Last chance to watch Mason Sexton's "prophecy"; 15 visuals every investor should memorize; 16th anniversary of the launch of the iPhone; More on weight-loss drugs

1) If my old friend Mason Sexton's name doesn't ring a bell, I wouldn't blame you...

Because after he famously called the crash of '87, he basically withdrew from the public eye. And for the last two-plus decades, he has kept his forecasts private, reserving them for his wealthy clients (which pay him as much as $10,000 a month for his insights).

That's too bad, because these forecasts included calling the bottom of the global financial crisis, the top (and bottom) of the COVID crash in 2020, and every single one of the 10 worst days in the stock market over the past three years.

That's why, when I heard what Mason was making his first public warning in decades – about a major event he says is coming in the next two weeks – I knew I had to share it with my readers.

Do yourself a favor and watch it right here. (It goes offline at midnight tonight, so don't procrastinate!)

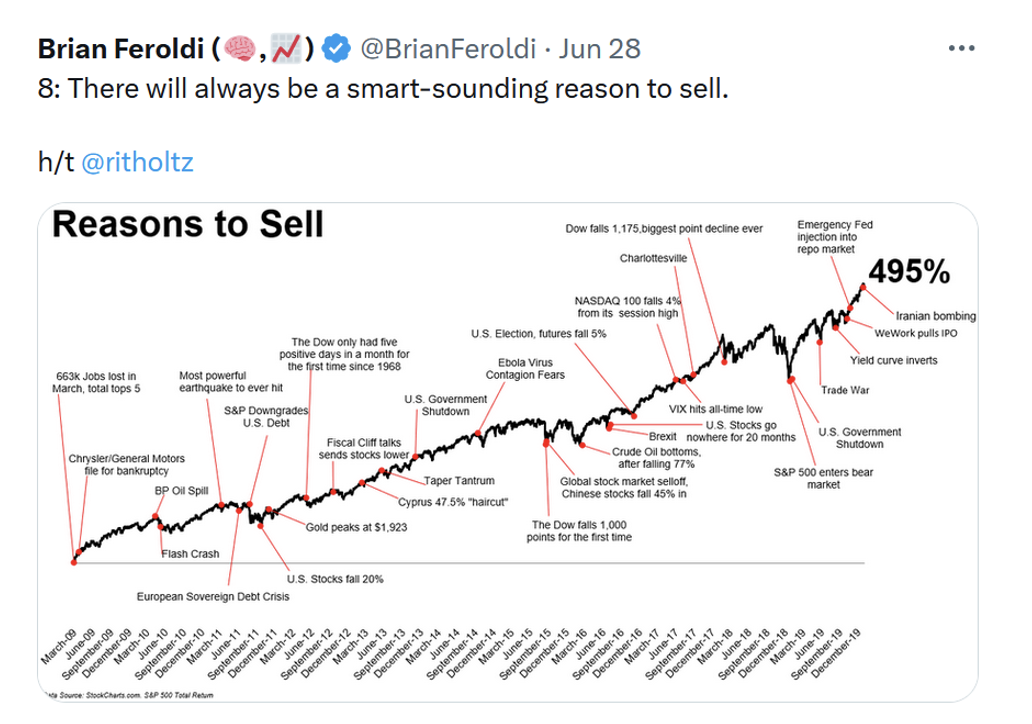

2) I've never heard of Brian Feroldi, but I thought the 15 charts he posted on Twitter on Wednesday were absolutely fascinating and spot on.

Apparently, I'm not the only one, as they have 7 million views! Here are my favorites...

