Herb Greenberg's big event is tomorrow; The rise in stocks trading above 10 times revenues; Problems at Freedom Holding; How Energy Markets Are Shaping Putin's Invasion – and the World; Ukraine Is Winning

1) My colleague Herb Greenberg is of the best-known investigative stock journalists in Wall Street history...

He was a senior stock commentator for CNBC, and has written for the Wall Street Journal, Fortune, MarketWatch, TheStreet, the Chicago Tribune. He also spent a decade at the San Francisco Chronicle, where his columns were mailed weekly to the legendary Warren Buffett.

I was thrilled when Herb joined the Empire Financial Research team back in October. Since then, he has been writing essays for the free Empire Financial Daily e-letter and has helped contribute to the Empire Stock Investor and Empire Investment Report newsletters. And now, he's gearing up for his next big move...

Tomorrow, at 8 p.m. Eastern time, I'll be joining Herb on camera as he shares his latest exposé. This goes beyond anything he's ever done... And it could be the most lucrative profit opportunity of the year.

In short, Herb says that the manic activity we've seen in the market recently has opened a huge "backdoor" that's 20 years in the making... which allows you take advantage of the shakeups in a way that the folks on Wall Street hope you'll never figure out.

The story is so important, that we've made the event completely free to attend... and we'll even give away a free recommendation just for showing up. You just need to reserve a spot here.

2) It used to be extremely rare for a large-cap stock in the S&P 500 Index to trade at more than 10 times revenues, but as NYU marketing professor Scott Galloway points out in this short video, it became increasingly common (though with the crash in richly valued high-growth stocks in the past year, a bit of sanity is returning to valuations in this sector): Who can afford the S&P 500?

3) Speaking of stocks with silly valuations, here's a report by Edwin Dorsey of The Bear Cave on one of my Dirty Dozen stocks: Problems at Freedom Holding (FRHC). Excerpt:

Freedom Holding (FRHC) operates retail stock brokerages, banks, and margin lending services in Russia and Eastern Europe. Headquartered in Almaty, Kazakhstan, Freedom Holding employs over 1,000 people in Russia, owns a stake in the Saint Petersburg Stock Exchange, has the majority of its brokerage branches in Russia, and has ties to Russian government officials and banks sanctioned for money laundering. Freedom Holding is also surrounded by other irregularities. For example, the company generates most of its activity in a related-party Belize brokerage and Freedom pushes customers to buy its own stock. Although Freedom Holding's Russia listing is halted, the company continues to benefit from accessing U.S. capital markets with an active Nasdaq listing. That may change.

4) I enjoyed this insightful Ezra Klein Show podcast episode in which Klein interviews energy expert Daniel Yergin: "How Energy Markets Are Shaping Putin's Invasion – and the World." You can listen to it on Apple, Spotify, or Google and the transcript is here. Excerpt:

Nearly every dimension of the Ukraine-Russia conflict has been shaped by energy markets.

Russia's oil and gas exports have long been the foundation of its economy and geopolitical strength. Vladimir Putin's decision to invade Ukraine – like his annexation of Crimea in 2014 – coincided with high energy prices. While Western sanctions have dealt a major blow to Russia's financial system, European carve-outs for Russian oil and gas have kept hundreds of millions of dollars flowing to Moscow every day.

As a result, energy policy has become foreign policy. European countries are doubling down on their commitments to decarbonize in order to reduce their dependence on Russian energy as quickly as possible. The United States has banned Russian oil and gas imports, and in the wake of spiking gasoline prices, the Biden administration is looking for any opportunity to increase the world's oil supply, including the possibility of normalizing trade relations with previously blacklisted countries like Venezuela and Iran.

But the intersection of energy and geopolitics extends far beyond this conflict. Energy is the bedrock of nations' economic prosperity, military strength, and geopolitical power. Which means energy markets are constantly shaping and reshaping global dynamics. You can't understand the way the world operates today if you don't understand the global flow of energy.

There are few people who have studied energy markets as closely as Daniel Yergin has. He is an economic historian and writer who has been called "America's most influential energy pundit" in the New York Times. And he's the author of numerous books on the intersection of energy and geopolitics, including the Pulitzer Prize-winning The Prize: The Epic Quest for Oil, Money, and Power and, most recently, the best-selling The New Map: Energy, Climate, and the Clash of Nations.

We discuss how Putin's invasion halfway across the world caused gasoline prices to rise in California; what would happen to European economies if they decided to cut off Russian gas; how the U.S. shale revolution has transformed the global political landscape; why, when it comes to China and Russia, Yergin believes that "a relationship that was once based on Marx and Lenin is now grounded in oil and gas"; whether Donald Trump was right to be skeptical of Nord Stream 2; why decarbonization is not only beneficial for the climate but also crucial for national security; whether the Biden administration's response to spiking energy prices is putting its climate agenda in jeopardy; why Yergin thinks hydrogen power could become central to combating climate change; and much more.

