Debate over inflation and the economy; F.D.A. Orders Juul to Stop Selling E-Cigarettes; Off to Europe; Air travel snarls

1) The raging debate continues over inflation and whether efforts to fight it will tip the economy into a recession...

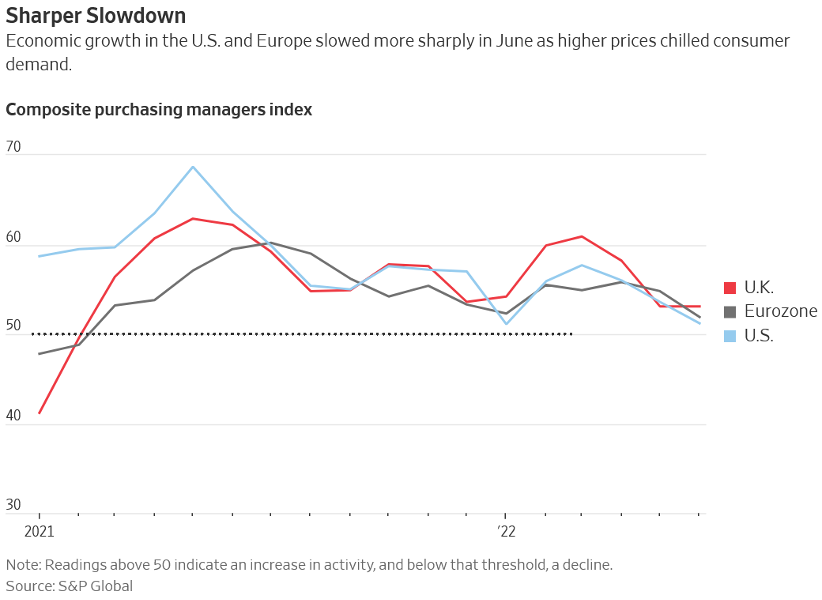

This was a front-page story in today's Wall Street Journal: U.S., European Economies Slow Sharply as Recession Risks Grow. Excerpt:

The U.S. and European economies slowed sharply in June as surging prices of energy and food weakened demand for other goods and services, business surveys showed, increasing the risk of recessions around the world.

The new figures on manufacturing and services activity underline how dark the outlook has become in both Europe and the U.S. Russia's war in Ukraine has hit global growth as high inflation spread across the globe. Economies also face continuing supply-chain disruptions and the prospect of rising interest rates that curb business investment. Europe faces additional pressure from a possible energy shortage this winter.

And this story on the front page of the business section of today's New York Times highlights how the Fed is struggling to deal with inflation: Fed Confronts a 'New World' of Inflation. Excerpt:

Federal Reserve officials are questioning whether their longstanding assumptions about inflation still apply as price gains remain stubbornly and surprisingly rapid – a bout of economic soul-searching that could have big implications for the American economy.

For years, Fed policymakers had a playbook for handling inflation surprises: They mostly ignored disruptions to the supply of goods and services when setting monetary policy, assuming they would work themselves out. The Fed guides the economy by adjusting interest rates, which influence demand, so keeping consumption and business activity chugging along at an even keel was the primary focus.

But after the global economy has been rocked for two years by nonstop supply crises – from shipping snarls to the war in Ukraine – central bankers have stopped waiting for normality to return. They have been raising interest rates aggressively to slow down consumer and business spending and cool the economy. And they are reassessing how inflation might evolve in a world where it seems that the problems may just keep coming.

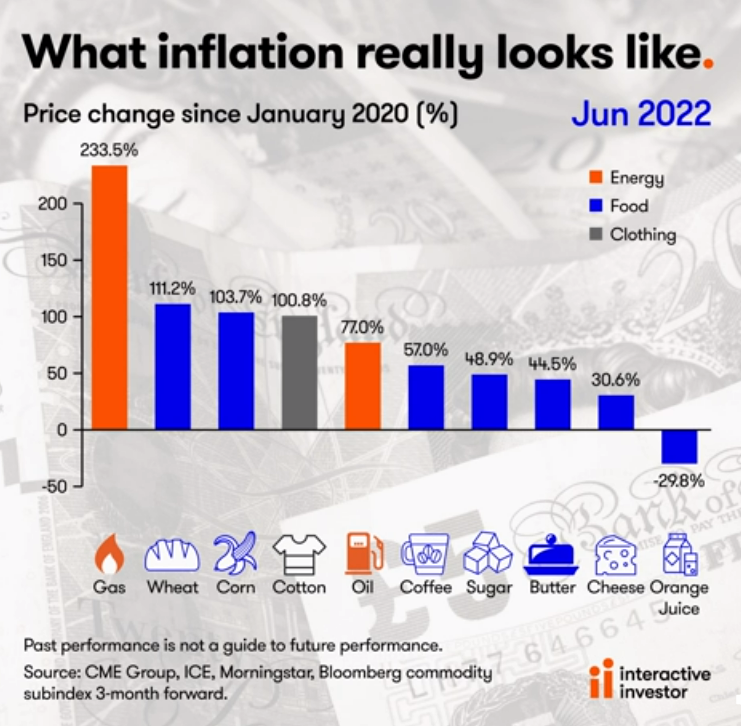

Here's an interesting visualization of how the prices of 10 everyday items have changed since January 2020:

The key question is how aggressively the Fed should continue to raise rates to deal with inflation.

