Billionaire investor Bill Ackman is hedging the pandemic again; Comparing the COVID-19 crash to prior ones; 'Our Recent Performance Sucks.' Here's Your $10 Billion Back; Value meme; The Shrink Next Door

1) Here's some very interesting breaking news: Billionaire investor Bill Ackman is hedging the pandemic again after raking in $2.6 billion from a similar bet in spring. Excerpt:

Billionaire investor Bill Ackman turned $27 million into $2.6 billion by insuring his hedge fund against a wave of corporate defaults earlier this year. The Pershing Square chief placed a similar bet – almost 30% of the original's size – on Monday after news broke of a highly effective COVID-19 vaccine, he revealed at the Financial Times' Dealmakers Conference on Tuesday.

"I hope we lose money on this next hedge," Ackman said, according to the Financial Times. "What's fascinating is the same bet we put on eight months ago is available on the same terms as if there had never been a fire and on the probability that the world is going to be fine."

Ackman described the vaccine news as "bearish" during his keynote speech, the Financial Times said. He cautioned people could become nonchalant about wearing masks and might worry less about catching or spreading the virus with mass inoculation on the horizon.

Investors are underestimating the continued threat of the coronavirus, Ackman continued, warning of a tough few months before an economic recovery takes hold. The hedge-fund boss sounded the alarm on the pandemic back in March during an emotional CNBC interview.

I've also become more bearish about the pandemic.

The news about rising hospitalizations in particular has been worse than I expected, especially in places like Arizona, which were already hit hard earlier this year. I'll share more detailed thoughts in a future e-mail (to receive them first, sign up for my coronavirus e-mail list by sending a blank e-mail to: cv-subscribe@mailer.kasecapital.com).

