Analysis of Berkshire Hathaway's third-quarter earnings; Seven tech giants' stocks have been cut in half; My dad's second ablation

1) Berkshire Hathaway (BRK-B), which I've long called America's No. 1 Retirement Stock, reported third-quarter earnings on Saturday (press release here and 10-Q here).

To analyze the report, I once again turn to my longtime friend and former hedge fund partner, Glenn Tongue. He writes:

After reporting net earnings in the second quarter of negative $43.8 billion, one of the largest losses in the history of corporate America, Berkshire reported another loss, albeit much smaller, of $2.7 billion in the third quarter.

Nevertheless, both were strong quarters for Berkshire, as the "losses" simply reflect misleading accounting conventions that require the company to run gains and losses in its massive $331 billion stock portfolio through its income statement.

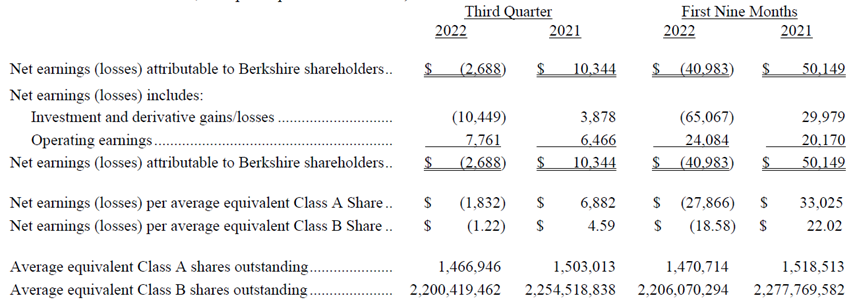

Instead, investors should focus on Berkshire's operating earnings, which were up 20% in the quarter and 19.4% year to date, astonishing growth for a company of Berkshire's scale, as shown in this table from the press release:

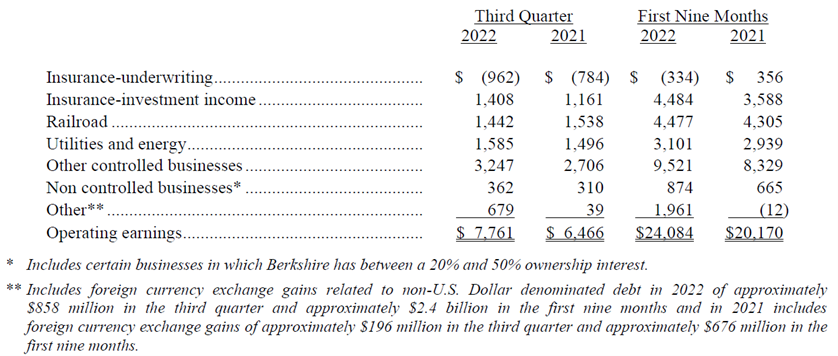

The next table in the press release shows the breakdown of the operating earnings by segment:

Standout performers during the quarter included Clayton Homes and Berkshire's auto dealerships, and investment income is surging thanks to rising interest rates.

The main underperforming segment was insurance due to Hurricane Ian (leading to a $660 million loss during the quarter for Berkshire Hathaway Primary Group) and a $769 million loss at GEICO...

"... primarily due to significant cost inflation in property and physical damage claims, which began to accelerate in the second half of 2021 and have continued through 2022. Increases in used car prices are producing increased claims severities on total losses and shortages of car parts are contributing to elevated claims severities on partial losses. In addition, injury claims severities continue to trend higher."

Overall, Berkshire's financial performance continues to impress and the company's intrinsic value continues to grow.

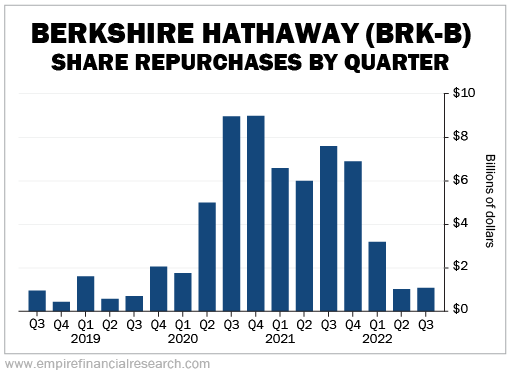

Buffett started buying back Berkshire's stock in 2018 and ramped it up in 2020 and 2021, but has really pulled back this year as you can see in this chart:

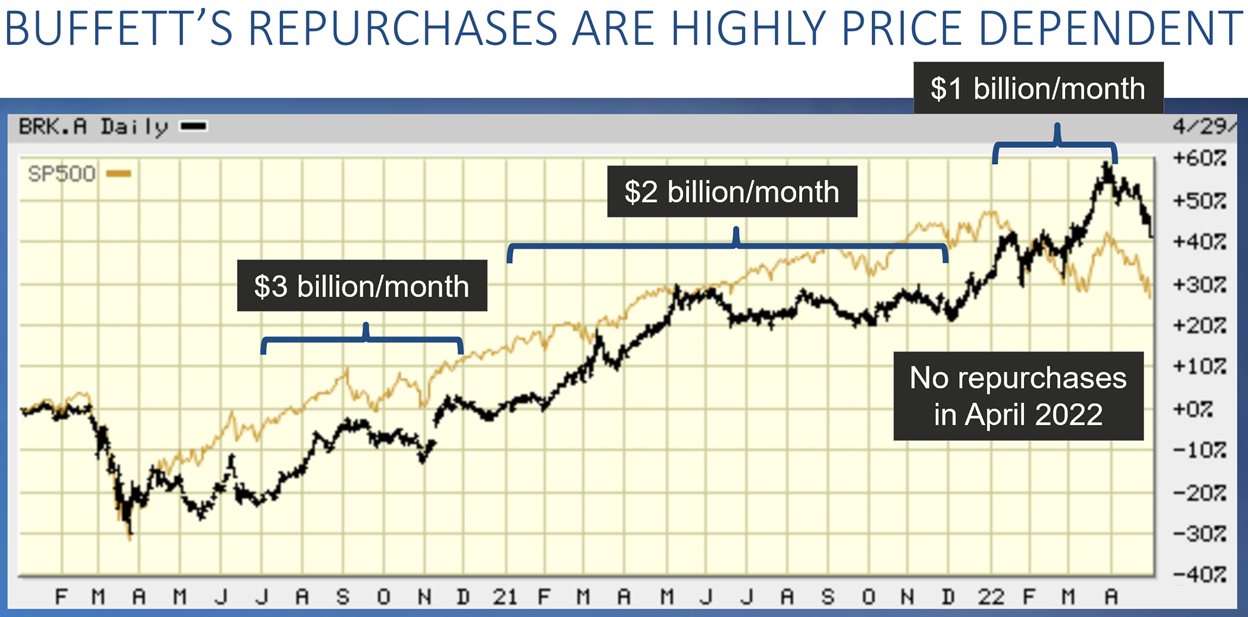

As you wrote in your May 3 and May 4 e-mails, Whitney, Buffett has been very price sensitive in his repurchases, buying back shares most aggressively when they're most undervalued, which is exactly what shareholders should want and expect. Here's that slide from your presentation:

We can see that as Berkshire hit an all-time high in late March, Buffett stopped buybacks altogether in April and May. But then, as the stock fell along with the market, he resumed buybacks, though in small size, likely due to the other opportunities he's seeing in the markets thanks to their big decline this year.

After buying an unprecedented $51.1 billion in stocks in the first quarter, Buffett and his two proteges, Ted Weschler and Todd Combs, have returned to more normal (though still immense) buying patterns, adding $6.2 billion and $9 billion in the second and third quarters, respectively. In total, they bought $66.2 billion in equity securities in the first three quarters of this year, partially offset by $17.3 billion of sales.

Buffett continues to buy the stock of Occidental Petroleum (OXY) and now owns over 20% of the company. He appears to have reduced his investments in financial stocks – I suspect he sold some shares of Bank of America (BAC) – but we won't know for sure until we see the filings.

Buffett's largest category of investing is growth capital for the nearly 100 businesses Berkshire owns. He has long written about the compounding value associated with businesses that can reinvest cash at high rates of return. This dynamic is playing out in particular at Berkshire Hathaway Energy and Burlington Northern Santa Fe. Capital expenditures at these businesses have totaled $7.9 billion so far in 2022, and I believe these investments will continue growing Berkshire's value long into the future.

Thank you, Glenn!

In tomorrow's e-mail, I'll share my updated estimate of Berkshire's intrinsic value... Stay tuned!

2) Over the past week, I analyzed Meta Platforms (META) and concluded in yesterday's e-mail why I think the stock "is a pound-the-table buy right now."

But it's not the only tech giant whose stock has taken a beating...

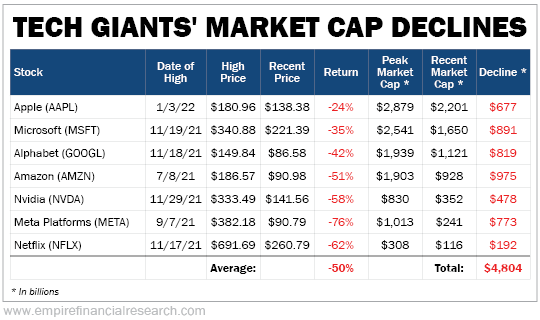

As you can see in this table, the stocks of seven tech giants have, on average, been cut in half and collectively lost nearly $5 trillion in market capitalization from their peaks, as this table shows (prices as of Friday's close):

These are seven of the greatest businesses of all time, which you can now buy for far less than investors were enthusiastically paying roughly a year ago. As a group, I think they will far outperform the S&P 500 going forward.

3) My 80-year-old father developed atrial flutter earlier this year, possibly as a consequence of having COVID last December. To address this, he underwent a surgical procedure called a catheter (or cardiac) ablation on September 16, which I described in my e-mail that day.

Initially, it seemed to work, and I wrote in my September 19 e-mail that he "appears to be back to 100%."

Well, I spoke too soon...

A day or two later, his Apple Watch detected an irregular heartbeat once again. When he went to the hospital to get it checked out, the doctors discovered that he had developed atrial fibrillation (A-fib).

They shocked his heart and put him on drugs, and he's been fine ever since... But there's a high chance that the A-fib will return unless he gets a second ablation, so he's having that done tomorrow.

He'll be in the hospital (Dartmouth Health in New Hampshire) for three days while the doctors monitor him and "load" him on a new drug, and then he should be good to go – with a high chance that the A-fib never returns – so he and my mom are planning to go back to Kenya on November 20.

I'm driving to New Hampshire tonight so my mom and I can accompany him to the hospital tomorrow.

An ablation has become a fairly routine procedure, but as always, thoughts and prayers are greatly appreciated!

Here's a picture of us from my last visit with them:

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.