Last chance to watch my 'Prediction X' presentation; Performance of my 'Dirty Dozen' stocks to avoid; Hindenburg Research report on Freedom Holding; What recession? This summer's economy is defying the odds; Why I think inflation will remain in the 3% to 4% range; Comedian trolls the LA City Council about inflation

1) I've predicted some pretty controversial things in the past, but my latest bold call – one I'm calling "Prediction X" – might be the most controversial one yet...

It's about an event almost no one expects to happen – one that could reshape global politics, redraw international borders, direct trillions in economic budgets, and completely crash the shares of certain U.S. stocks... while adding billions to the bottom line of other companies.

And as a result of this unexpected geopolitical event, we'll see a once-in-a-lifetime buying opportunity unfold.

I recently shared all the details in a special presentation, but it's coming offline at midnight tonight... If you haven't already, I urge you to watch it right here while there's still time.

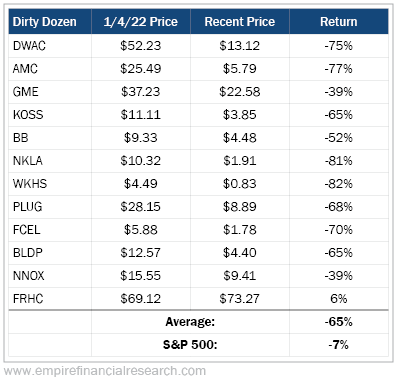

2) In yesterday's e-mail, I discussed AMC Entertainment (AMC), one of my "Dirty Dozen" stocks to avoid that I named in my January 4, 2022 e-mail. Here's a table showing the performance of every stock I named (note that I removed GME on March 23 and DWAC on April 14):

As you can see, 11 of the 12 stocks have fallen between 39% and 82%, with an average decline of 65% versus only 7% for the S&P 500.

But there's one outlier – Freedom Holding (FRHC), which has risen 6%. At the time I put it in the Dirty Dozen basket, I wrote:

A year ago, I wrote this about Freedom Holding:

My friend Roddy Boyd at the Foundation for Financial Journalism recently exposed one of the most obvious promotions I've seen in quite some time – which has a $3 billion market cap! Freedom Holding: After 'Borat,' the Silliest Kazakh Import of the Century.

Later, on March 23, 2022, I added:

Speaking of stocks with silly valuations, here's a report by Edwin Dorsey of The Bear Cave on one of my Dirty Dozen stocks: Problems at Freedom Holding. Excerpt:

Freedom Holding operates retail stock brokerages, banks, and margin lending services in Russia and Eastern Europe. Headquartered in Almaty, Kazakhstan, Freedom Holding employs over 1,000 people in Russia, owns a stake in the Saint Petersburg Stock Exchange, has the majority of its brokerage branches in Russia, and has ties to Russian government officials and banks sanctioned for money laundering. Freedom Holding is also surrounded by other irregularities. For example, the company generates most of its activity in a related-party Belize brokerage and Freedom pushes customers to buy its own stock. Although Freedom Holding's Russia listing is halted, the company continues to benefit from accessing U.S. capital markets with an active Nasdaq listing. That may change.

So with the stock up more than a year later, am I willing to admit a (small) mistake and make it the third stock I've removed from my Dirty Dozen?

Heck no!

Freedom Holding is one of the most obvious frauds I've ever seen and I think its share price is highly manipulated – and I'm even more sure of this after reading this in-depth report by activist short seller Nate Anderson of Hindenburg Research: Freedom Holding Corp: Brazen Sanctions Evasion, Hallmarks Of Fabricated Revenue and Risky Bets with Commingled Customer Funds. Excerpt:

- Freedom Holding is a $4.6 billion market cap online brokerage business, founded in 2008, formerly based in Moscow and later moved to Kazakhstan. Its multi-billionaire Chairman & CEO, Timur Turlov, owns over 70% of the company's shares and has since inception.

- Since listing on Nasdaq in 2019, Freedom shares have rocketed over 450%, luring investors in with the image of quickly growing firm led by a young, tech-savvy founder.

- Our investigation into the company, undertaken over the course of a year, has included a review of extensive international corporate and regulatory records, interviews with former employees and industry analysis.

