Here's What Comes After the Bloodbath

It's hard for investors to be optimistic right now.

But I (Jeff Havenstein) want to bring you a glimmer of hope.

Let's start with the bloodbath that happened late last week. As you've seen just about everywhere, markets took it on the chin when President Donald Trump announced his "Liberation Day" tariff plan...

The S&P 500 Index fell nearly 5% last Thursday and 6% last Friday. It was the third-worst two-day stretch for the market since the turn of the century.

Investors are clearly panicking. CNN's Fear & Greed Index recently posted a score of just 4... out of 100. That signals "extreme fear."

However, this isn't the first time we've seen markets fall steeply over a two-day period. It has happened quite a few times. And the good news is that, according to history, markets are usually significantly higher both a year later and two years later.

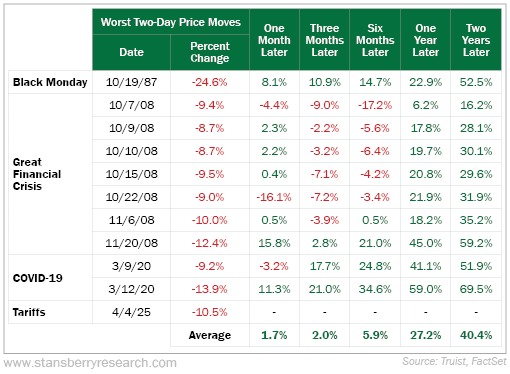

The following table comes from banking company Truist Financial. It looked at the 10 worst two-day stretches for the market since 1950 (not including the recent tariff drawdown).

There was Black Monday, a number of instances during the great financial crisis, and two more during the COVID-19 bear market. Take a look...

In the months after these sudden drops, results vary. But on average, stocks were up 2% three months later and nearly 6% six months later.

When you look further out, it gets more encouraging. In all of these situations, the S&P 500 was higher one and two years later. The average gains were 27% and 40%, respectively.

For long-term investors, there are still reasons to be optimistic. You'll just have to stomach the short-term volatility.

Of course, the big concern is that these tariffs will lead the U.S. – along with other countries – into a recession.

Goldman Sachs' most recent estimate of a U.S. recession stands at 45%. And JPMorgan Chase thinks the probability of a global recession is 60%.

As we've talked about before, the losses during a recession are much larger than those of a bear market without a recession attached to it.

According to Truist, the median S&P 500 decline around a recession is 24%.

The market is currently down about 19% from its February high. It's not too far off.

So the good news is that the market is already pricing in a decent amount of recession risk. But the fear is that this will not be a typical recession if tariffs remain in place for a while and market valuations stay high.

If you're a longtime reader, you'll know I have been bullish on the market. These tariffs obviously add a new wrinkle, and things can admittedly get rockier over the next few weeks and months. But I still like the outlook for the next year or so. As the table above shows, things are likely to improve in that time.

Now, if this recent sell-off has been stopping you out of your portfolio positions and you have some extra cash floating around, I have just the recommendation... In our new issue of Retirement Millionaire publishing tonight, Doc Eifrig and I highlight a stock that every investor should buy today.

It's a name everyone knows. It's one of the best dividend stocks ever. And it's trading for a decade-low valuation.

Most importantly, this is a stock you want to own when there's panic in the air. That's what makes it so perfect today.

Retirement Millionaire subscribers should check their inboxes in just a couple hours for all the details of this once-in-a-decade buying opportunity.

And if you don't subscribe to Retirement Millionaire, you can click here to get started.

What We're Reading...

- Something different: LIV Golf Miami is in the books, and it'll be judged by nothing that happened at Trump Doral.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein

April 9, 2025