Human Emotions Point to More Market Gains

Bull markets don't die with a whimper.

A lot of new investors don't understand this. When I (Jeff Havenstein) was younger, I certainly didn't.

I'd see the market go on a long run higher and stock valuations at extremes... Then I'd convince myself that stocks would have to move lower so that these exorbitant valuations would match up with the more grounded fundamentals of the underlying businesses.

It's a logical approach. But that's not how markets work.

Markets are driven by people and their emotions. With that in mind, things don't always have to make complete sense.

Economist John Maynard Keynes created an apt metaphor for this point in 1936.

He described the financial markets as a beauty contest and investors as the judges of the beauty contest. In this role as judge, your goal isn't to pick the contestant you find most attractive...

Instead, you're trying to pick the contestant that you think others will judge the most attractive.

Markets are fueled by emotion. And a lot of this emotion typically occurs near the tail end of a bull market.

You've probably heard of "FOMO" before. It stands for the "fear of missing out." FOMO is one of the most powerful drivers of the market when stocks are moving higher.

Toward the end of long bull markets, folks who were sitting on the sidelines in cash get tired of hearing about how much money other people have made. They feel like they're missing out, so they want in on the action, too. That's when they go "all in" and buy stocks.

This new round of buying leads to higher stock prices... And that only tempts investors to recklessly gamble more money in the market. With everyone buying at the same time, this creates a "blow-off top" rally... or what former Stansberry Research editor Steve Sjuggerud has called a "Melt Up."

When folks are blindly throwing money into the markets with hopes of becoming rich overnight, the end is in sight. In other words, bull markets end with euphoria.

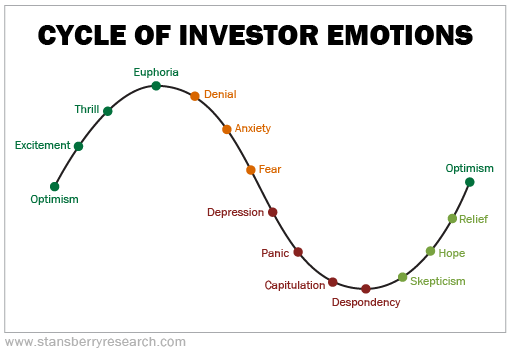

Below is a classic outline of market cycles. You'll see that excitement leads to thrill, which eventually leads to euphoria at the peak. Take a look...

Given that the market is near all-time highs today, we're clearly somewhere in the dark green on the above chart. But I don't think we've quite reached the euphoria stage yet...

People are still acting too rationally.

For reference, let's think back to past blow-off-top rallies. The most obvious example is during the late 1990s.

As the Internet mania took hold, investors piled into any and every dot-com stock they could find. This even included ones with no substantial fundamental data backing up valuations.

The euphoric dot-com companies thought they couldn't lose, either. During the 2000 Super Bowl, 17 different dot-com companies bought ad spots for a combined $44 million. As we all know now, most of these businesses didn't last the year... For the 2001 Super Bowl, only three dot-com companies bought ads.

Investors who believed the hype lost a lot of money. Folks initially thought that Internet stocks were a ticket to get rich quick... And they didn't want to be among the fools sitting on the sidelines missing out on free money.

We also saw a sense of euphoria as recently as late 2021. Coming out of COVID-19, investors bought up any Internet and software company they could get their hands on. Many of these stocks saw hundreds-of-percent gains. And along the way, investors thought they could never lose money with these investments.

Then, of course, there were no more buyers left. Stocks crashed in 2022, with tech stocks among the hardest hit. Investors collectively lost trillions of dollars.

One way to figure out if we're in a euphoric state right now is to look at an investor sentiment survey.

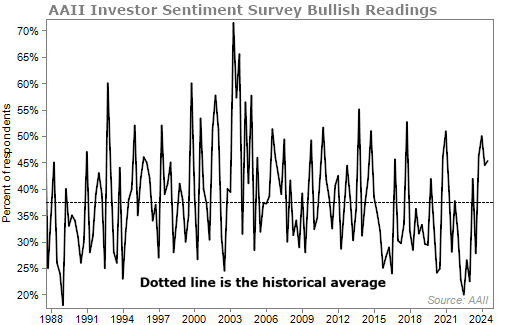

The chart below comes from the American Association of Individual Investors ("AAII"). Since 1987, AAII members have been answering the same simple question each week: "Do you feel the direction of the stock market over the next six months will be up (bullish), no change (neutral), or down (bearish)?" The results are compiled into the AAII Investor Sentiment Survey.

Historically, about 37.5% of investors are bullish, 31.5% are neutral, and 31% are bearish. Today, we're seeing that more folks are bullish than average, with a reading of 45.3%. Take a look...

We're not at an extreme peak. Sure, we're well above average, but we probably have some more room to run before we reach a peak in the market.

Believe me, you'll know when things have turned from excitement to euphoria... Your neighbors will incessantly want to talk about stocks. Stocks will be all you'll see on the news. And you'll even have a few co-workers come to you with alleged "can't miss" investment ideas.

I don't think we're there yet. And that means more gains are possible.

In the meantime, many investors are worried about volatility. But Marc Chaikin, the founder of our corporate affiliate Chaikin Analytics and 50-year Wall Street veteran, says that this turbulence is actually an opportunity to profit.

Tomorrow, Marc is going on camera to share how you can prepare for what's coming next... and how you can capitalize on all this uncertainty. Plus, he's giving away two recommendations – one stock to avoid and one worth buying.

The event is free to attend, but you must sign up in advance. Get all the details here.

What We're Reading...

- Something different: Bad news for iPhone users.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein

September 18, 2024