I saw 16 companies at the first day of the ICR conference; Thoughts on Boot Barn and Five Below; Druckenmiller fired one of his money managers for shorting TSLA without driving the car; Antarctica polar plunge

1) Greetings from Orlando, where I'm attending the annual ICR conference, at which more than 200 public retail, restaurant, and consumer companies meet with analysts and investors.

Every half hour from 8:00 a.m. to 4:00 p.m., three to five companies present or do "fireside chats" (Q&A sessions with an analyst) in one of the ballrooms and, separately, do small-group breakout sessions.

I had to make a lot of hard decisions, as I often had to choose between two companies I wanted to see during the same time slot.

Here were the 16 companies I saw yesterday, in chronological order: Chico's FAS (CHS), Guess (GES), Macy's (M), United Natural Foods (UNFI), Five Below (FIVE), Boot Barn (BOOT), ONE Group Hospitality (STKS), Jack in the Box (JACK), Potbelly (PBPB), Lovesac (LOVE), Movado (MOV), Purple Innovation (PRPL), Container Store (TCS), Duckhorn Portfolio (NAPA), Chefs' Warehouse (CHEF), and Verano (VRNOF).

In today's e-mail, I'll share comments on two of them...

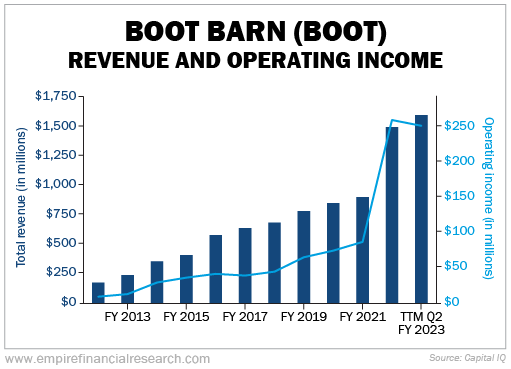

2) I was very impressed with Boot Barn, which has more than 325 stores in 40 states selling cowboy boots and other western-themed footwear, clothing, and accessories. As you can see in the chart below, revenue and operating income have grown steadily over the past dozen years, with an exceptional year in 2021 (fiscal year ending in March 2022) as the world reopened from the pandemic:

Boot Barn CEO James Conroy said that every single store is profitable and that new stores pay for themselves in just over a year. His growth plan is simple: The company doesn't have to do anything new or different to double sales and profits over the next six years – just keep doing what it's doing. The plan is to grow to 340 stores this year and, eventually, 1,000.

The company has had especially notable success developing its own brands, which have grown from almost nothing – $5 million – a decade ago to $500 million today, accounting for 33% of sales.

Conroy concluded by noting that analysts project that Boot Barn will earn $5.70 in EPS this fiscal year (ending in March 2023), about as much as they project discount retailer Five Below to earn next fiscal year (ending in January 2024). (Five Below's management had just presented in the same room half an hour earlier.)

So why, he asked, is Boot Barn's stock at $68.44 per share (equal to a modest 1.5 times sales, 6.4 times EBITDA, and 10.2 times trailing earnings), while Five Below's stock closed yesterday at $186.83 per share, nearly 3 times higher?

The answer, Conroy hypothesized, is that investors and analysts – who are mostly based in places like New York and Boston, where Boot Barn doesn't have any stores – "don't see our customers every day so it's not familiar to them." He concluded by encouraging those in the audience to "go visit our stores and talk to our store associates and customers."

No doubt some of Five Below's valuation premium is due to the belief that the company is likely to grow at a higher rate going forward than Boot Barn (though both businesses, interestingly, have grown revenue at an identical compounded rate of 20% over the past five years), but I think Conroy makes a good point and gives good advice.

(Five Below has a great concept and has executed superbly, so I expect the company will continue to do well going forward... but I wouldn't touch the stock here, trading at 3.8 times sales, 16.2 times EBITDA, and 42.9 times earnings.)

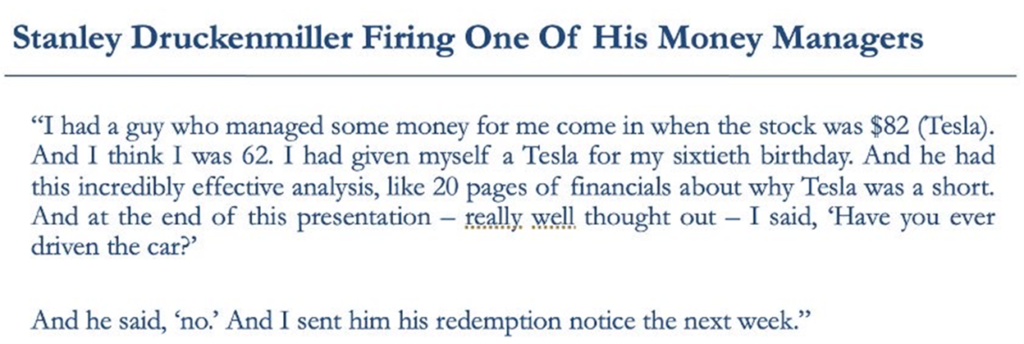

3) Conroy's advice reminds me of this slide from a presentation by my friend Alix Pasquet of Prime Macaya Capital Management:

Conroy and Stanley Druckenmiller are making the same point: To be a good analyst and investor, you have to have an open mind and do your homework!

I'll share further thoughts on some additional companies that I saw at the ICR conference in future e-mails...

4) One of the highlights of our trip to Antarctica was taking a polar plunge!

I've done a similar plunge a few times in my life, so I aspired to show what a tough guy I was by swimming out to a nearby ice floe, especially since the air temperature was a balmy 50 degrees.

But those plans went out the window the moment I hit the water... Holy cow, it was cold – I couldn't get out fast enough!

It reminds me of the famous Mike Tyson quote: "Everyone has a plan until they get punched in the mouth."

Below are pictures, and here's a funny video of all eight of us doing it. (Note the spectacular scenery.)

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.