Beware of valuation shorts, especially accelerating growth; Jack Bogle Was a Punk; Dive trip in Fiji

1) Continuing where I left off in Friday's e-mail, I'm sharing slides from my presentation on "Lessons From 15 Years of Short Selling"...

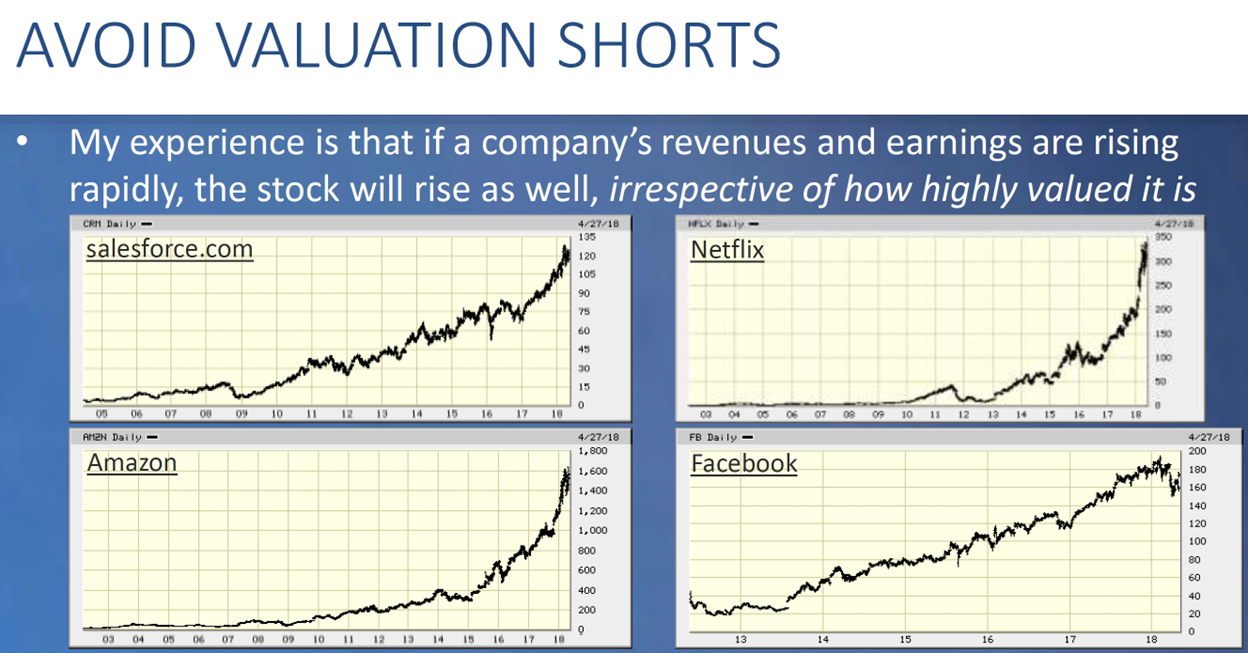

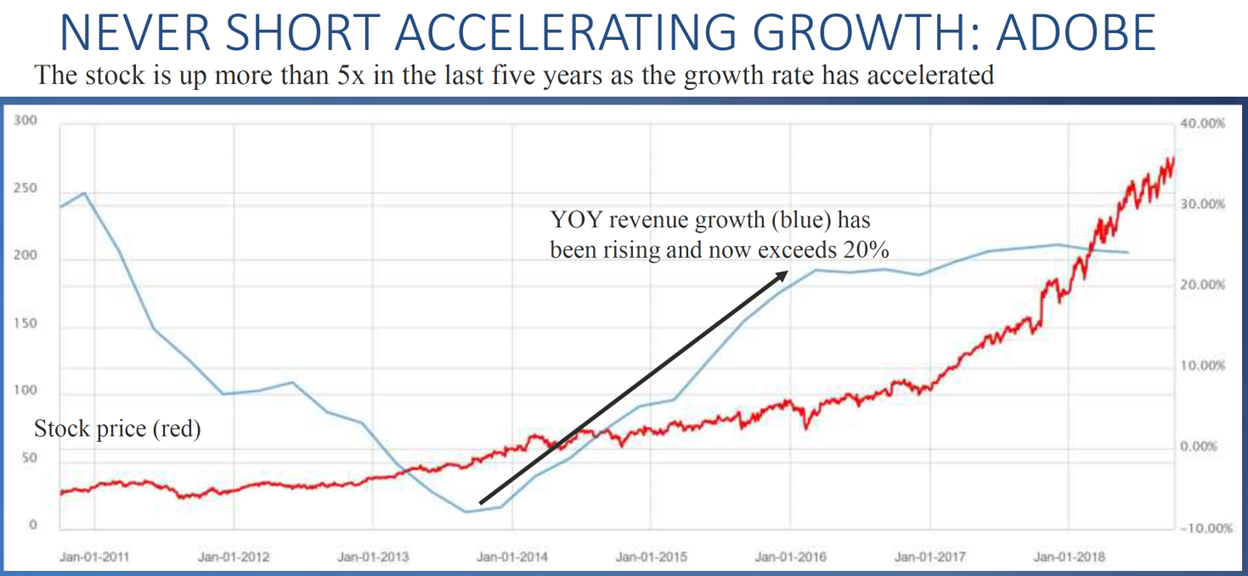

In the slides below, I warn against valuation shorts, especially companies experiencing accelerating growth:

2) The author of a new book, The Bogle Effect: How John Bogle and Vanguard Turned Wall Street Inside Out and Saved Investors Trillions, shared some of his key insights about the legendary man in this Bloomberg article: Jack Bogle Was a Punk. Excerpt:

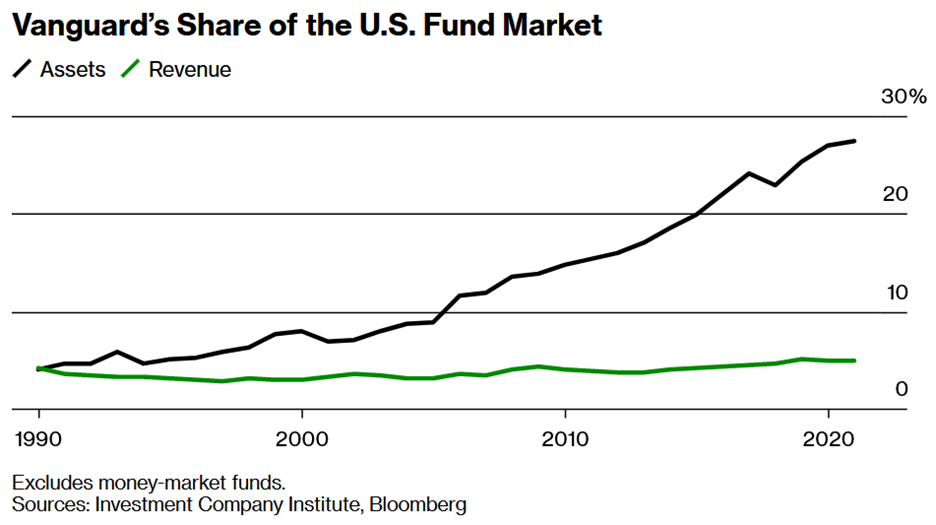

The money manager now has more than $8 trillion in assets – second only to BlackRock, which it could surpass in a few years – as well as the three biggest funds in the world and another three in the top 10. Vanguard's influence extends well beyond the numbers on any scoreboard. The entire investing universe now bends toward the company's headquarters in sleepy Malvern, PA...

Perhaps the most astonishing fact about Vanguard is that, though it manages more than a quarter of the assets in the entire fund industry, it accounts for only 5% of the industry's revenue. Bogle's net worth was about $80 million when he died, a fraction of what his peers in finance had amassed. "In the history of Wall Street," Michael Lewis, author of Liar's Poker and The Big Short, told me, "the ratio of money touched to money taken was never so high."

Bogle may have looked like a friendly grandfather, but throughout his career the words that left his mouth (and some that filled his bestselling investing books) were utterly punk rock. His TV hits on business networks were mostly about the futility of trying to pick stocks or time the market. He'd give a speech at an ETF conference about why ETFs were awful, or trash active management at a conference for fund managers. He could be savage and stubborn; he got the boot at the only other place he ever worked, Wellington, and late in his career tangled with Vanguard's management, too.

Bogle's story may seem like ancient history, or like it lacks a dramatic arc, yet it's about what's to come in finance – a future full of conflict and consequence. He was so hardcore that his dream remains far from complete. "The first sign that Vanguard's mission has created a better world for the investor will be when our market share begins to erode," Bogle told employees in a 1991 speech, when the company had less than 1% of its assets today. For Vanguard, success meant forcing other money managers to follow its lead in cutting costs and putting customers' interests first.

Bogle shared something else with punk: the concept of addition by subtraction. As Johnny Ramone once described the genre to Rolling Stone: "What we did was take out everything we didn't like about rock 'n' roll and use the rest, so there would be no blues influence, no long guitar solos, nothing that would get in the way of the songs." Punk rock was, as the magazine had previously written, "a negation, a call to stark, brutal simplicity." If that doesn't describe Bogle's life's work – and a low-cost index fund – I don't know what does. He built an entire genre of investing by trying to eliminate everything that gets in the way of investors getting a fair share of returns, including management fees, brokers, turnover, trading costs, market timing, and human emotion. The company he founded would actually be owned by the mutual funds it managed – and in turn by their shareholders – so its chief incentive would be to get more and more efficient and leave more money in clients' pockets.

Bogle knew Vanguard's customer-owned structure would, over time, lower costs to the point that investors would beat a path to the company's door. And they did. That structure, paired with Bogle's contrarian attitude, has already saved investors about $1 trillion. But what many financial professionals and investors don't realize, and what I document in my book, is that index funds were merely a byproduct of Vanguard's unique ownership structure and arguably get too much credit for the index fund revolution. In the end, the funds needed Vanguard more than Vanguard needed them – the two just happened to be a perfect match.

3) I got back from a weeklong dive trip in Fiji on Saturday morning...

It was fabulous: The 14 dives in six days were amazing, there was a lot of quality time with old and new friends, the food was delicious, and the 15 staff on the boat took great care of the 15 of us. (There was minimal cell service most of the week, which was mostly a blessing!) Here's the website of the diving boat we chartered.

Below are some pictures (I've posted more on Facebook here):

And here are two videos:

- Footage from the drone a guy brought (two minutes)

- An unexpected highlight of the trip was the Fijian guys singing (four minutes). They did three performances for us and, in addition, every evening they hung out on deck and sang just for the joy of it – it was really beautiful!

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.