Financial advice to retired readers

I get many e-mails from retired readers who ask how they should invest their savings.

Unfortunately, because Empire Financial Research is a publisher, not an investment advisor, I can't give specific advice to any individual... so let me instead address a hypothetical couple, based on what I've heard from many different readers.

Here are their characteristics:

- Age: 72

- Both in good health, vaccinated, nonsmokers

- Two adult children plus grandchildren

- $75,000 of annual income from Social Security and a pension

- Expenses of $50,000 annually

- No expected large payments such as the purchase of vacation home

- No debt

- Savings of $500,000, currently in cash

- Risk-averse

Here is the advice I would give this couple regarding how to invest their nest egg...

My biggest message would be:

Congratulations! You appear to have done everything right and, as a result, are in a great financial position that will almost certainly allow you to live comfortably and enjoy the rest of your life.

Before I go any further, a key factor to address is life expectancy. I Googled the average life expectancy for a 72-year-old American and the result was 13 years for a man and 15 for a woman.

However, I think this hypothetical couple need to plan for nearly double this, given that they are in good health, have access to high-quality health care, have a stable financial and marital situation, etc.

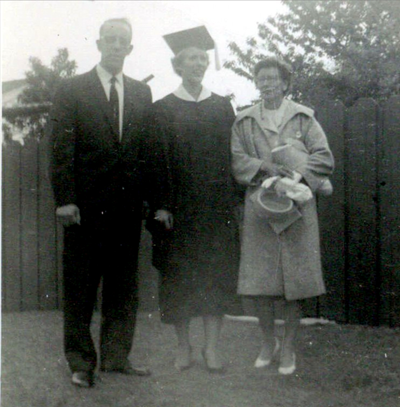

My grandparents could be this hypothetical couple. My grandfather was a Seattle fireman and then, after he was injured on the job, worked for the Water Department. In the days before the middle class in this country was gutted, his salary alone was sufficient to provide for his family and send my mom and her three siblings through the University of Washington in the 1960s without debt (thanks in part to all of them working through high school and college) and onto successful careers and lives. Here's a picture of them with my mom on the day of her college graduation in 1962:

When he retired, he had two pensions, so he and my grandmother lived comfortably. The only sad part of this story is that he died too young at age 82, no doubt in part due to developing a big belly in his old age and a lifetime of smoking, which he stopped only after a heart attack that required triple-bypass surgery at age 75 (my grandmother remarried and lived to age 99).

As for how my hypothetical couple should invest their $500,000 nest egg, because they have no debt and expect that their income will exceed their expenses every year going forward, they don't need to do anything with it. They can leave it all in cash and cash equivalents (such as super-safe short-term bond funds) and live happily ever after, with no risk or stress. If a calamity strikes – for example, one of them has a medical issue that requires expensive long-term care, $500,000 is enough to cover all but the worst scenarios.

On the other hand, because their financial situation is so healthy and they have (I estimate) at least a 20-year investment horizon, if they want to grow their nest egg, they are in a good position to invest significantly more in stocks than average 72-year-olds.

So what would I advise? Roughly splitting the difference...

I would suggest a target (for now) of having 60% or $300,000 of their savings in stocks, but I wouldn't rush to get there. With the market near all-time highs right now, I'd instead recommend dollar-cost averaging, so maybe invest $100,000 right away and then $50,000 in six, 12, 18 and 24 months from now. In that way, they'd get to the equity allocation I suggest in two years and also have plenty of "dry powder" (say, an additional $50,000) to put into stocks if there's a significant market pullback of 20% or more.

As for the remainder, I'd leave it in cash or cash equivalents – perhaps $50,000 in a checking account (even though it earns almost no interest these days) and the balance in a super-safe short-term bond fund with a one- or two-year duration that might earn a little interest. That's what I did with some of my excess cash at Citibank – most banks and mutual fund companies will have offerings.

I suspect many financial advisors would advise this couple to put a significant amount of their savings in higher-yielding bonds – either longer-dated and/or riskier ones – but I'm worried about rising interest rates (which would crush long-term bonds) and the paltry yields relative to risk with corporate and municipal bonds. To use a phrase coined long ago by Jim Grant, bonds in general these days in my opinion offer "return-free risk" (as opposed to what they're supposed to offer: risk-free return).

As for the specifics of the 60% allocation to equities, I'd suggest putting 50% to 80% of it into the S&P 500 Index fund, either via a mutual fund company like my favorite, Vanguard, or buying the SPY exchange-traded fund ("ETF") in a brokerage account.

Then, with the balance, they can try to do a little better than the market by buying a dozen stocks, with an expected holding period of at least three to five years, ideally longer.

I'd suggest that this couple stick mostly to blue-chips, both because they don't need to take extra risk and also because, I assume, they want to enjoy their retirement rather than having to watch their portfolio every day and do a lot of trading.

I'd start with a $25,000 position in Berkshire Hathaway (BRK-B), which I continue to believe is the No. 1 retirement stock in America thanks to its combination of growth and, more importantly, safety. It's my favorite stock for the foundation of a "stay rich" (as opposed to a "get rich") portfolio. And best of all, it's trading today well below the price that CEO Warren Buffett has been buying it, as I discussed in my September 23 e-mail.

But again, I wouldn't suggest buying more than a dozen stocks – that's just clutter and causes brain damage. There's already plenty of diversification – 500 stocks! – by owning the S&P 500.

My last piece of advice to older folks who are in strong financial positions is not to be too frugal – something I regularly lecture my parents about. They are real penny-pinchers, which, over a lifetime, is how they have achieved financial security. But now that they've achieved it, they should enjoy it by spending some money – not on material goods, but rather experiences. Extensive research shows that this is what leads to the greatest happiness, as outlined in these articles: Buy Experiences, Not Things and Why Experiences Are Better Than Things.

For those who like to travel, go see this magnificent country. Rent an RV and take a trip, as Susan and I did last month. If you enjoy it, buy an RV and take regular trips. And don't forget international travel – there's a vast, incredible world to explore!

And don't forget to include your family – in my opinion there's nothing better than spending time with your siblings, children, and grandchildren. Pay for your children and their families to join you on a cruise in Alaska or a beach vacation in Mexico, something my in-laws have done for us.

I'm just throwing out ideas – it's up to every couple/family to decide on the details – but you get the picture...

How much should my hypothetical couple spend on these experiences? There's no definitive answer, but here's how I'd think about it: Since they have annual income of $75,000 and only need to spend $50,000 to cover their basics, then I'd suggest that they budget $25,000 every year to have wonderful experiences.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.