A Historic Set-Up for Cannabis? Facebook's Rebranding Is Like Google's; Meta's Ad Returns Are Its Redemption for Advertisers; Facebook... What To Do? Note From a Reader

1) I want to give a shout-out to my newest colleague, Herb Greenberg, who nailed it in his column on Tuesday, A Historic Set-Up for Cannabis? Excerpt:

This is a generational investment opportunity in an industry with phenomenal growth and limited access to capital. We aim to invest before full legalization occurs and believe that patient capital will be well rewarded in the years to come.

Patience? Years? For those who get it right, that's the difference between investing and trading... And some would say true wealth creation.

Since then, the exchange-traded fund he recommended, the AdvisorShares Pure U.S. Cannabis Fund (MSOS), has jumped 11%, thanks in part to this news:

Cannabis stocks rose late Friday after Marijuana Moment reported a fresh Republican-led attempt to legalize marijuana. The States Reform Act led by Rep. Nancy Mace (R-SC) is still in the preliminary stage, and a final version is expected to be filed later this month.

I share Herb's bullishness on the cannabis sector and own MSOS in my personal account, for reasons I detailed in my August 18 e-mail.

2) I'm quoted in this Business Insider article comparing how Google rebranded itself as Alphabet (GOOGL) and how Facebook is doing the same as Meta (FB). I explain that both were strategic missteps and capital allocation errors. Yet, their stocks were/are buys because their core businesses are so good: Google sank billions into flailing 'moonshot projects' after it rebranded to Alphabet. Facebook, now Meta, could face the same fate. Excerpt:

And as Meta gears up to pour billions into its metaverse mission over the years, "we're seeing history repeat itself," Whitney Tilson, a former hedge fund manager and the CEO of Empire Financial Research, told Insider.

Cashflow can hinder ambitious projects from true growth

Tilson says a major weak point for Google was creating an overarching framework in Alphabet. Instead, the company should have spun out its ambitious projects instead of keeping them under a parent company, where they were insulated from the market with Alphabet's pile of cash.

"Because it had access to unlimited capital with very little oversight, it has not achieved what it could have achieved as an independent company with its own board of directors where it had to go back to the market for capital by showing milestones," Tilson said...

Investors have shrugged off any losses. Google's market value has soared since the reorganization, outperforming the benchmark S&P 500 Index by double since 2015.

As will Facebook's, regardless of how its metaverse project churns out, Tilson said, because the two firms' core businesses and their positions in the digital ads space are just that strong.

Zuckerberg and other company executives have acknowledged that it will be years before the metaverse materializes – at least 10 years to be exact.

But Tilson said Facebook should do what Google should have done: focus on its supremely successful businesses, deal with the high-profile problems associated with them, and "not waste $10 billion a year on the metaverse."

"Google and Facebook are both examples of the world's greatest businesses but also how the world's greatest businesses lead to so much cashflow that it leads to complacency and capital allocation mistakes and empire building," Tilson said.

3) This Heard on the Street column in the Wall Street Journal a week ago captures why I hold my nose and continue to recommend Meta's stock: Meta's Ad Returns Are Its Redemption for Advertisers. Excerpt:

For all the recent controversy surrounding Meta Platforms' algorithms and their potential to cause users harm, their unique power is irresistible for its real customers: advertisers.

Wall Street forecasts total advertising revenue for the company formerly called Facebook will reach more than $114 billion this year, or about 17% of the entire global ad market. That is 10 times the amount projected for social media competitors Twitter (TWTR), Snap (SNAP), and Pinterest (PINS) combined. Last year the ad revenue Meta generated in the U.S. and Canada alone was more than two-thirds of the total spent on U.S. television ads and nearly five times the ad revenue for the entire U.S. newspaper industry.

Controversial or not, Meta's family of apps and its 3.5 billion monthly users are too big to ignore. Case in point? Last year, Facebook faced a massive advertiser boycott over concerns about hate speech on the platform with over 1,000 brands participating. Since then, Meta's platforms have collectively added roughly one million advertisers. Meta now says it has more than 10 million advertisers even as its competitors haven't dared to give recent comparisons.

Meta's edge in advertising comes from more than just reach. The very mechanics that make its platforms addictive for consumers also hook advertisers, who value a high return on their investments...

