones, which magically become faster and more powerful with each new version.

Chips are key for emerging tech such as artificial intelligence ("AI") and autonomous vehicles.

To make cutting-edge chips, you need cutting-edge equipment. And the EUV machine is the latest and greatest chipmaking machine.

If you're a chipmaker and want to cost-effectively mass-produce the most advanced chips, you need EUV machines. And only one company in the world makes them – ASML.

Investors Love ASML's Legal Monopoly

Philips and chipmaker Advanced Semiconductor Materials ("ASMI") created ASML as a joint venture in 1984 with a single mandate: commercialize a machine that could shrink chip features faster than Moore's Law was moving.

In 1965, Gordon Moore, a co-founder of Fairchild Semiconductor and later Intel, famously observed that the number of features crammed on a chip had been doubling every year. Moore predicted that the pace of miniaturization would continue for a decade, which it did.

Moore revised his forecast rate to a doubling every two years. This prediction, which became known as "Moore's Law," has held true for decades.

Moore's Law can continue profitably because of a process called photolithography, or just lithography. Lithography means harnessing light to "print" circuit patterns on a silicon wafer. It's a complex process involving light-sensitive materials and hyper-precise machinery and optics. And it's the key to packing more and more transistors and other features into a microchip.

That's what ASML does...

By the mid-1990s, ASML was able to capture about a 20% market share in global lithography. And soon after that, it reached 40% market share.

But ASML wanted total domination of the market...

For Moore's Law to continue to hold in coming decades, chipmaking would require smaller and smaller scales. But using light meant the wavelength of that light would become a limiting factor. Shorter light wavelengths would be required for higher resolutions.

It's like using a ballpoint pen with a wide tip. If you'd switch to using a pen with a finer tip, you could draw with more detail.

ASML's older lithography machines used deep-ultraviolet ("DUV") light at 248-nanometer ("nm") and then 193-nm wavelength.

On the other hand, EUV light has a wavelength of just 13.5 nm – so short that it's on the cusp of being an X-ray. Using EUV lithography for semiconductors would allow for further chip-feature shrinkage.

But EUV is more than just shorter light waves. It involves technology that doesn't exist in DUV. That's why there was no guarantee that ASML could succeed in creating an EUV machine.

Some industry experts thought it would be impossible... and indeed, ASML's two main competitors gave up pursuing leading-edge lithography in 2009 and 2011.

Today, if you want to produce the best chips... you can only do so with ASML's technology.

Taiwan Semiconductor (TSM), which has emerged as the world's largest and most important chipmaker, has the most EUV installations of any chipmaker. And for good reason... it produces an estimated 90% of the world's most advanced chips.

And again... ASML has no competition.

Stansberry Research Has Long Flagged ASML as a Capital Efficient Compounder

In November 2022, Stansberry's Investment Advisory's lead analyst Alan Gula recommended investors buy ASML (link for paid subscribers) after it had sold off by as much as 57%...

He put it simply:

The Chip War may escalate further, and as you know, we've been watching for China to take drastic action against Taiwan. A global recession could also dent demand for logic chips.

However, we're thinking about the long term. Bear markets are the time to go through your shopping list and see which best-of-breed companies are on sale. ASML qualifies...

In addition, he focused on ASML's capital efficiency. All that means is that ASML is a business that generates lots of cash but doesn't require a ton of capital to grow. That means that it can scale better, doesn't require significant external funding, and is better able to return cash to shareholders...

Semiconductor-equipment makers tend to be more capital efficient than the chipmakers they supply.

The main reason: Fabs are incredibly costly to build and equip, and they get more expensive with each new node... in large part because of the ever-increasing cost of lithography machines. But that's revenue, not an expense, to equipment suppliers like ASML.

ASML's Strong Numbers, Uncertain Outlook

This morning, ASML reported second‑quarter sales of nearly $9 billion and net income of $2.7 billion. And its bookings hit $6.4 billion... beating estimates by 25%.

ASML's legal monopoly on EUV lithography machines made up 42% of those bookings.

But management also admitted that the longer politicians haggle over tariffs, the harder it will be to achieve its 2026 sales targets. That warning sent shares tumbling to their worst single-day drop since the 2022 chip downturn... the same pullback that the Investment Advisory took advantage of to initially recommend ASML in 2022.

ASML's warning came three days after President Donald Trump threatened to slap a blanket 30% tariff on European imports starting on August 1. Semiconductors are technically exempt for now, but the White House has hinted the exclusion might disappear, stoking uncertainty across the fab supply chain...

My colleague Corey McLaughlin flagged that political risk in April, noting that ASML was "stuck in the tariff‑war crosshairs." That same Digest argued that companies may pull their forward guidance rather than guess at which tariff policies might be in force... exactly what ASML just did.

Should Investors Buy, Sell, or Hold ASML Today?

This isn't the first time that ASML has sold off for tariff or export-control reasons...

Lithography machines are crucial for manufacturing the cutting-edge chips needed for AI and other compute-intensive applications. That's the whole reason why the U.S. government wants to keep these machines out of China's hands.

Short-term volatility notwithstanding, ASML's business looks strong for the long term.

Overall, it's ranked in the top 100 out of more than 4,600 stocks graded...

My team recommended buying the stock in November 2022. And subscribers who followed the advice to buy back then are up 87%.

Today, ASML is a "Hold" in the Investment Advisory model portfolio.

What's Whitney Recommending You Buy Today?

Today, Whitney is focused on a secretive project he's calling "Amazon Helios"...

As he puts it: Jeff Bezos' Amazon has conquered retail, logistics, cloud computing, and media. And now Whitney predicts that what he calls "Helios" could mark Bezos' next major milestone – and change society forever.

Find out what "Helios" is and the best way to play it right here.