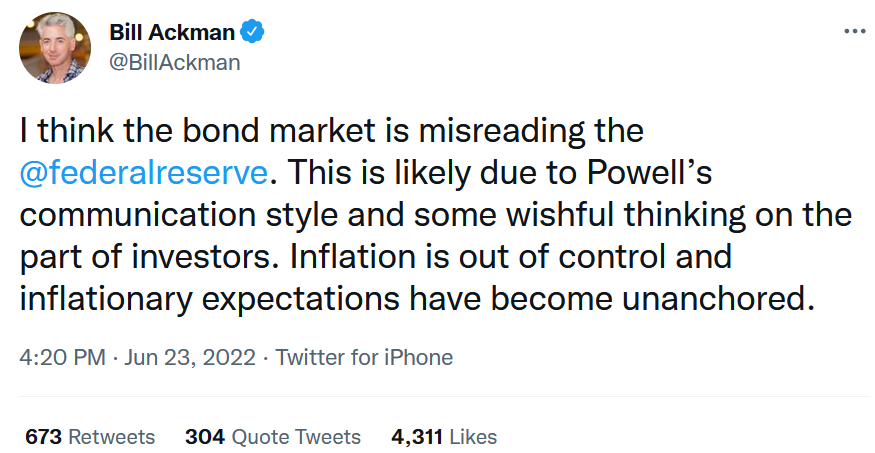

My college buddy Bill Ackman of Pershing Square Capital Management – who has been very right about inflation (and made more than $1 billion betting on this) over the past year (see his 17-slide presentation to the New York Fed on April 13, which I covered in my May 18 e-mail) – continued his call for aggressive Fed action in a Twitter (TWTR) thread yesterday, which you can read here. It starts:

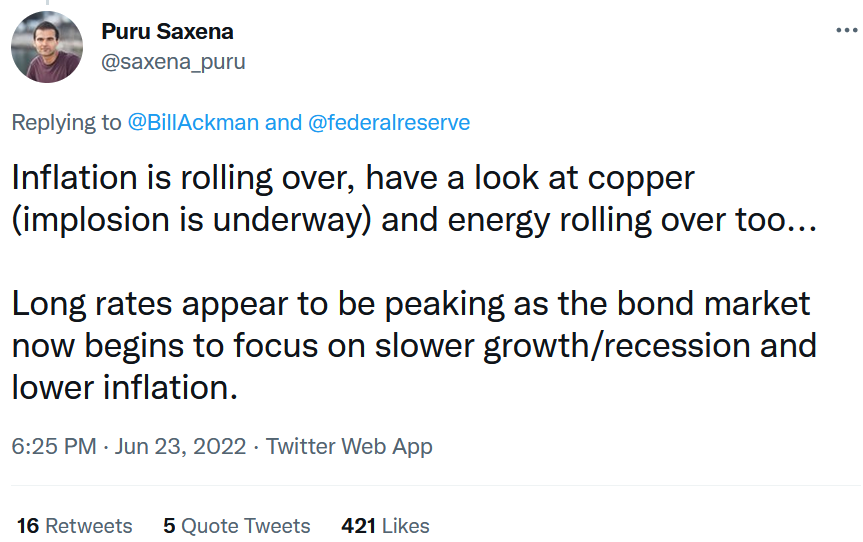

Readers tweeted plenty of contrary opinions. Here's one:

And here's another, with some very interesting charts:

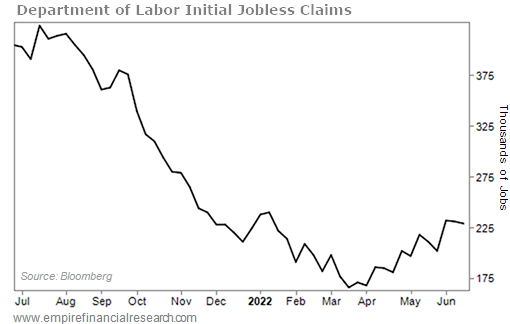

In addition to raw materials prices plunging, there are also signs that the tight labor market is loosening a bit. Since hitting a 60-year low in mid-March, the jobless claims numbers have steadily risen:

Lastly, here's Paul Krugman in today's New York Times: Beware the Dangers of Sado-Monetarism. Excerpt:

More important, policymakers are acting to undo their mistakes. Budget deficits are plunging. The Federal Reserve has begun raising the interest rates it controls, and the longer-term rates that matter for the real economy – especially mortgage rates and corporate borrowing costs – have soared. These policies pretty much ensure a slowdown in the U.S. economy, which might be sharp enough to be considered a mild recession.

