How to Handle This Trading 'Disaster'

Coming out of the 2008 financial crisis, we stumbled upon one of the world's greatest businesses trading for a steal of a price.

At the time, my Retirement Trader newsletter was a new trading service... And this was the exact setup we were looking for. It was the ideal mix of potential return and safety. Naturally, we recommended throwing some money at the opportunity.

It looked like a great opportunity to generate some healthy income. But then the trade took a turn..,

It was August 2010, and our eyes were set on Intel (INTC). At the time, the chipmaking juggernaut dominated its competition and was rolling in profits. We said that it "might be the world's greatest business."

As we wrote at the time...

Intel is a money-making machine. It is the dominant manufacturer of the most essential component used in computers. All of the name-brand computer makers – Microsoft, Dell, and Apple – rely on its processors. Modern-day electronics makers use its chips to improve the brainpower of everything from ovens to garage door openers.

To get a sense of what a colossus Intel is, realize it controls 80% of the global market for microprocessors. Its nearest competitor, AMD, accounts for 10%.

Intel had everything we look for in an investment... Its financials were impeccable. It had tremendous brand loyalty and recognition. It rewarded shareholders. And it invested in the future. Yet the stock was trading for just 2.5 times book value, 2.5 times sales, and 9.4 times earnings.

With such a depressed valuation, we had a huge margin of safety.

Even better, we were getting paid quite a bit to sell INTC options... Volatility was still high. Even though the market had bounced off its March 2009 low, it went through a correction of 13.7% just before we made our trade.

Investors were plenty scared. And they were willing to pay for options protection – even on a stalwart like Intel.

Intel was trading at $19.47 when we made our trade. We sold INTC September $19 puts for $0.47.

We were expecting to earn 2.5% in just a few weeks, or 26.5% annualized. Again, it was the perfect mix of potential return and safety... on one of the world's best businesses at the time.

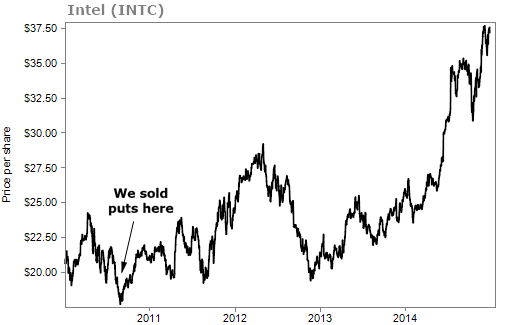

Take a look at the chart below. Intel shot up 50% over the next 21 months. And it nearly doubled over the next four years...

Everything about our thesis was correct... Intel was too cheap, and shareholders eventually realized it.

But when you trade options, the short term matters.

Soon after we made our trade, Intel fell further. Folks who sold puts were either assigned shares in early September or at expiration a couple weeks later.

For every put a subscriber sold, he or she had to come up with the cash to buy 100 shares – $1,900 a pop. That's called being "put the stock." As we wrote after September expiration, though, this was not a problem...

This is just fine. Remember, we only sell puts on stocks we'd be happy to own outright. And that's what happened here. INTC is the dominant manufacturer of the most essential component used in computers. Its balance sheet is impeccable, and it treats shareholders well. It might be the world's greatest business.

And we bought it at a discount. Yes, we just paid $19 a share for it (slightly more than its close price Friday). But we get to keep the $0.47 premium...

So we really paid $18.53 per share. Even better, we can now use our new stock position to take in even more money.

That last part is important... Even though the trade did not go according to plan since we had to buy shares, we could still make more money on the trade. Specifically, we would sell an INTC November $19 call and earn $0.70 more.

As you saw in the chart above, shares of Intel didn't fall for long. They were on the rise by November. The stock ended up well above our $19 strike price at expiration. Plus, because we'd become shareholders, we collected a $0.26 dividend payment as well.

At November expiration, we walked away with a gain of 7.2%, or 26.7% annualized. Our calls were exercised, and our shares were sold.

Some subscribers think being assigned shares is a losing trade. It means the plan didn't work out and they had to cough up a bunch of cash. But that's not how we view it...

We made more money than we put into the trade. That's the definition of a winner. With Intel, we bought shares at $19, sold them two months later at the same price, and kept all the income we generated from a dividend payment and selling two options (the September put and the November call).

Don't think of being assigned shares early as a catastrophic event. It happens. And there are – as we've explained today – ways you can turn your newly acquired stock into profits.

This is just one reason why I tell folks that my Retirement Trader strategy works in any market environment. I find good businesses that do well regardless of what the market is doing. And – even if an investment doesn't work in the short term – we can earn extra income while things turn back around.

But too many folks are afraid to add options to their investing toolkit.

On Friday, I released a video where I showed pro golfer Kevin Kisner how to sell options. I walked him step by step through the process and explained why selling options isn't as difficult or risky as some may think.

This video is going offline tonight, so click here to watch it now.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

September 9, 2024