5) Following up on Monday's e-mail about the war in Ukraine...

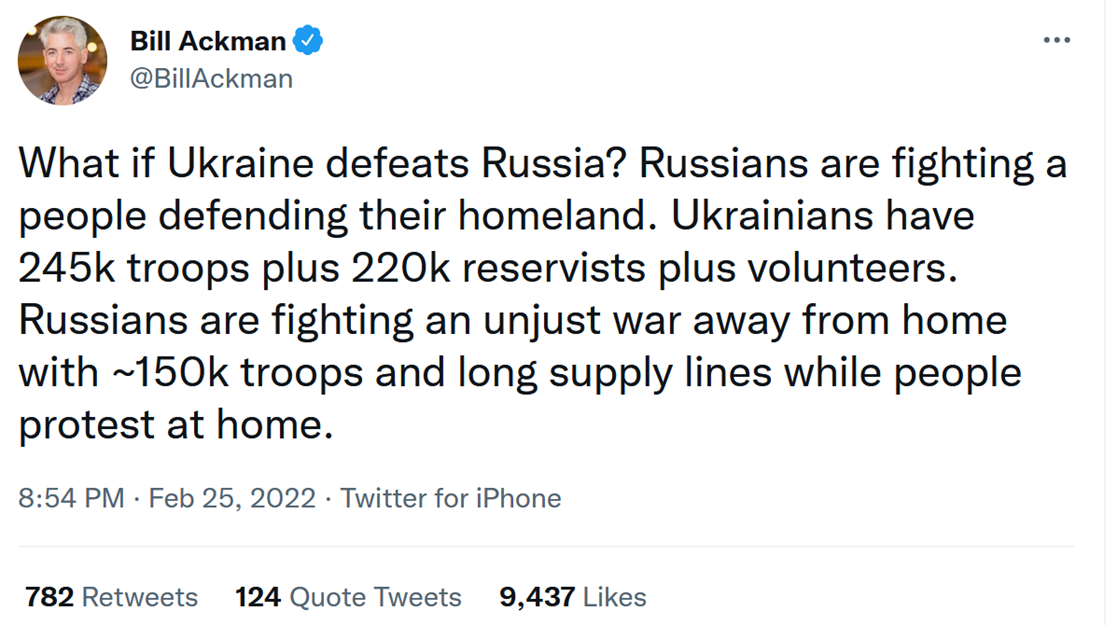

On February 25, only one day after Russia invaded Ukraine, when nearly everyone thought a quick Russian victory was all but certain, my friend Bill Ackman of Pershing Square tweeted:

(Bill's great-grandfather, a shepherd living in western Ukraine when the country was part of the Russian Empire, fled the country to avoid conscription in the tsar's army and the regime's discrimination against Jews. My wife's great-grandfather has a similar story...)

It looks increasingly likely that Bill will once again quickly be proven right regarding one of his highly contrarian predictions. To see why, see this article in The Atlantic by Eliot Cohen, a former Counselor of the Department of State: Ukraine is Winning. Excerpt:

When I visited Iraq during the 2007 surge, I discovered that the conventional wisdom in Washington usually lagged the view from the field by two to four weeks. Something similar applies today. Analysts and commentators have grudgingly declared that the Russian invasion of Ukraine has been blocked, and that the war is stalemated. The more likely truth is that the Ukrainians are winning...

If the Ukrainians continue to win, we might see more visible collapses of Russian units and perhaps mass surrenders and desertions. Unfortunately, the Russian military will also frantically double down on the one thing it does well – bombarding towns and killing civilians.

The Ukrainians are doing their part. Now is the time to arm them on the scale and with the urgency needed, as in some cases we are already doing.

We must throttle the Russian economy, increasing pressure on a Russian elite that does not, by and large, buy into Vladimir Putin's bizarre ideology of "passionarity" and paranoid Great Russian nationalism. We must mobilize official and unofficial agencies to penetrate the information cocoon in which Putin's government is attempting to insulate the Russian people from the news that thousands of their young men will come home maimed, or in coffins, or not at all from a stupid and badly fought war of aggression against a nation that will now hate them forever. We should begin making arrangements for war-crimes trials, and begin naming defendants, as we should have done during World War II.

Above all, we must announce that there will be a Marshall Plan to rebuild the Ukrainian economy, for nothing will boost their confidence like the knowledge that we believe in their victory and intend to help create a future worth having for a people willing to fight so resolutely for its freedom.

As for the endgame, it should be driven by an understanding that Putin is a very bad man indeed, but not a shy one. When he wants an off-ramp, he will let us know. Until then, the way to end the war with the minimum of human suffering is to pile on.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.