47 managers' 13F filings; Inflation is easing in supply chains; Must we suffer to bring inflation down?; BBBY's challenges; Escaped bull rampaging through Israeli bank

1) Last Tuesday, I wrote:

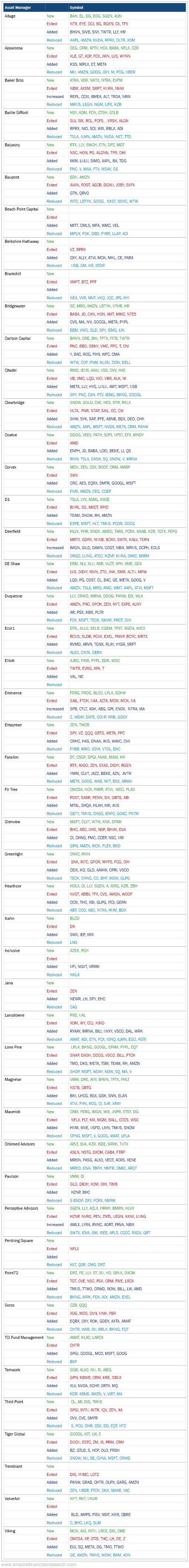

Institutional investors with $100 million or more under management are required to publicly file a Form 13F with the SEC every quarter, disclosing stock holdings – including number of shares – as of the end of the most recent quarter.

I've always skimmed these filings, both to see what institutional investors as a group are doing, as well as to get stock ideas from some of the investors I respect most.

In that e-mail, I wrote about Berkshire Hathaway's (BRK-B) 13F, which revealed Warren Buffett's latest moves.

Today, I'd like to share this summary of 47 other large funds:

As I scan this list of hundreds of trades, here are some of the ones that caught my eye...

- David Tepper of Appaloosa bought two open recommendations in our Empire Stock Investor newsletters, Netflix (NFLX) and Meta Platforms (META). He also reduced his holdings in Amazon (AMZN), Alphabet (GOOG), oil company Occidental Petroleum (OXY), and California utility PG&E (PCG).

- Seth Klarman of Baupost established a new position in Amazon and trimmed Alphabet.

- Philippe Laffont of Coatue Management navigated the crash in growth stocks better than anyone I'm aware of, as I detailed in my June 23 e-mail. He bought Chinese Internet giants Alibaba (BABA) and JD.com (JD) and trimmed electric car makers Tesla (TSLA) and Rivian (RIVN).

- Larry Robbins of Glenview added Microsoft (MSFT) and trimmed Amazon.

- David Einhorn of Greenlight bought a new position in Rivian, which surprises me.

- Soros Fund Management joined Buffett in buying Occidental Petroleum.

- Chris Hahn of TCI added to Microsoft, Alphabet, and credit ratings agency Moody's (MCO).