For advertisers, the proof is in the pudding. In the second quarter, Meta said it generated on average more than $51 per monthly user in the U.S. and Canada. All social media companies report returns on users a bit differently, but Meta's stand out pretty much any way you slice them. Pinterest said its average revenue per monthly active user in the U.S. was just over $5 over the same period, while Snap said it generated just over $7 per daily active user in North America. And Meta is improving: In the third quarter, the company said its average advertising return per user in the U.S. and Canada was up more than 85% from the same period three years earlier...

It is true that Apple's recent privacy changes have made it more difficult for companies to track users' activity off their sites. Ironically, that has helped Meta to justify higher ad prices, even in the face of declining targeting ability. Simply put, brands seem to need more help. This year thus far, Meta's ad pricing has grown an average of 33% – 22 percentage points more than its average over the last five years.

4) If you think I'm a harsh critic of Meta, you should read NYU marketing professor Scott Galloway, who's one of my favorite thinkers. In his weekly missive on October 29, he wrote:

Time's 2021 Person of the Year, and likely recipient of the Nobel Peace Prize, will be Frances Haugen. Lawmakers, academics, journalists, philosophers, and Borat have all railed against the global menace that is Facebook. And for good reason. The KGB, CCP, and Iranian Ministry of Intelligence could not have dreamt of a more perfect weapon. An ordinance that spread death, disease, and disability across the U.S. via an unnatural increase in vaccine hesitancy, catalyzed an insurrection at the Capitol by people fed a steady diet of misinformation, and contributed to a decline in the mental health of America's youth. And... we financed it.

Many sounded the alarm. But all we've done is put on a masterclass re the difference between being right and being effective. Ms. Haugen's rollout (multichannel, branded, coordinated) is the first time it feels as if we're fighting Panzer tanks with tanks, vs. on horseback.

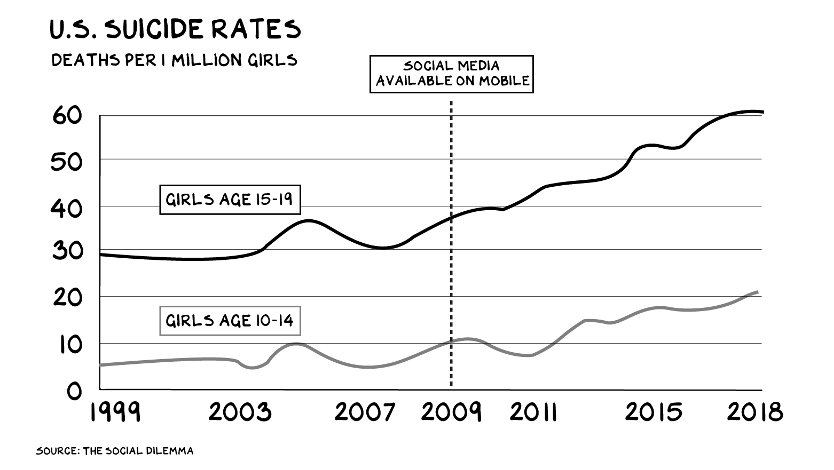

And in his latest one, Facebook ... What To Do?, he highlighted ways to rein in the social media companies that are doing so much harm in the world, especially to our youth. He included this chart showing that the suicide rate among teenage girls in the U.S. has doubled since social media apps became available on smartphones, which is very scary...

My friend Brent is the strong silent type. But he said something – while we were at a Rüfüs Du Sol concert, no less – that rattled me, as it was so incisive: "Imagine facing your full self at 15." He went on to say he'd rather give his teenage daughter a bottle of Jack and a bag of marijuana than Instagram and Snap accounts. We age-gate alcohol, driving, pornography, drugs, tobacco. But Mark and Sheryl think we should have Instagram for Kids. We will look back on this era with numerous regrets. Our biggest? How did we let this happen to our kids...

5) A nice note from one of my readers:

"Thank you for writing your excellent newsletters.

"They teach me a lot about both investing and life. While the stock tips and economic discussions are great, the anecdotes about your life, adventures, and family have become one of my favorite parts of the letters. It nice to be able to observe how someone else has set up their life and strikes a balance between work and fun.

"Congratulation on your anniversary. Hope the hikes were great." – Andrew W.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.