Last night's big event; Eli Lilly soars 15% on blowout earnings and results of study; Short Seller Hindenburg Nabs Tiny Gains Off $173 Billion Carnage; Carl Icahn's Firm Slashes Dividend in Half After Activist Pressure; Stock Slides; Grim economic news from China; Ex-Auburn football player helps bail out wife, her lover who are accused of plotting his murder

1) Did you miss it?

Last night, I went on camera to share all the details of what I've been calling "Prediction X."

I've literally put my "boots on the ground" multiple times this year gathering research and risking my life to make this prediction... And I've also outlined five steps you can take right now to position yourself for the major event I see ahead.

We're keeping a replay of the Prediction X event live for the next few days, so do yourself a favor and check it out now while you still can. You can watch it right here.

2) I've been writing about the miraculous new weight-loss drugs for nearly a year, and have even created a new personal e-mail list dedicated to this topic (to join it, simply send a blank e-mail to: weightlossdrugs-subscribe@mailer.kasecapital.com).

Back on September 22, I wrote:

I've recently become aware of three new weight-loss drugs, which appear to be nothing short of miraculous, especially Mounjaro (tirzepatide), which seems to have fewer side effects (mostly gassiness) and results in the greatest weight loss...

I know many people on these drugs and they're all thrilled with them, having lost large amounts of weight with few side effects...

Alas, while I highlighted the stock of Mounjaro's maker, Eli Lilly (LLY), I didn't pound the table on it, writing:

Eli Lilly now trades at 10 times revenue, nearly 30 times trailing EV/EBITDA, 48 times trailing earnings, and 34 times expected earnings over the next year.

This is a great company with a bright future – especially with Mounjaro – but those are some very rich multiples... so I'm not a buyer today. That said, I wouldn't argue with anyone who wanted to establish a starter position on the thesis that trailing 12-month revenue is $29 billion, and Mounjaro alone could equal that.

But I'm going to stay on the sidelines for now and hope for a pullback...

I should have followed my instincts and paid up for the stock, as it's up 68% since then after yesterday's 15% spike in the wake of blowout earnings and this huge news: Obesity Drug Wegovy Cuts Risk of Heart Attacks and Strokes by 20%, Study Shows.

While Wegovy is made by Novo Nordisk (NVO), I have no doubt that the similar studies underway for Mounjaro will show similar, if not greater, results.

I'm not surprised that a drug that significantly reduces obesity would also significantly reduce one of the major things obesity causes – a major cardiac event – but the results from this global five-year study are nevertheless extraordinary.

It should dramatically increase the usage of these weight-loss drugs, both because more people will want to take them and also because payors – governments and health insurers – will find it harder to deny coverage.

Lastly, I think it's highly likely that future studies will show tremendous benefits across a wide range of ailments that result from obesity, which I summarized in my June 27 e-mail:

A heartbreaking 1.13 million Americans have died of COVID since the deadly virus struck a little more than three years ago.

Over the same time, nearly as many Americans have died of another deadly disease that causes high rates of diabetes, heart disease, 13 types of cancer, osteoarthritis, high blood pressure, sleep apnea, dementia, various forms of mental illness, body pain, and poor physical functioning.

Worse yet, it is immediately obvious who is suffering from this disease and there are terrible stigmas associated with it. Those suffering from it are widely assumed to be ugly, lazy, lacking willpower and moral character, having bad hygiene, and being less intelligent. Not surprisingly, therefore, sufferers feel anxiety, depression, and shame.

By now you've probably guessed that the disease I'm talking about is obesity.

More than 70% of Americans are overweight, almost half of whom qualify as obese.

This leads to a myriad of lifelong health problems, culminating, for many, in early death: An estimated 300,000 Americans and between 2.8 million and 4.7 million people worldwide die each year from being overweight or obese.

3) Kudos to Nate Anderson for his courage and accuracy in exposing a wide range of frauds, scams, and promotions all over the world: Short Seller Hindenburg Nabs Tiny Gains Off $173 Billion Carnage. Excerpt:

Gautam Adani, Jack Dorsey, Carl Icahn. Nate Anderson has picked them off one by one.

In mere months this year, he erased as much as $99 billion of their combined wealth while knocking $173 billion off the value of their publicly traded companies. In an era when prominent short sellers have retreated from the limelight – fretting lawsuits, short squeezes, and government probes – the deft researcher has emerged as the gutsiest bear around. Allies say he's risking civil suits, physical attacks, and potentially even overseas arrest.

