Dumb Money; Chuck Akre on not selling 'great compounders'; Howard Buffett on Ukraine

1) On Friday, Susan and I went to see "Dumb Money," the new movie about the GameStop (GME) craze (trailer here).

It's a rollicking tale of how a group of average folks on the WallStreetBets message board on Reddit – led by a nerdy nobody, Keith Gill (aka RoaringKitty and DeepFu**ingValue) – engineered one of the greatest short squeezes in history.

They drove GME shares up more than 100 times in just a few months, costing the well-heeled hedge fund managers – most notably Gabe Plotkin of Melvin Capital – who were short the stock billions of dollars. (Here's a good review in the Wall Street Journal: 'Dumb Money' Review: David, Goliath and the GameStop Frenzy.)

I was writing regularly about GameStop and the meme stock mania at the time, warning my readers that it was a gigantic bubble that would end very badly. On January 26, 2021, I wrote (note that GME split 4:1 on July 22, 2022, so you need to divide the prices here by 4 to compare them to today's price around $17):

Like everyone else who follows the markets, I can't tear my eyes away from the stock of video-game retailer GameStop (GME), which in recent weeks has been on one of the wildest rides I've ever seen...

Just yesterday, GME shares opened at $96.73, up from Friday's close of $65.01. Then, in a little more than an hour, they soared to $159.18, then crashed to $61.13, before finishing the day at $76.79 (and then rose to $100 earlier this morning).

Lots of retail investors have made a fortune, while professionals have gotten clobbered. To wit, one of the largest hedge funds in the world, Gabe Plotkin's Melvin Capital Management – which started the year with $12.5 billion under management – suffered losses of 30% in the first 15 trading days of this year thanks to its short book (which of course included GameStop)... forcing it to do an emergency $2.75 billion capital raise yesterday...

That said, I correctly saw that the foolishness still had room to run, writing: "I'm not ready to call a top yet."

I didn't have long to wait...

The very next day, GME shares soared to an intra-day high of $483 ($120.75 today) and I called the top, not only of GME but 24 other silly meme stocks, writing:

The stock of video-game retailer GameStop (GME) has gone from insane to surreal, soaring 93% yesterday – and then another 48% in after-hours trading thanks to this tweet by Tesla (TSLA) CEO Elon Musk:

There's no doubt that GameStop's stock is wildly overvalued and will crash – I stand by my prediction in yesterday's e-mail that, from Friday's high, "it will be down by two-thirds within a month (less than $53.27 per share) and 90% within a year (less than $15.98 per share)" – but in the next few days (or maybe even weeks), it could trade anywhere.

That's why I would never short it. As economist John Maynard Keynes once said, "the markets can remain irrational longer than you can remain solvent" – a lesson many short-sellers are learning the hard way right now... (Short-sellers have lost $91 billion so far this year, according to this article.)...

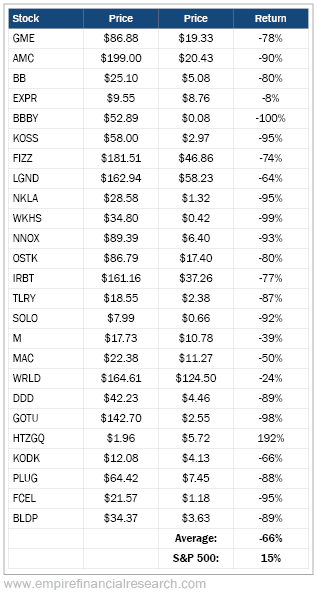

I think these 25 stocks (including GameStop) are highly likely to underperform going forward. In fact, I'll stick my neck out even further and say that I think today will be the top. They remind me of the eight "bankruptcy bubble" stocks I named in my June 9, 2020 e-mail, which collapsed by an average of 74% in the subsequent five weeks (see the performance table in my July 17 e-mail).

I was one day off, as these 25 stocks soared an average of 57% the following day (here's what I wrote about it) – and then began a sickening crash that, for almost all of them, continues to this day.

As you can see in this table, using the closing prices on January 27, 2021, all but one of these stocks (I exited Hertz on 5/13/21) is down big, with an average decline of 66% during a period in which the S&P 500 is up 15%:

So, while I enjoyed the movie, I worry that it sends the wrong message: that what Gill and his followers did is a good idea.

To be clear, it's not.

In fact, I can't think of a quicker way to lose all of your money than engaging in the reckless, speculative behavior shown in the movie.