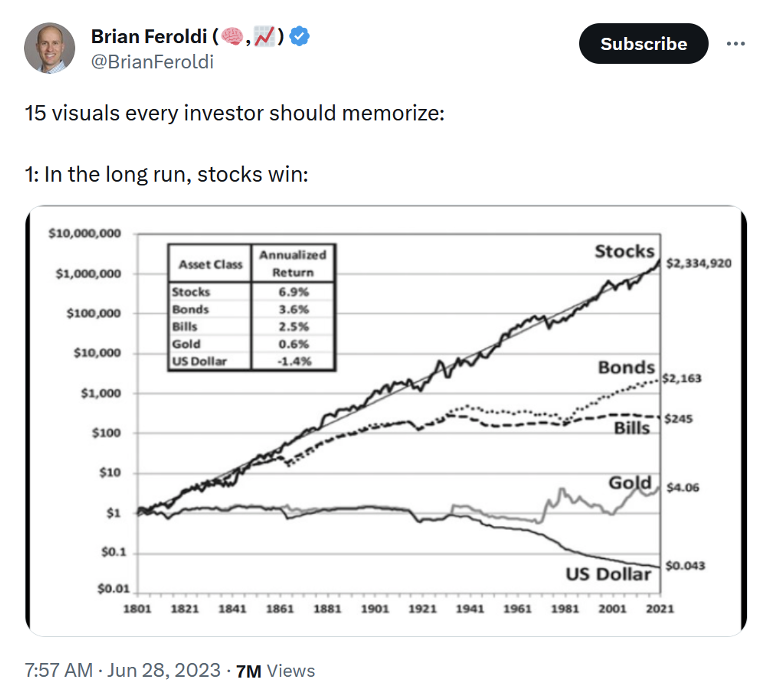

Over time, stocks have, by far, delivered better returns than bonds, T-bills, gold, and cash under your mattress:

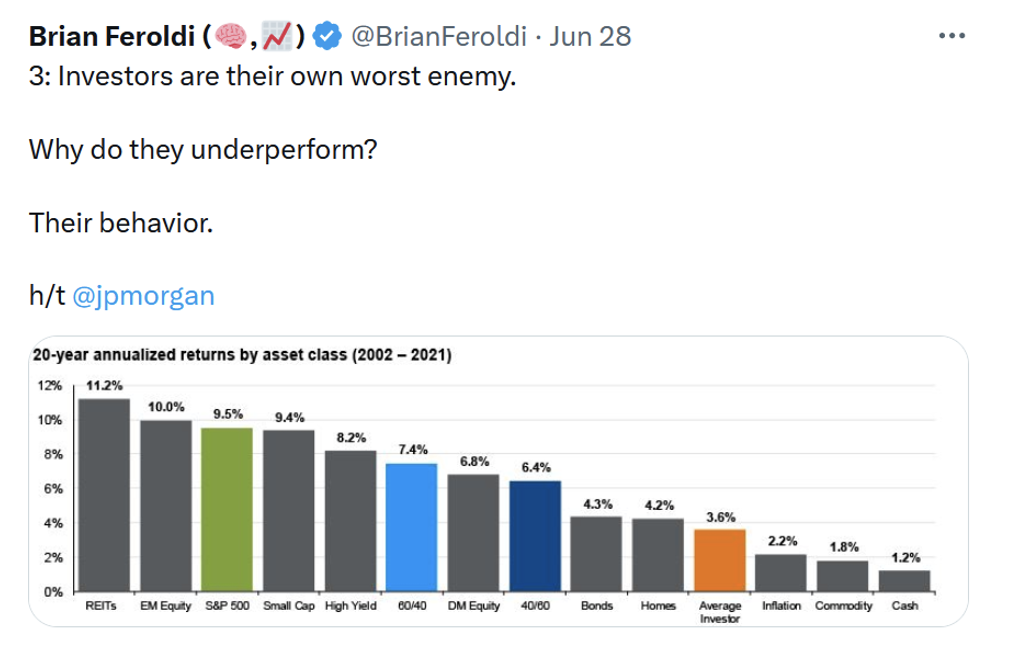

This one resonated with me because, as I've discussed many times in the past, portfolio management can create or destroy as much value over time as stock picking (sadly, the latter is far more common):