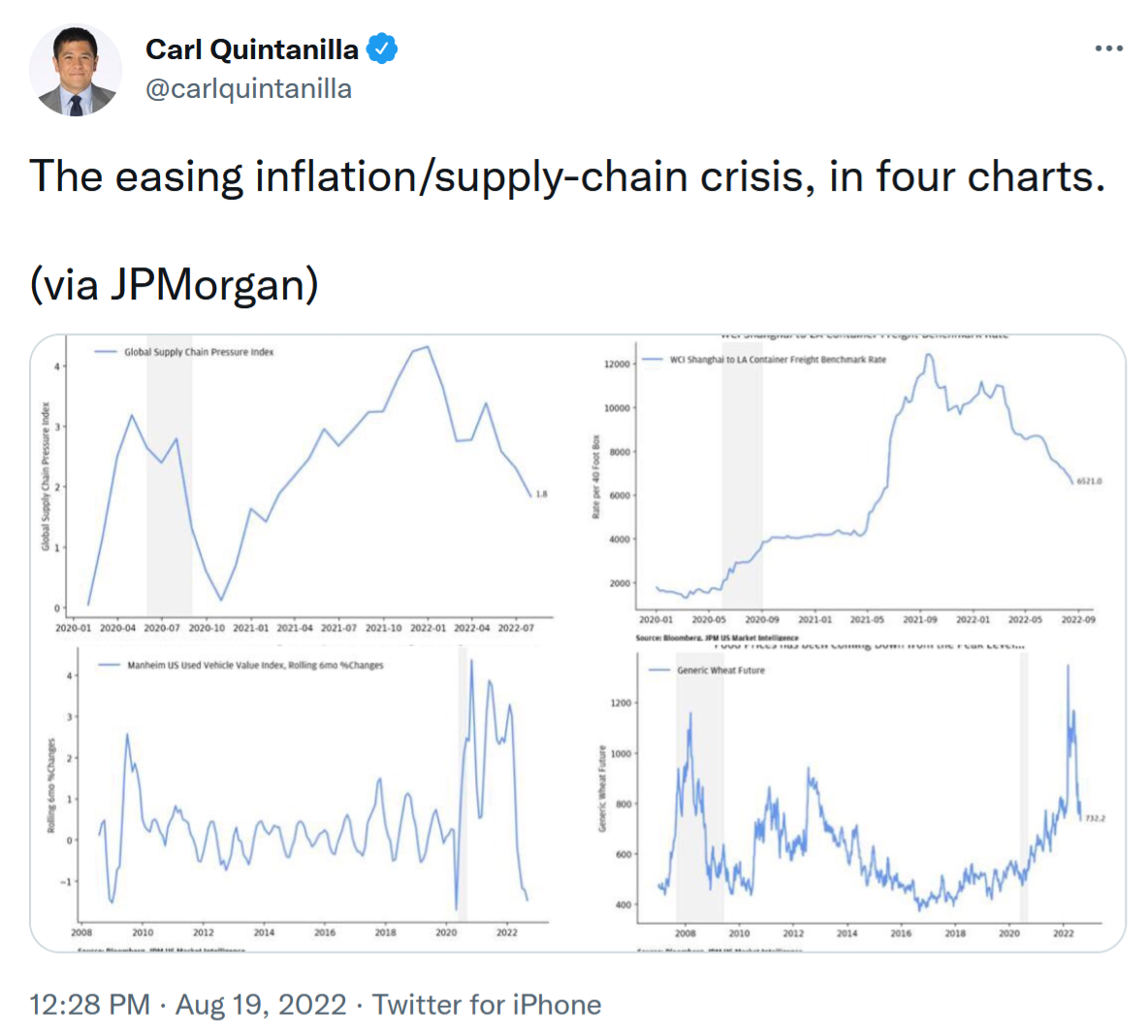

2) Further evidence that inflation is easing in supply chains here:

And here:

3) Speaking of inflation, Nobel Prize-winning New York Times columnist Paul Krugman is surprisingly pessimistic about the Fed's ability to rein it in without triggering a recession.

This is yet another reason why I've turned neutral on the markets for the rest of this year: Must we suffer to bring inflation down? Excerpt:

And the Fed believes – correctly, I think – that it's operating on a clock. So far, expectations of inflation have stayed anchored, but we can't count on that happy condition persisting if inflation stays high for an extended period. The Fed, therefore, needs to take action to reduce underlying inflation fairly quickly.

So orthodoxy – reducing inflation by engineering a slowdown – it is. It's still unclear whether this slowdown will be severe enough to be labeled a recession, but it will be painful for consumers even if it isn't. There are many good things to be said about a hot economy and tight labor markets, and we'll miss them when they're gone. But there don't seem to be any realistic alternatives.

4) More details are emerging – but critical ones are still missing – here: Bed Bath & Beyond's Challenges Linger After Loan Deal. Excerpt:

Bed Bath & Beyond (BBBY) selected asset manager Sixth Street Partners to supply new financing, according to people familiar with the matter, as doubts remain among vendors and some investors about the company's turnaround prospects.

Sixth Street is in exclusive talks with Bed Bath & Beyond and is nearing final terms for a loan of close to $400 million to shore up the troubled retailer's liquidity, according to people familiar with the matter. Negotiations to finalize the loan documents are ongoing, one of the people said...

A loan deal would help refill the company's coffers and give confidence to vendors that Bed Bath & Beyond can pay its bills. The business has sought to stretch payments to some vendors, which have been pulling credit to the company in recent weeks amid mounting doubts that it could pay them back and a shortage of credit insurance, according to people familiar with the matter.

At least one firm that finances suppliers has stopped providing credit on shipments to Bed Bath & Beyond, the Journal has reported.

5) This killed me! Wild video shows escaped bull rampaging through Israeli bank. Excerpt:

It's a bull market.

Wild footage captured the moment an escaped bull charged into an Israeli bank on Monday sending terrified employees running for their lives.

The bizarre incident took place on Monday morning at a Bank Leumi branch in the city of Lod near Tel-Aviv, reported the Israeli news site Ynetnews.com.

The large farm animal had somehow gotten loose from its owner's property and made its way to the bank's parking lot, with a rope still tied around its neck.

Cellphone videos that have been circulating on social media then show the panicked bovine running wild through the hallways in a scene more appropriate for Pamplona, Spain, than a regional bank branch in an Israeli suburb.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.