Last night's 'TaaS 2.0' event; My China e-mail list; Munger: 'What I see in China now just staggers me'; Maher: Losing to China; China's Jaded Techies Find a Hero in Elon Musk; The Right Way to Boycott the Beijing Olympics; E-mail from a friend; Pictures

1) Last night, my colleague Enrique Abeyta and I hosted our big "TaaS 2.0" event...

It was all about our biggest idea here at Empire Financial Research: The rapid development of electric vehicles ("EVs") and autonomous vehicles ("AVs") will lead to an entirely new industry called "TaaS" – "Transportation as a Service." And this exciting future is coming sooner than almost anyone expects.

During the event last night, Enrique and I discussed...

- The name and ticker symbol of my favorite TaaS stock.

- Why the sector is about to see as much as $2.5 trillion invested over the next several years... and the move you need to make before this second wave of investment is unleashed.

- How to access the name and ticker symbols of Enrique's two favorite EV stocks, which he says each have 500% upside potential.

You don't want to be caught on the sidelines of this massive trend... If you missed last night's event, you can still catch the replay right here.

2) I have conflicting feelings about China, but always find it endlessly fascinating... so I spend a fair amount of time reading about the country, its history, and its people, and I take every opportunity to travel there.

I even have a China-focused e-mail list, which you can subscribe to (roughly one e-mail per week) by sending a blank e-mail to: china-subscribe@mailer.kasecapital.com. Below is what I've sent to that list recently...

1) Investing legend Charlie Munger is a big fan of China. Here's what he had to say at the recent Daily Journal (DJCO) annual meeting, which I covered in my February 26 e-mail: 'What I see in China now just staggers me'. Excerpt:

Nobody else has ever taken a big country out of poverty so fast and so long. And what I see in China now just staggers me. There are factories in China that are just absolutely full of robots are working beautifully. They're no longer using peasant girls to beat the brains out of our little shoe companies in America. They are joining the modern world very rapidly and they're getting very skillful at operating.

2) Here's a spot-on rant by comedian Bill Maher: New Rule: Losing to China. I transcribed the first part:

You're not going to win the battle for the 21st century if you are a silly people. And Americans are a silly people...

That's the classic phrase from Lawrence of Arabia when Lawrence tells his Bedouin allies that as long as they stay a bunch of squabbling tribes, they will remain a silly people.

Well, we're the silly people now...

Do you know who doesn't care that there's a stereotype of a Chinese man in a Dr. Seuss book? China.

All 1.4 billion of them could give a crouching tiger flying f**k...

Because they're not a silly people. If anything, they're as serious as a prison fight.

Look, we all know China does bad stuff: They break promises about Hong Kong autonomy, they put Uighurs in camps, punish dissent.

We don't want to be that.

But there's gotta be something between an authoritarian government that tells everyone what do to and a representative government that can't do anything at all!

In two generations, China has built 500 entire cities from scratch, moved the majority of their huge population from poverty to the middle class, and mostly cornered the market in 5G and pharmaceuticals. Oh, and they bought Africa.

Their new Silk Road Initiative is the biggest infrastructure project in history, indebting not just that continent, but large parts of Asia, Europe, and the Middle East to the people who built their roads, bridges, and ports.

3) Here's an interesting article in the New York Times: China's Jaded Techies Find a Hero in Elon Musk. Excerpt:

China is having its techlash moment.

The country's Internet giants, once celebrated as engines of economic vitality, are now scorned for exploiting user data, abusing workers and squelching innovation. Jack Ma, co-founder of the e-commerce titan Alibaba, is a fallen idol, with his companies under government scrutiny for the ways they have secured their grip over the world's second-largest economy.

But there is one tech figure who has managed to keep the Chinese public in his thrall, whose mix of impish bomb-throwing and captain-of-industry bravado seems tailor-made for this time of dashed dreams and disillusionment: Elon Musk.