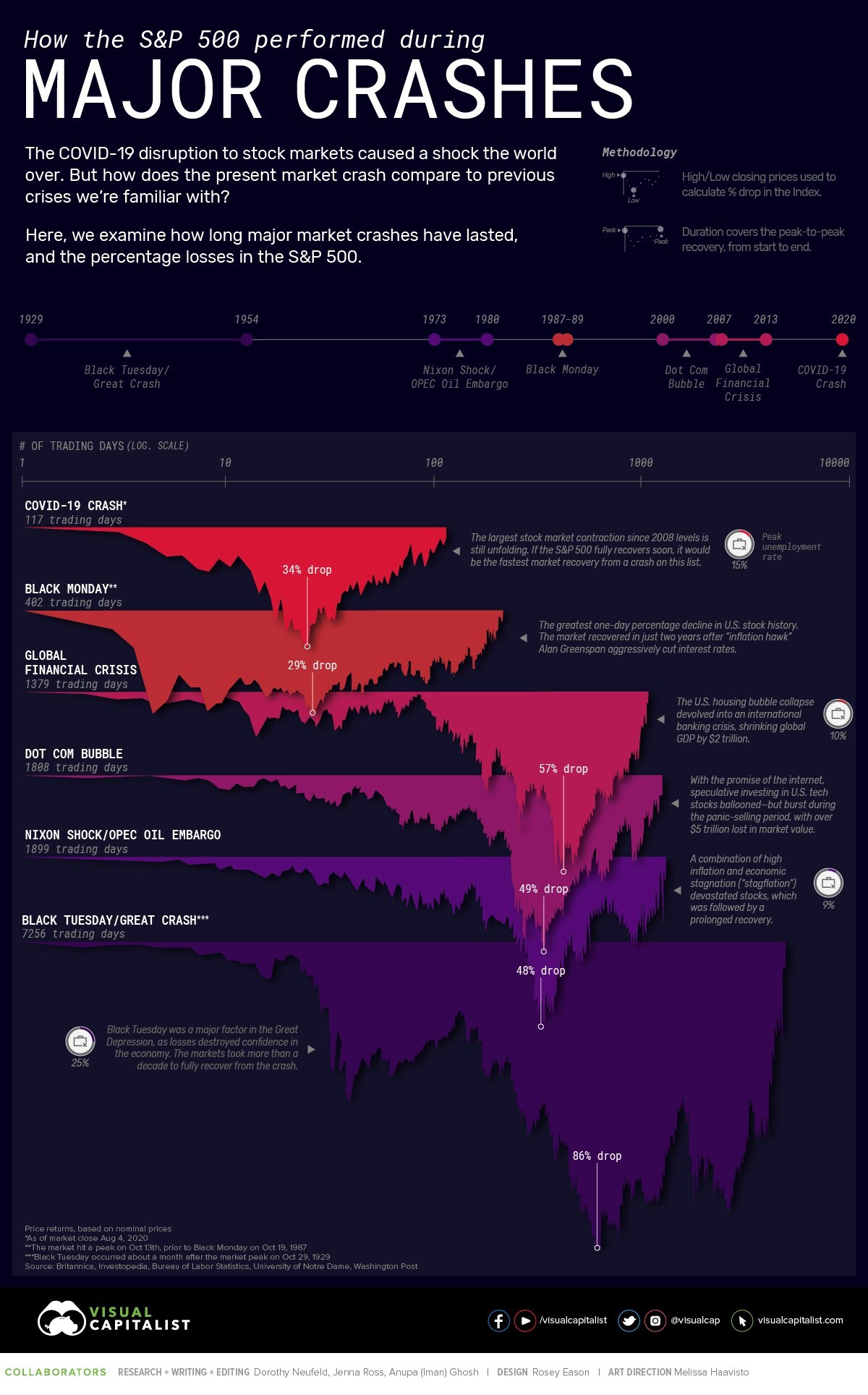

2) Though it's three months out of date, this is nevertheless an interesting chart from VisualCapitalist showing how rapid the COVID-19 crash and recovery was relative to five other major market crashes over the past century:

Note that the S&P 500 Index surpassed its prior all-time high set in February on August 18, only nine trading days after this chart was published. This means that the market's recovery took only 126 days – by far the fastest on record.

3) This Wall Street Journal article about value investor Ted Aronson and his decision to close his firm reminds me of how I felt from 2010 until I decided to close my own funds in 2017 (though he had a lot more money under management than I did!): 'Our Recent Performance Sucks.' Here's Your $10 Billion Back. Excerpt:

You can complain about the death of value investing, or you can do something about it.

The discipline of buying cheap stocks, and holding them until they deliver superior returns, has lagged behind the market for so long that most of its practitioners seem to do little but talk about how bad it is and speculate about when it will get better.

Then there's Ted Aronson. He is giving back $10 billion to his investors and shutting down his Philadelphia-based value-investing firm, AJO. That is after more than 30 years in which AJO's returns were often among the best in the business of managing money for pension funds, university endowments, and other institutions. They aren't among the best anymore.

"Our recent performance sucks," says Mr. Aronson. "And our record over most of the last five years has been so sucky that even if we outperformed mightily over the next five, we would still have – at best – a drab return looking back over those 10 years."

He concedes that he may be getting out of the business with "the exact wrong timing" and that the exit of a firm like his might well signal that value investing's long-awaited comeback is imminent. Even so, given AJO's recent results, Mr. Aronson says he had no choice but to give clients their money back.

How unusual is that? Asset managers return their investors' capital about as often as sharks regurgitate swimmers without a scratch.

4) This meme captures the gallows humor among value investors:

5) I highly recommend The Shrink Next Door, a seven-episode podcast by one of my favorite journalists, Bloomberg's Joe Nocera.

It tells the story of Isaac Herschkopf, a psychiatrist who exploited his relationships with his patients for personal gain. It's a wild – and scary – story! Here's a summary:

Veteran journalist Joe Nocera had a Hamptons neighbor: Ike, therapist to celebrities and Manhattan's elite. He had star-studded parties at the vacation house. But one summer, Joe came back to discover that Ike was gone, and the summer house next door had never belonged to Ike in the first place. It was Marty's, a therapy patient of Ike's who had finally broken free from Ike's psychological domination. The Shrink Next Door is the story of one therapist's psychological manipulation as he crossed lines and defrauded his patients – and he's still out there.

Best regards,

Whitney