The surprise is that Anderson, 39, who runs tiny Hindenburg Research with a team of roughly a dozen researchers, probably reaped relatively small profits from those fights.

Take his report on May 2, accusing Icahn's holding company, Icahn Enterprises, of overvaluing assets. Within four weeks, the stock's plunge erased $17 billion of the billionaire's wealth. Yet the combined gain for all investors who shorted the shares before the report would have been about $56 million if they timed their exits perfectly, according to data from S3 Partners. And that's not counting the cost of setting up the bets.

4) Speaking of Icahn Enterprises (IEP), shares tumbled 23% on Friday, its worst day ever, as Anderson's bearish thesis on the company was validated by a dreadful earnings report: Carl Icahn's Firm Slashes Dividend in Half After Activist Pressure; Stock Slides. Excerpt:

Carl Icahn made a multibillion-dollar fortune as an activist investor, bullying companies into changing their businesses. Another activist has now forced him to do the same.

Icahn Enterprises, which says it offers small investors a chance to "invest alongside the iconic Icahn," said Friday it was cutting its dividend in half to $1 a share, the first reduction since 2011. Icahn also published a letter saying that his company would focus again on corporate activism, where it made big profits. He said it would wind down bets that the stock market would collapse, which have inflicted heavy losses.

"Our returns have been overwhelmed by our overly bearish view of the market," Icahn said. "Going forward, we intend to stick to our knitting and focus on our activist strategy."

Shares in Icahn lost 23% by Friday's close, their worst day on record.

The changes come in the aftermath of a campaign launched against the company by activist short seller Hindenburg Research. In May, Hindenburg alleged Icahn Enterprises was overvalued, that its dividend was unsustainable and that Icahn himself had borrowed heavily against his shares in the company, leaving it vulnerable to a selloff.

In a tweet Friday morning, Hindenburg said that it was still shorting Icahn.

I continue to recommend avoiding this stock at all costs.

5) There has been all sorts of grim news from China, the world's second-largest economy, over the past two days, which I've been covering in my China e-mail list (to join it, simply send a blank e-mail to: china-subscribe@mailer.kasecapital.com).

Yesterday, there was this news, Chinese Exports Fall at Steepest Pace Since February 2020. Excerpt:

China's exports to the rest of the world tumbled in July, adding to the challenges for the world's second-largest economy and offering fresh evidence that a drying up of Western demand is hurting Beijing's attempts to rekindle growth.

After a short-lived rebound in the spring, goods exports from China resumed a long-term slide that dates to October last year, when consumers in Western developed countries began shifting their spending away from buying furniture and electronic gadgets, and instead diverted it toward services such as entertainment and dining out.

Worsening geopolitical tensions between Beijing and the U.S.-led West have also prompted some Western manufacturers to reduce their reliance on China's supply chain, which in turn is expected to erode trade ties between the two sides...

Overseas shipments from China slumped 14.5% in July from a year earlier, the steepest year-over-year decline since February 2020, in the earliest days of the COVID-19 pandemic, data released Tuesday by China's General Administration of Customs showed...

For China, weakening exports signal more trouble for its domestic economy, which is sputtering on several fronts. The country's economic recovery, which was sparked by the lifting of COVID-control measures late last year, has been losing steam since April.

The private sector has been battered by the years of COVID-19 restrictions and regulatory crackdowns, and weak confidence among consumers has caused them to avoid splurging on big-ticket items from apartments to home appliances, economists say.