- Our research has unveiled a laundry list of red flags including evidence that Freedom (i) brazenly skirts sanctions (ii) shows hallmark signs of fake revenue (iii) commingles customer funds then gambles assets in highly levered, illiquid, risky market bets (iv) and displays signs of market manipulation in both its investments and its publicly traded shares.

I think when regulators wake up and take action, FRHC is a zero...

3) This Washington Post article provides a good overview of how strong the economy is right now: What recession? This summer's economy is defying the odds. Excerpt:

It's no secret the United States appears to have sidestepped economists' worst fears of a recession. Many business owners began this year bracing for the worst – expecting to slash budgets and lay off employees. That fear was particularly acute for those, like Basu, in corners of the economy that specialize in nice-to-have luxuries that are often the first to get cut when times get tough.

But now the summer of 2023 is shaping up to be a period of unexpected expansion. With unemployment near 50-year lows, inflation edging down and wages rising faster than prices, businesses and families are still spending: Orders for American-made goods spiked in June and fresh data this week shows that retail and restaurant sales climbed for the fourth straight month in July. The Atlanta Fed is now predicting economic growth will reach 5% this quarter.

Ducatis and BMW motorcycles are flying off lots. Cruise bookings are at all-time highs. And crowds are spending billions to see Taylor Swift, Beyoncé and Barbie. In all, Americans spent more at restaurants, bars, clothing shops and hardware stores in July than they did the month before, according to federal data.

"We've had three years of unusual and puzzling moments and frankly, this summer is just one more," said Claudia Sahm, founder of Sahm Consulting and a former Federal Reserve economist. "People have been talking about a recession for two years – wishing on it, even – but the economy is still strong. Inflation is coming down, unemployment is staying low. Things are not cratering."

Business owners around the country say demand remains brisk. Despite earlier precautions, such as cutbacks in marketing or delayed investments, many say they've been pleasantly surprised that people are continuing to spend. Instead of axing workers, some are hiring more or offering overtime, just to keep up.

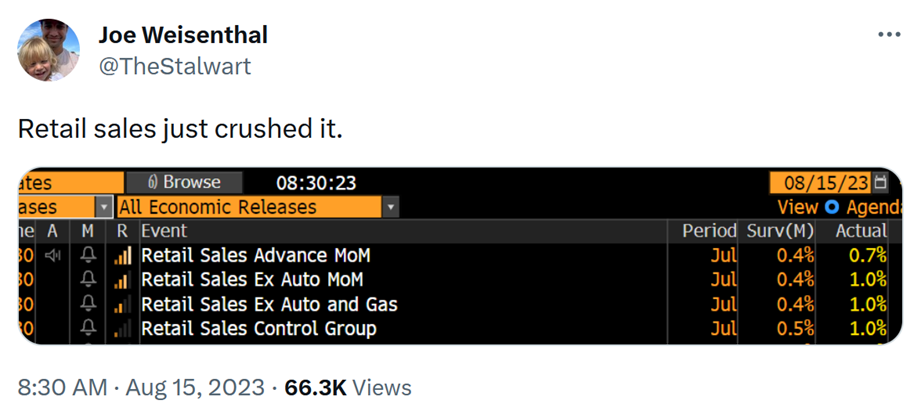

Along the same lines, yesterday's retail sales report came in well above expectations:

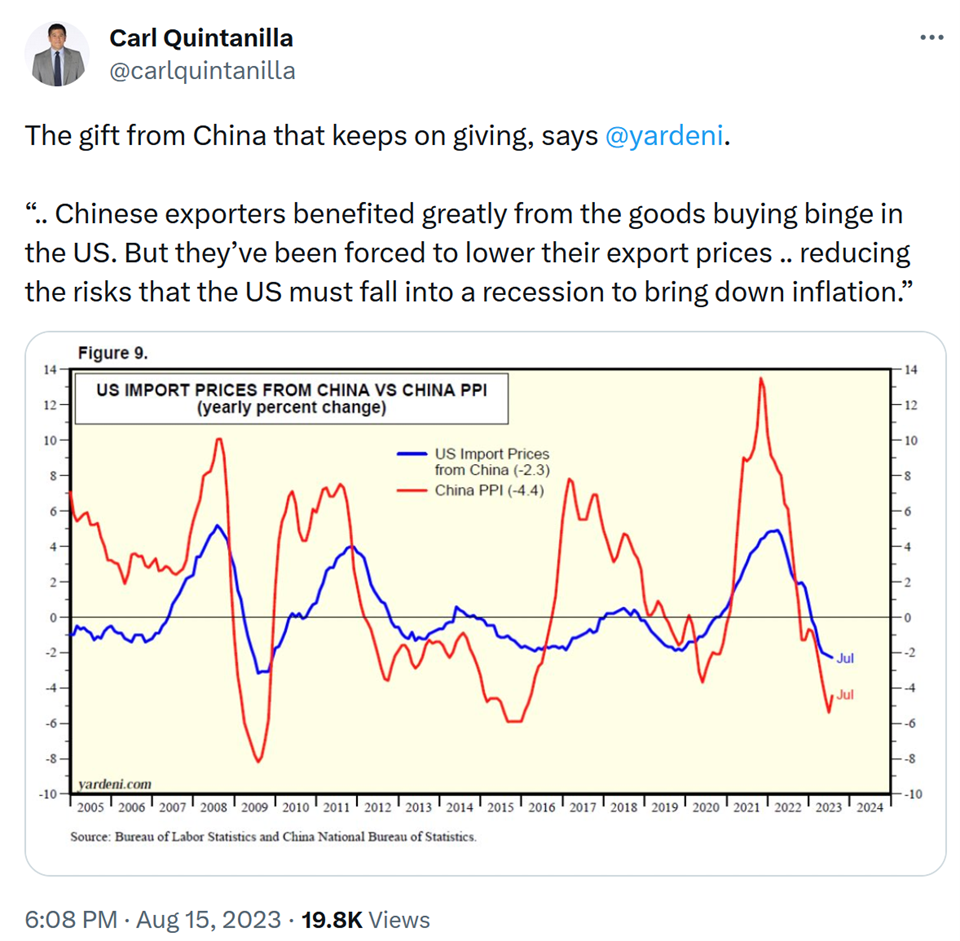

4) While the economy remains strong, which is normally inflationary, there are a number of deflationary factors that I think will keep inflation in the 3% to 4% range.

One is lower prices on goods imported from China:

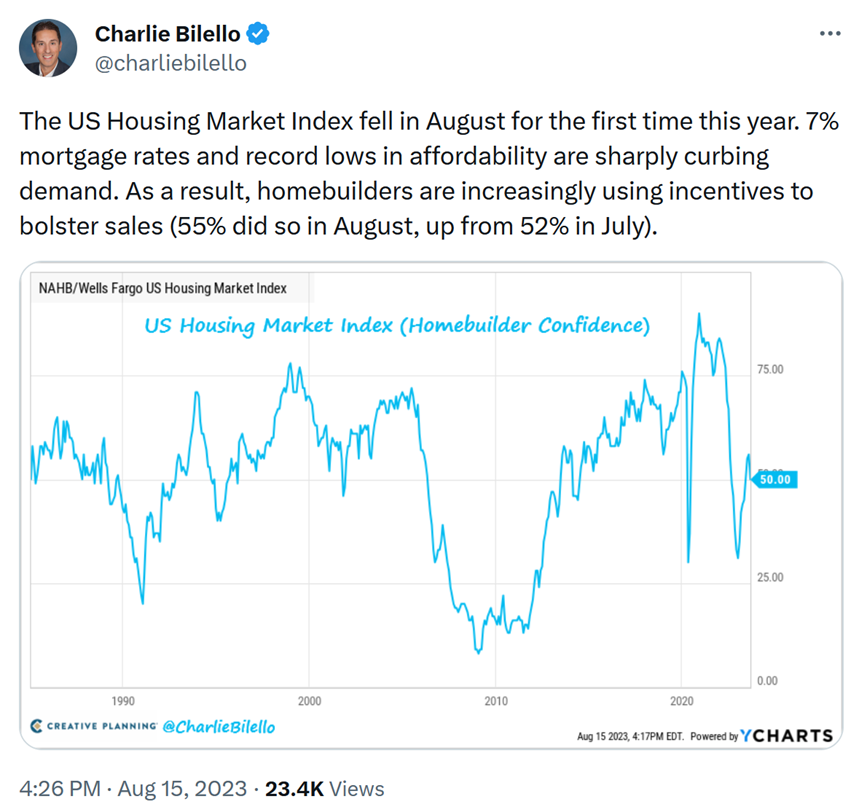

Another factor is a slowdown in housing and rental prices (note that "shelter" costs account for about 30% of the value of the basket of goods that the Bureau of Labor Statistics evaluates to put together the Consumer Price Index):