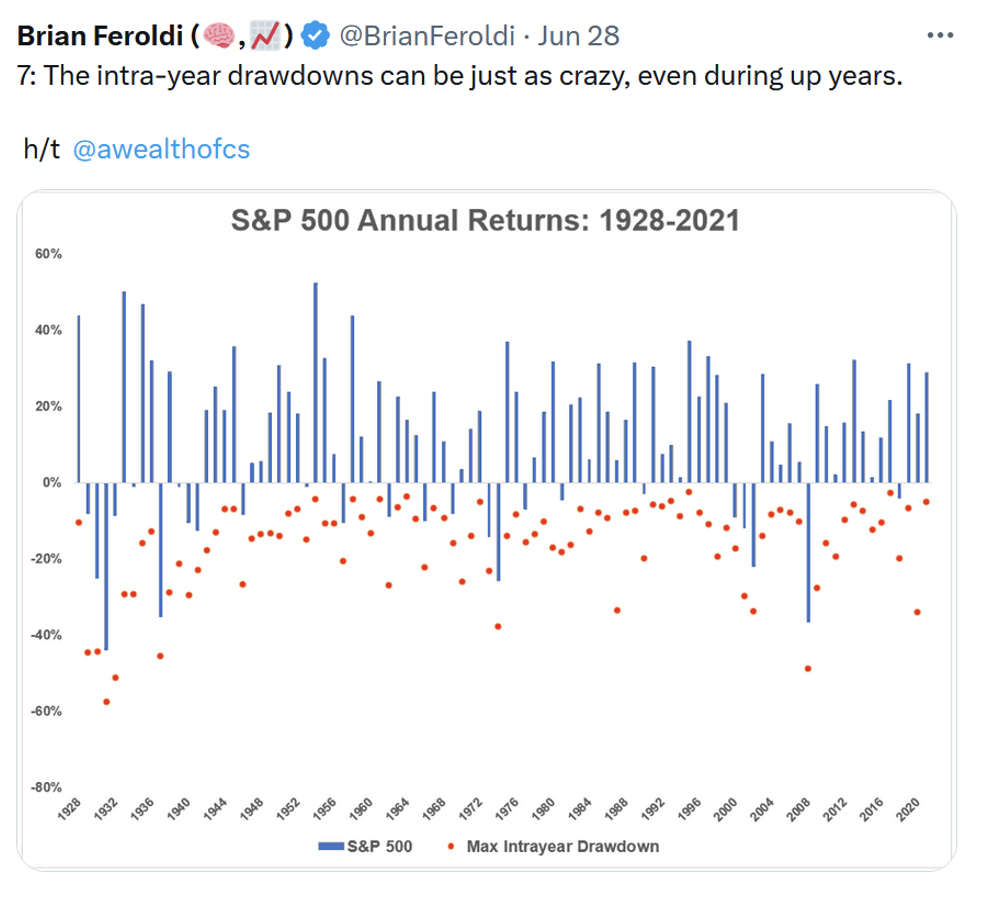

I've never seen this chart before:

This next one hurts because it was precisely during this period, after the global financial crisis, which I had navigated so well, that my fund underperformed year after year.

I kept worrying about another market crash and hence sold my winners far too quickly, held too much cash, and maintained a large short book.

In effect, I had battened down the hatches and trimmed the sails of my ship, despite the fact that the skies were mostly clear and sunny...