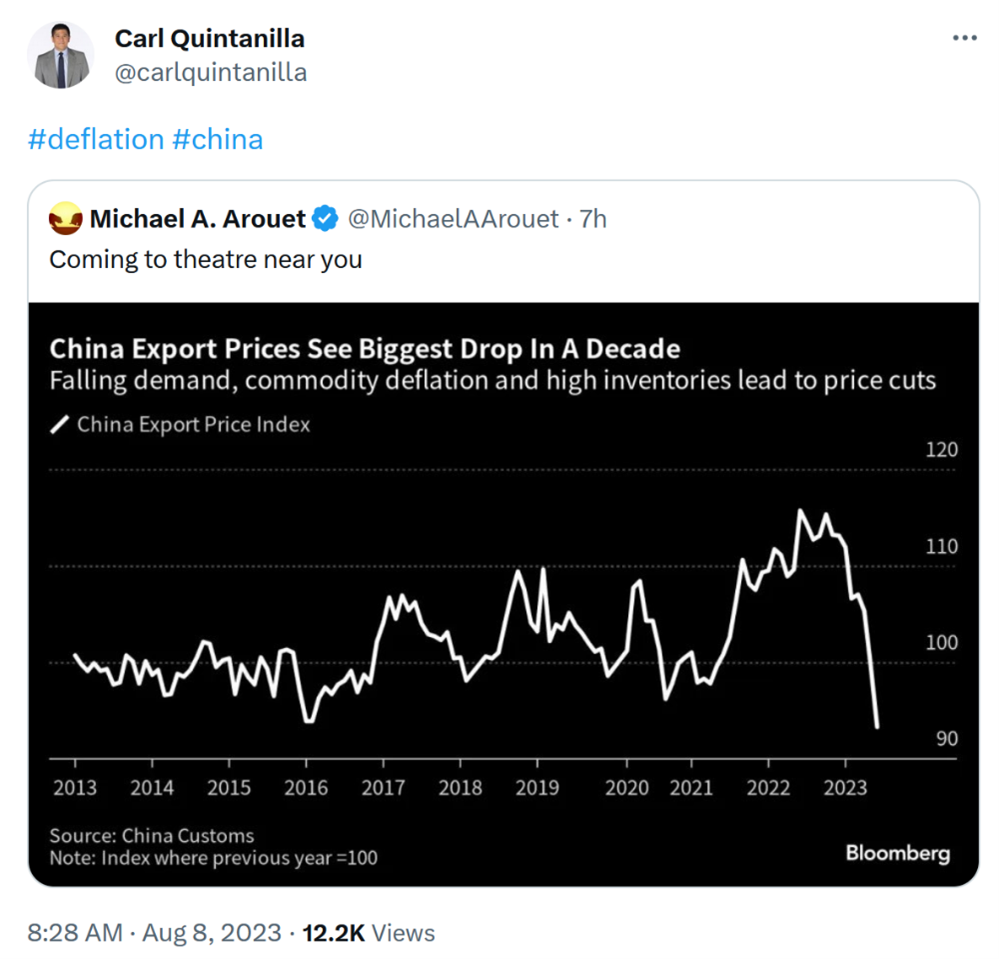

CNBC's Carl Quintanilla also noted the plunge in export prices in this tweet:

Then today, there was this news: China Slips Into Deflation in Warning Sign for World Economy. Excerpt:

Tepid consumer demand and rising economic concerns in the world's second-largest economy have tipped China into deflationary territory for the first time in two years, adding pressure on Beijing to act more aggressively to avoid a deepening economic malaise.

Instead of experiencing a surge in prices after the lifting of COVID-19 pandemic curbs late last year, China is suffering an unusual bout of falling prices for a range of goods, from commodities such as steel and coal to daily essentials and consumer products such as vegetables and home appliances.

China's economic predicament stands in contrast to that of the U.S. and other developed Western economies, where soaring inflation after the lifting of COVID restrictions sent central banks, including the Federal Reserve, on an aggressive path of interest-rate increases aimed at cooling the economy without triggering a recession.

While falling prices in China may help ease inflationary pressure elsewhere as Chinese exports become cheaper, they could become the source of another concern for the global economy. For instance, a flood of low-price Chinese goods risks squeezing profits for producers in other countries and hurting employment opportunities.

Lastly, this won't help matters either: Biden to Restrict Investments in China, Citing National Security Threats. Excerpt:

The Biden administration plans on Wednesday to issue new restrictions on American investments in certain advanced industries in China, according to people familiar with the deliberations, a move that supporters have described as necessary to protect national security but that will undoubtedly rankle Beijing.

The measure would be one of the first significant steps the United States has taken amid an economic clash with China to clamp down on outgoing financial flows. It could set the stage for more restrictions on investments between the two countries in the years to come.

The restrictions would bar private equity and venture capital firms from making investments in certain high-tech sectors, like quantum computing, artificial intelligence and advanced semiconductors, the people said, in a bid to stop the transfer of American dollars and expertise to China.

It would also require firms making investments in a broader range of Chinese industries to report that activity, giving the government better visibility into financial exchanges between the United States and China.

The recent news underscores why I don't invest in China – it's just too hard. Unless you're truly an expert on the country, you're likely to get blindsided...

6) I forwarded Susan this article, Ex-Auburn football player helps bail out wife, her lover who are accused of plotting his murder: report, and told her that if she and her lover plan to murder me and get caught, I will NOT be bailing them out! 😜👍🙏🤣

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.