2022 in review; Historical returns of the 60/40 strategy; BlackRock vs. Goldman in the Fight Over 60/40; Kayaking in Antarctica

1) Regular readers may have noticed that one of my favorite tweeters is Charlie Bilello, director of research at Pension Partners.

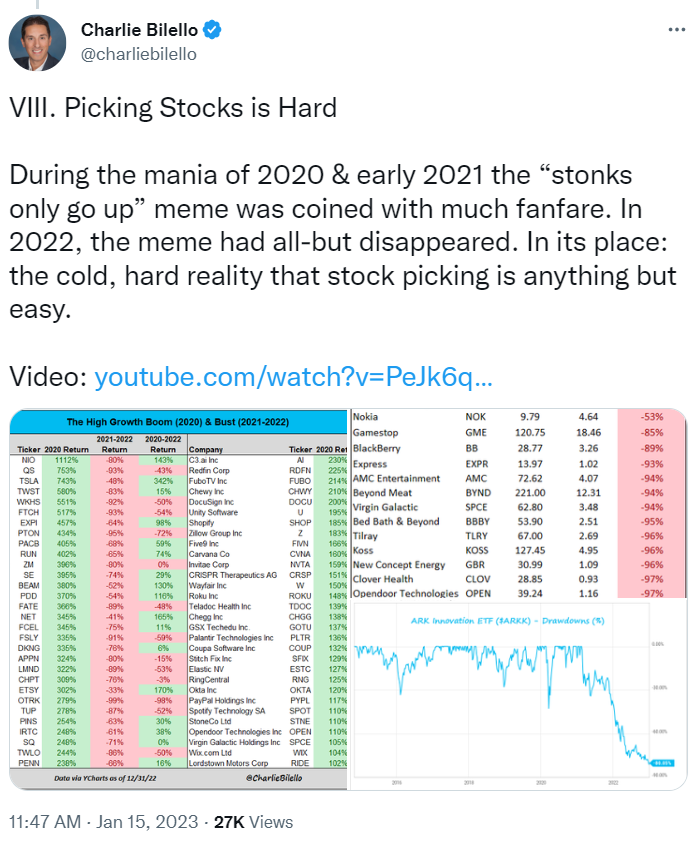

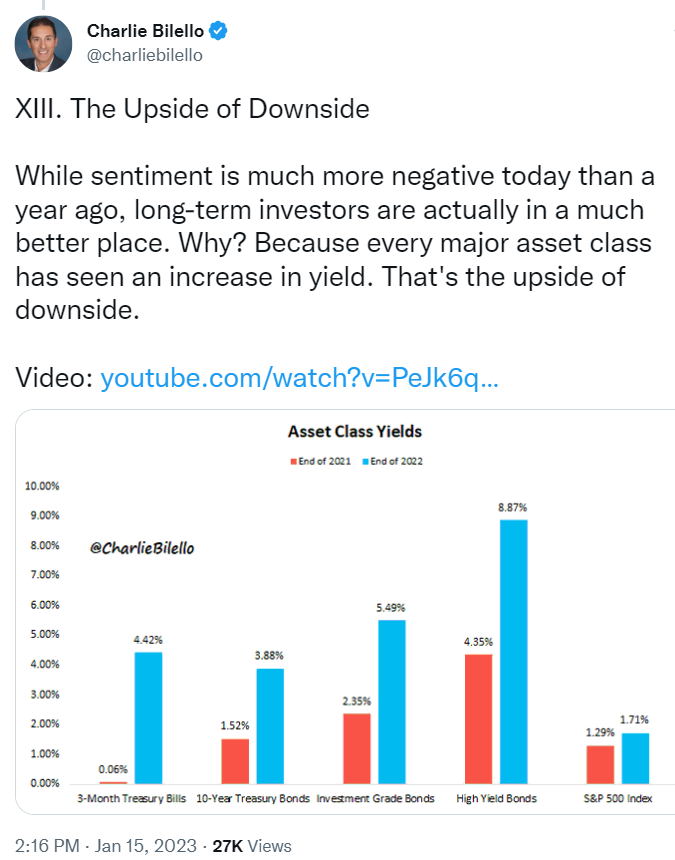

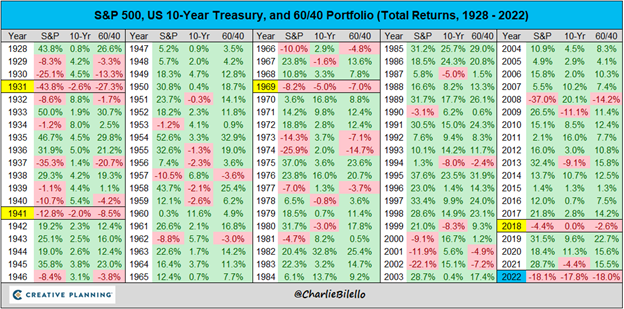

He regularly posts interesting data, charts, and opinions. This 13-tweet thread with a visual summary of 2022 is an excellent example. Here are some of the highlights:

I've never had the pleasure of meeting with or even e-mailing him, but thank you, Charlie!

2) I want to take a closer look at the chart he included in the second graphic above, about which he wrote: "2022 was the worst year for a 60/40 portfolio of the S&P 500 and 10-Year Treasury Bond since 1937, and the first time both assets fell more than 10% in a calendar year."

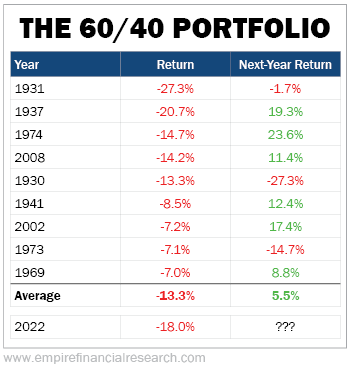

To see what history might tell us about what this year might hold for a 60/40 strategy, I ran a simple analysis, examining what happened the year after the 10 worst years for a 60/40 portfolio. Here's what I found...

This is promising: In the nine prior times the 60/40 strategy has fallen by 7% or more (an average of -13.3%), it's risen six times by an average of 5.5%. And there have only been back-to-back annual losses of 7% or more in the Great Depression and the oil shock/energy crisis recession in 1973 to 1974.

3) Two of the largest financial firms in the world have very different views of the merits of the 60/40 strategy going forward: BlackRock vs. Goldman in the Fight Over 60/40. Excerpt:

The best-known names in asset management and investment banking are taking opposite sides in the debate over the classic way of building a portfolio – 60% stocks and 40% bonds – after a disastrous performance for the 60/40 model last year.