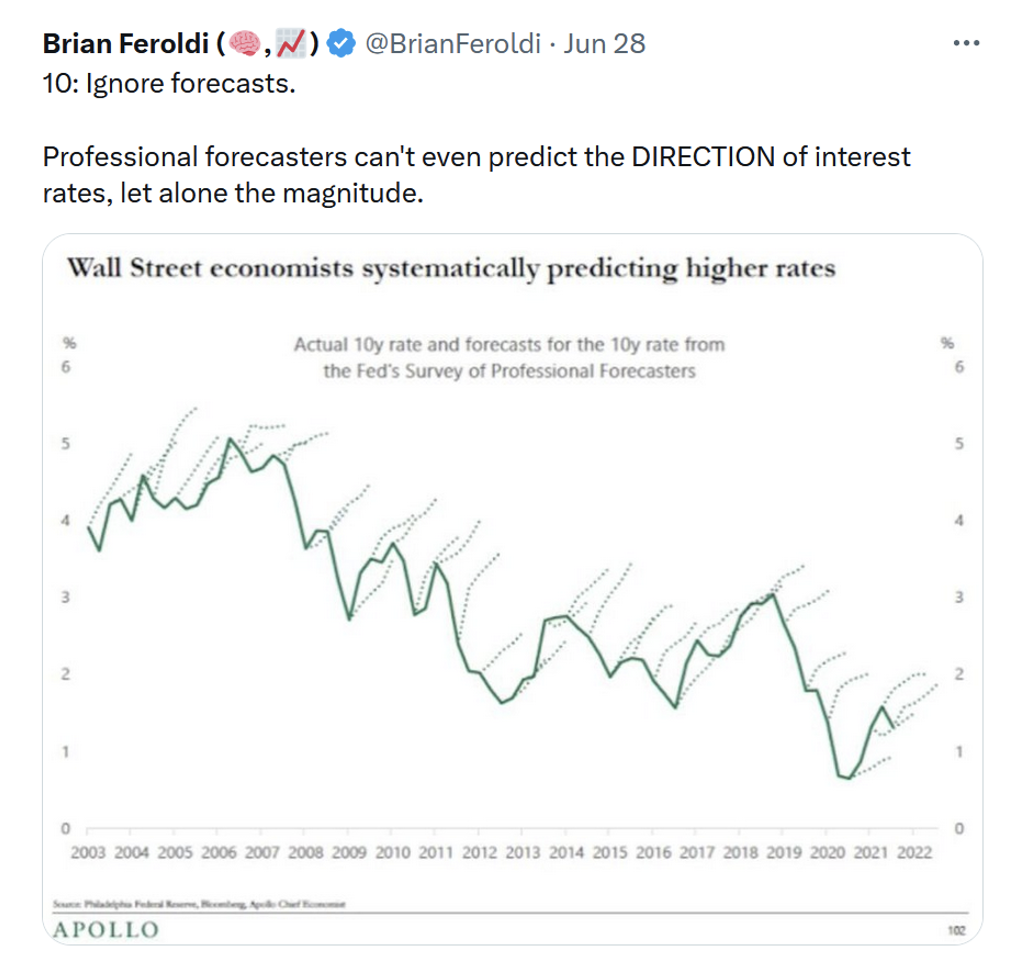

3) I want to discuss this chart separately because it relates to my forecast about what the Fed is likely to do the rest of this year. As you can see, professional forecasters almost always predict higher interest rates:

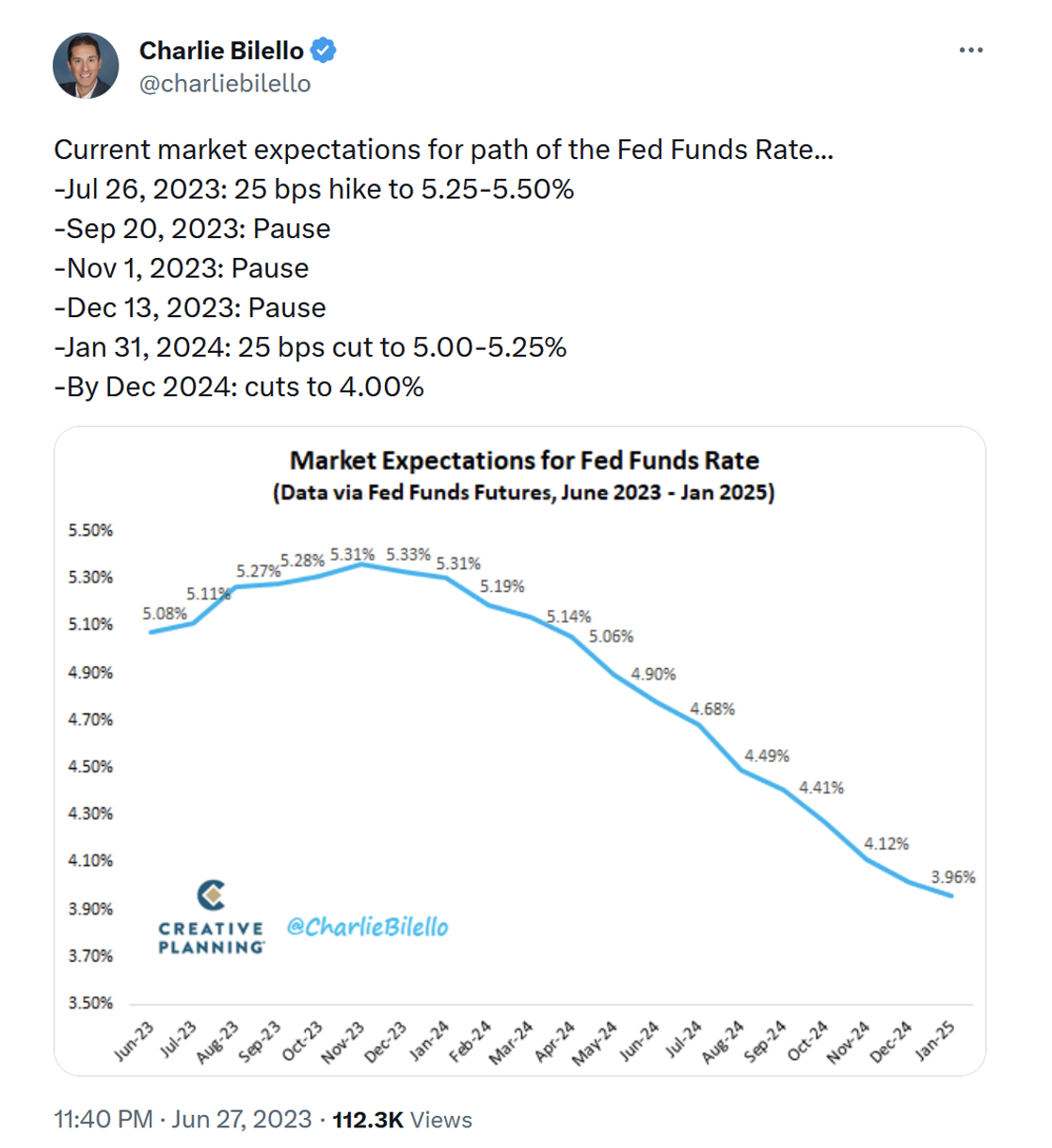

Sure enough, as this tweet by Charlie Bilello shows, they're doing it again. The current prediction is that, after pausing its pattern of rate increases at its last meeting, the Fed is going to raise again at its next meeting on July 26:

My out-of-consensus view continues to be that there's at least a 50/50 chance that the Fed is finished raising, and will cut once by the end of the year.

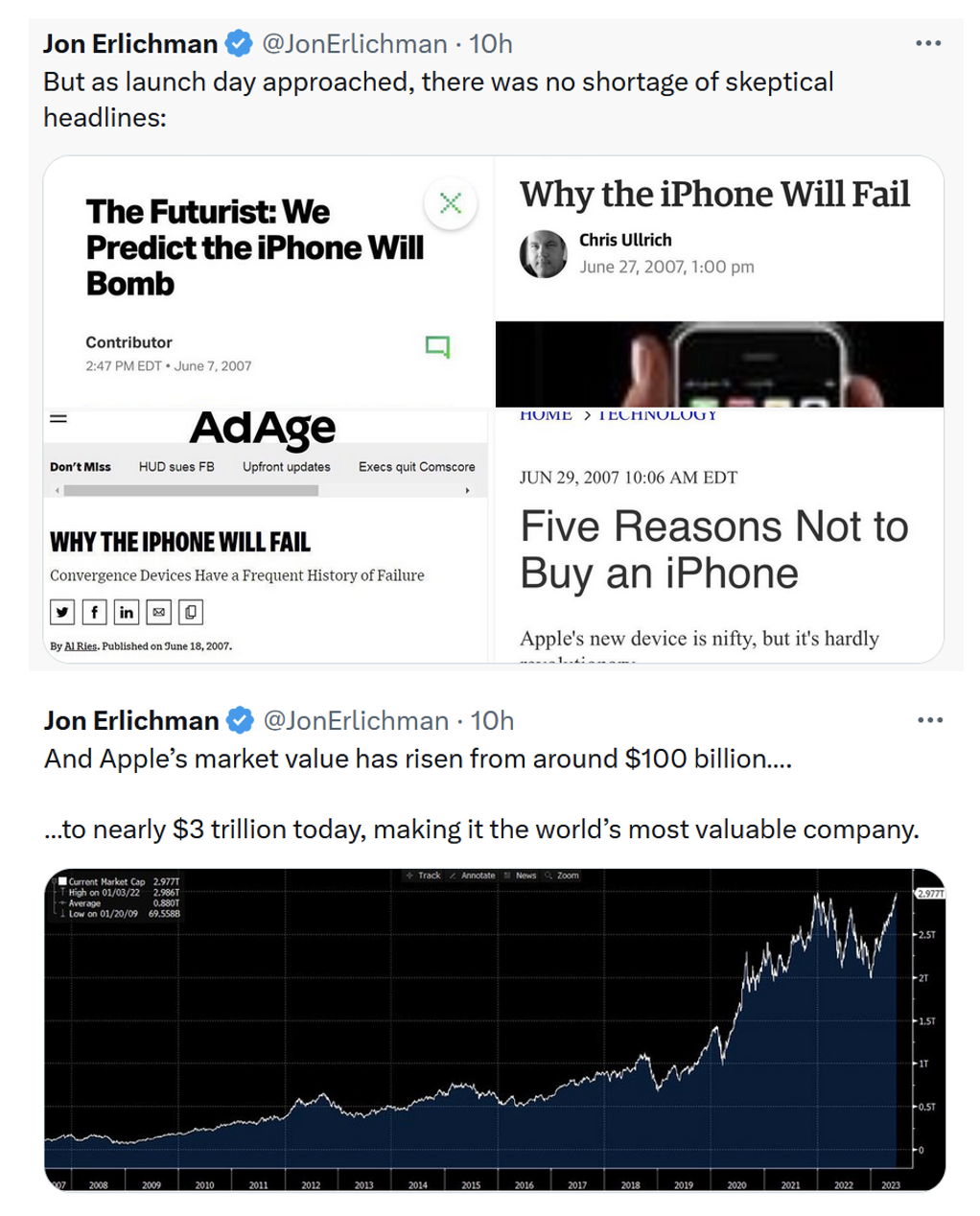

4) Yesterday was the 16th anniversary of the launch of the iPhone, which I'd argue is the most revolutionary and successful product in history.