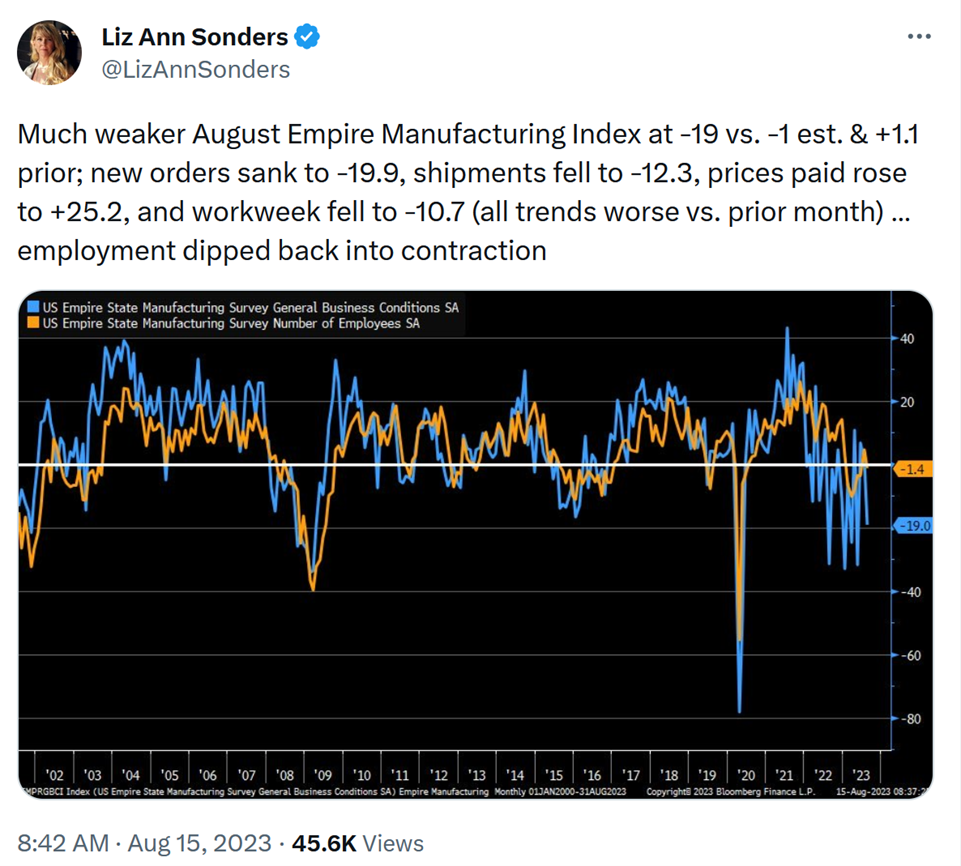

Meanwhile, the Empire State Manufacturing Survey noted that the "index for future business conditions rose six points to 19.9, its highest level in more than a year, suggesting firms have become more optimistic about future conditions." Yet the same report showed a sharp drop in current conditions:

If I'm right that inflation stays in the 3% to 4% range, I think the U.S. Federal Reserve won't raise rates further, which is the second pillar of my moderately bullish thesis for stocks for at least the rest of this year and likely well into 2024: a strong (but not too strong) economy combined with a neutral (and possibly easing) Fed.

5) For a lighter look at inflation, here's a hilarious short video of a comedian trolling the Los Angeles City Council about the "out of control" prices for bottle service he encountered while at a friend's bachelor party in Las Vegas:

Here's an article about him: These SoCal bros went viral for their prankish videos from city council meetings. Now they're taking their humor to Netflix.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.