And that's my main beef with the movie: It profiled a handful of average folks who made a ton of money – and then gave some of it back – but didn't show a single one of the hundreds of thousands (millions?) of naïve folks who bought in near the top of GME and similar meme stocks and got incinerated, many no doubt losing their life savings.

I had the chance to ask this question because, in an unexpected bonus, there was a Q&A after the show with one of the movie's producers, Wall Street Journal reporter Lauren Schuker Blum, and Ben Mezrich, the author of the book the movie is based on. (He also wrote the classic book, Bringing Down the House: The Inside Story of Six M.I.T. Students Who Took Vegas for Millions, as well as the book that was the basis for the movie The Social Network). I spoke with them briefly afterward – here's a picture of me with Ben:

I asked them why they didn't profile anyone who lost their shirt. Lauren said it's because they wanted to develop characters by following certain people for a period of time (when the stock was going up), which wasn't possible during the stock's collapse because it was so quick.

I don't buy that explanation. I think the real reason is that a lot of average folks losing a lot of money doesn't make for a good story...

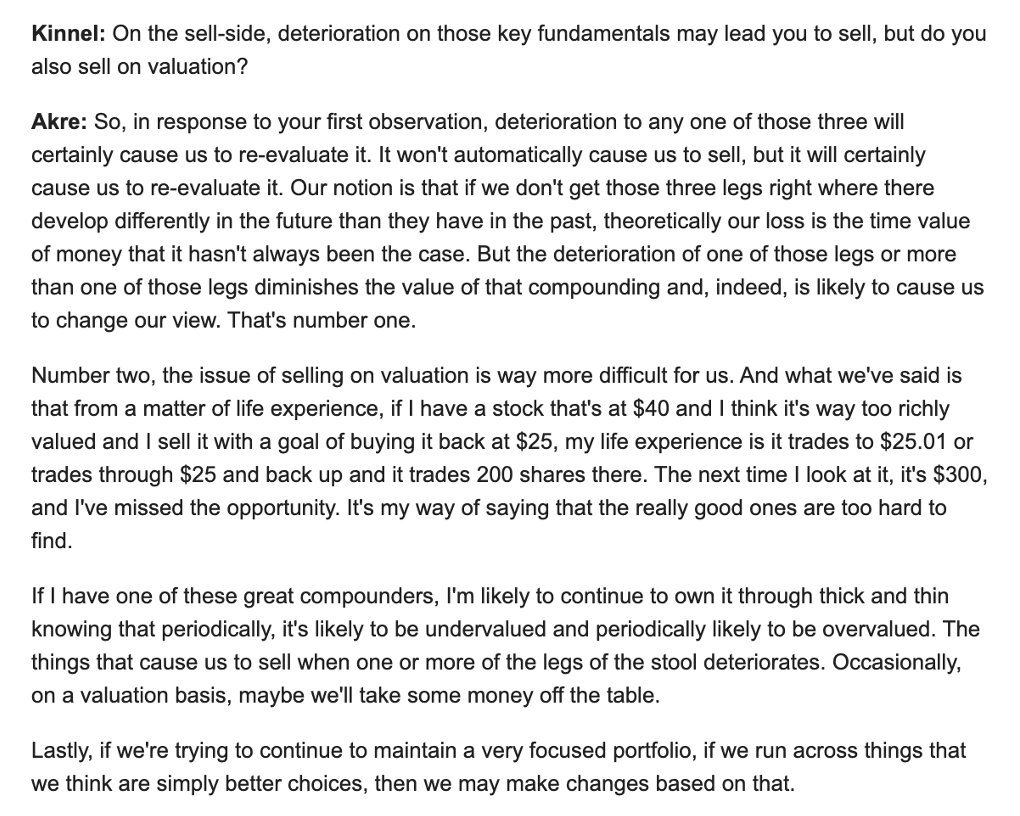

2) For some wise words on sensible investing, here's Chuck Akre of Akre Capital Management (who long ago was an investor in one of my hedge funds) on not selling "great compounders":

3) Last Wednesday, I sent this note to Warren Buffett about his son:

Dear Mr. Buffett,

I thought you'd be interested in this interview Howie just did with the Kyiv Post.

I continue to be amazed and inspired by what he's done and continues to do in/for Ukraine.

I continue to be deeply involved as well, buying vehicles/ATVs and generators, but the $100,000 or so I'm raising and putting to work every month pales in comparison to what Howie's doing.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.