Here's journalist Jon Erlichman with a good Twitter thread about it – there were many skeptics, but Apple's (AAPL) stock is up 30 times since then:

5) Longtime readers may remember that, during the pandemic, my go-to source of the best information and insight was Dr. Kevin Maki.

Well, to my surprise, it turns out that his "main area of research has been studying interventions to prevent and manage cardiovascular disease and diabetes." Here are his comments on one of my recent e-mails about the new weight-loss drugs:

Your e-mail is spot-on. Obesity is a risk factor for cardiovascular disease, diabetes, various types of cancer, kidney disease, arthritis/joint replacement, depression, sexual dysfunction, incontinence, etc. For the first time we have effective treatments that will move the needle in terms of body weight reduction.

The studies are underway to assess longer-term risks and benefits. However, given the results with bariatric surgeries, it is very likely that the net effects will be favorable. We already have obesity stigma, and it is awful that we are now adding treatment stigma to the list of challenges for those with obesity.

A few weeks ago, I sent you a paper we recently published: Pharmacotherapy for obesity: recent evolution and implications for cardiovascular risk reduction. You may not have seen it because you were traveling. Although you and I have mostly communicated about Covid, my main area of research has been studying interventions to prevent and manage cardiovascular disease and diabetes.

I have been frustrated with the results for the last 30 years for obesity management. Now there is a good deal of reason for optimism. Current practice is to advise lifestyle change and then treat various risk factors that are driven by, or at least contributed to, by obesity individually (cholesterol, blood pressure, diabetes, etc.). That may change soon.

Anecdotally, when I attended the American College of Cardiology meeting earlier this year, I was struck by how many cardiologists I have know for years who carried a few extra pounds have slimmed down. I don't think that is coincidence. These are some of the most knowledgeable and disciplined people I know.

The fact that they struggled with overweight/obesity tells me that: a) it is not just a matter of willpower for some people, and b) they have been convinced by the available data that the benefits likely outweigh the risks for medications like Ozempic/Wegovy and Mounjaro.

We will have results soon from a large cardiovascular outcomes trial with Ozempic/Wegovy. If they turn out the way I expect, we will likely experience a sea change in medicine around the issue of obesity.

Thank you, Dr. Maki!

6) Here are two more e-mails I received from my readers:

M.H. writes:

I have very personal experience with Mounjaro: my wife. She has struggled with weight loss and is a foodie (not in a good way). She also isn't morbidly obese and is not the "intended user." I am speaking from a viewpoint that isn't going to be popular in that she is a person that is using it for vanity purposes.

It worked. Just like a "miracle" it worked. She has the body of her 20-year-ago self.

But, she now has perspective. She knows how hard it was to lose. She knows how important/vital it is to stay away from "emotional eating."

This is a game-changer and I feel like Lilly's shares are fairly priced (even a value play... which is anti-value in our circles) simply because of how the masses will come around a few years from now plus the development of the drug in pill form.

This is a crazy drug. I took it for four weeks and got into bodybuilder shape. It is nuts.

You can share my story, but please refrain from my name as I'd like to protect my wife from embarrassment. I'm also happy to give updates. For instance, for me: I took it (vanity and curious) and have been off it for five weeks. For someone like me, the last 10 pounds is SO hard to lose. (Again, this is pure vanity, but I wanted to get to 10% body fat.) It just fell off in one month. Crazy.

And M.R. adds:

I've been on Wegovy for 12 weeks and have lost 2+ pounds per week during that span. I've been using it in connection with the Noom weight loss app, which may increase the benefits. Plus, I've largely stopped drinking alcohol, which is consistent with these articles in The Atlantic and the WSJ: Did Scientists Accidentally Invent an Anti-addiction Drug? and Ozempic Might Help You Drink and Smoke Less.

I've just created a new personal e-mail list to which I'll send articles and commentary about these new drugs. To subscribe to it, simply send a blank e-mail to: weightlossdrugs-subscribe@mailer.kasecapital.com.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.

P.P.S. Empire will be closed Monday and Tuesday for Independence Day, so look for the next issue of Whitney Tilson's Daily on Wednesday.