But there's a loud chorus of voices insisting that the Fed must tighten even more – indeed, that it must drive the U.S. economy into a sustained period of high unemployment something like the big slump of the early 1980s. And there's a real danger that the Fed may be bullied into overreacting.

So let's talk about why the demands for even more aggressive Fed action are misguided...

As I said, however, policymakers have already taken strong steps to cool the economy back down. So why isn't that enough?

The answer I keep hearing is that harsh policy is necessary to restore the Fed's credibility. And to be fair, there are good reasons to believe that credibility is an important factor in keeping inflation under control. What we don't have are good reasons to believe that this credibility has been lost...

...expectations of persistent inflation aren't entrenched the way they were in 1980. So it doesn't look as if we need harsh, Volcker-type policies that punish the economy until morale improves.

Inflation is a real problem, and tighten the Fed must. But it will be tragic if the Fed listens to people who are in effect demanding a much deeper slump than the economy seems to need.

In Monday's e-mail, I'll share my thoughts on how I think all of this will affect the markets... Stay tuned!

2) This is great news: F.D.A. Orders Juul to Stop Selling E-Cigarettes. Excerpt:

The Food and Drug Administration ("FDA") on Thursday ordered Juul to stop selling e-cigarettes on the U.S. market, a profoundly damaging blow to a once-popular company whose brand was blamed for the teenage vaping crisis.

The order affects all of Juul's products on the U.S. market, the overwhelming source of the company's sales. Juul's sleek vaping cartridges and sweet-flavored pods helped usher in an era of alternative nicotine products that were exceptionally attractive to young people. The company's initial dominance invited intense scrutiny from antismoking groups and regulators who feared the products would do more harm to young people than good to cigarette smokers trying to quit.

I've written many times about Juul in the past:

- Which is more of a total disgrace, DoorDash stealing its delivery workers' tips, or Juul marketing to young non-smokers, addicting millions of them to nicotine? The latter I, think... (11/26/19)

- Jeers to e-cigarette company Juul, as this book reveals: The Devil's Playbook: Big Tobacco, Juul, and the Addiction of a New Generation. (6/11/21)

3) I'm off to Europe tonight for two weeks!

During the first week, Susan and I are doing our eighth Backroads trip – this one is a six-day trip on the Italian and French Mediterranean islands of Sardinia and Corsica. Here are the details and here's a map of our route:

The trip ends Friday and then Susan will fly home, and I'll fly to London to hang out with a friend for four days (we have tickets to the ABBA virtual concert, Henley Royal Regatta, and Wimbledon) before I fly back to Italy, where my friend Ciccio Azzollini and I will be co-hosting – for the 18th time! – our Value Investing Seminar in Trani, Italy on July 7 and July 8.

We limit it to 50 people, many of whom share their latest thinking on where the best opportunities lie and outline their current favorite investment idea(s). It's fun, educational, and a great addition to any European vacation! You can learn more and register right here.

Here's a picture of Ciccio and me with the port of Trani in the background:

4) If you're traveling overseas, keep this in mind and leave yourself extra time: Airports Around the World Battle Long Lines, Canceled Flights. Excerpt:

Delays, cancellations, long lines, and lost baggage are plaguing air travel world-wide, as airlines and airports struggle with soaring summer demand and staff shortfalls.

London's Gatwick Airport has told airlines to cut back on inbound flights as it struggles with staff shortages and canceled flights. Over a four-day weekend celebrating Queen Elizabeth II's Platinum Jubilee earlier this month, lines of passengers waiting to check in stretched out of the terminal. Amsterdam's Schiphol Airport is limiting the number of passengers allowed inside, asking travelers not to show up more than four hours before their flights. It is also warning them to wear comfortable shoes for the hours-long wait once inside.

The two airports – both gateways for European vacations this summer – are struggling, like the rest of the industry, with chronic staff shortages. They and others have tried to hire staff back after letting them go during a two-year-long travel bust thanks to COVID-19 restrictions...

The start of summer can be a tough time to travel in the best of years. But delays, especially in Europe, are particularly high this summer season. So far this month, 25% of scheduled flights on the continent, excluding Russia, took off late, with an average delay of 34 minutes, according to FlightAware, a flight-tracking platform. That compares with 21%, with an average delay of 28 minutes, in June 2019. At Schiphol in Amsterdam, 36% of flights have been delayed this month, up from 28% in 2019.

Flight cancellations have risen in June, according to data compiled by aviation data consultancy Cirium. In the U.S., about 3% of scheduled flights have been scrapped so far this month, compared with a 2% rate in 2019, before the COVID-19 pandemic. The total number of cancellations rose 16%, to 13,581 fights, from the year-earlier period.

In Europe, excluding Russia, about 2% of all flights have been canceled so far in June, compared with a rate of 1% for the same period in 2019.

I got a bitter taste of this yesterday when EasyJet canceled my connecting flight tomorrow from Milan to Olbia. I had to scramble and ended up paying almost $400 for a flight six hours later – out of a different airport (I fly into Malpensa and out of Linate). GRRRRRR!

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.