BlackRock (BLK) says the losses – the worst in nominal terms for a 60/40 portfolio since the financial crisis of 2008-9 and the worst in real terms in a calendar year since the Great Depression – show that the structure is outdated. Goldman (GS) demurs, arguing that the odd big loss is inevitable in any strategy and that 60/40 remains a valid basic approach. Strategists and fund managers at other large money managers and banks have been piling in on both sides.

Investors should be paying close attention after decades of 60/40's being accepted at a minimum as a reasonable base on which to construct a portfolio. Abandon it, and investments once considered exotic – BlackRock likes private debt and equity, commodities, infrastructure and inflation-linked bonds – join stocks and bonds as building blocks. Stick with it and they amount to small add-ons to the stock/bond core.

There are decent arguments for and against the 60/40 split as a sensible starting point for a portfolio.

I agree with the author of the article, who concludes:

With valuations back in the range of reasonable for both stocks and bonds, a 60/40 equity/bond split is a decent starting point for building a portfolio – even if those who worry more about long-run inflation, as I do, might add a little more inflation protection than comes as standard.

4) Continuing my ongoing series of the highlights from our 12-day Antarctica trip last month...

We spent two days each way going across the Drake Passage, giving us eight days on the continent. The first day we arrived was stormy, but then the weather improved and we were able to do trips in the Zodiac boats every morning and afternoon, about two-thirds of the time going onshore and the rest of the time just doing a boat "safari," seeing wildlife, icebergs, and scenery.

In addition, everyone was able to sign up for three small-group adventures, which took the place of one of the Zodiac trips: kayaking, camping overnight on shore, and mountaineering. I'll share pictures of kayaking here and cover the other two later...

We paddled around and got very close to some seals, saw some cool icebergs, and saw our first penguin. Here's my favorite picture of a seal with Susan and me in the background – and you can see more pictures that I posted on Facebook here:

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.