"He can fight the establishment and become the richest man on earth – and avoid getting beaten down in the process," said Jane Zhang, the founder and chief executive of ShellPay, a blockchain company in Shanghai. "He's everybody's hope."

Whether out of hope, envy or morbid curiosity – like spectators hoping to see one of his rockets go down in a fiery blast – China cannot get enough of Mr. Musk. Tesla's electric cars are big sellers in the country, and the government's growing space ambitions have spawned a community of fans who track SpaceX's every launch....

The frustration with Big Tech is part of a wider malaise in China. For many young people, decades of breakneck economic growth seem to have resulted in only fiercer competition for opportunities, less stability and less say over the direction of their lives.

On the Chinese Internet, the term that has captured the mood is "involution," previously used by anthropologists to describe agrarian societies that grew in size or complexity without becoming more advanced or productive.

The feeling among young Chinese people that they are fighting harder for a slimmer chance at material gain is leading them to hope to "reorganize life in a different way," said Biao Xiang, who studies social change in China and is director of the Max Planck Institute for Social Anthropology in Germany.

Beyond criticizing the tech industry's high-pressure work culture and the gig economy's labor abuses, young Chinese people are more skeptical of the vast influence that internet platforms like Alibaba's wield over commerce and finance. Still, Professor Xiang believes people in China have not turned against businesses that deliver technological advancements of a more tangible nature, which is why Mr. Musk's industrial optimism still has appeal.

"They're not really against tech," Professor Xiang said. "They're more against this kind of platform-style manipulation of social relations."

4) Senator Mitt Romney addresses calls to boycott the 2022 Winter Olympics in Beijing: The Right Way to Boycott the Beijing Olympics. Excerpt:

So if we shouldn’t forbid American athletes from competing, then how should we meaningfully repudiate China’s atrocities? The right answer is an economic and diplomatic boycott of the Beijing Olympics. American spectators — other than families of our athletes and coaches — should stay at home, preventing us from contributing to the enormous revenues the Chinese Communist Party will raise from hotels, meals, and tickets. American corporations that routinely send large groups of their customers and associates to the Games should send them to U.S. venues instead.

Rather than send the traditional delegation of diplomats and White House officials to Beijing, the president should invite Chinese dissidents, religious leaders and ethnic minorities to represent us.

An economic and diplomatic boycott should include collaboration with NBC, which has already done important work to reveal the reality of the Chinese Communist Party’s repression and brutality. NBC can refrain from showing any jingoistic elements of the opening and closing ceremonies and instead broadcast documented reports of China’s abuses.

We should enlist our friends around the world to join our economic boycott. Limiting spectators, selectively shaping our respective delegations and refraining from broadcasting Chinese propaganda would prevent China from reaping many of the rewards it expects from the Olympics.

5) Lastly, I have many friends in China who keep me abreast of what's happening on the ground. Here's a recent e-mail from one of them:

A few interesting things have happened here recently.

1) The General Manager of our company recently attended a class on how to minimize taxes on corporate distributions. There were 20 to 25 companies represented at the class. At one point the instructor asked how many companies keep only one set of books. Only our GM's hand was raised... Things that make you go HMMMM...

2) Chinese banks are on a big push to offer personal lines of credit. Typically 100,000 renminbi at around 5%. There is speculation that the push may be due to pending entry of American Express into the Chinese banking market.

3) The very muted New Year's celebration along with the extensive contact tracing seems to have kept COVID-19 well under control.

In a follow-up e-mail, he added:

I did some more digging into banks offering personal lines of credit.

First, the speculation about it having anything to do with American Express is probably wrong.

But the push to offer personal lines of credit is real: Chinese banks are offering personal lines of credit to the employees at the company I work at. Some people have reported being offered lines of up to 300,000 renminbi ($46,000).

The story behind the lines of credit is interesting...

My company's payroll is processed through two banks (one is one of the big four and the other is a large regional bank). All employees need an account at one of them to collect their salary. Both of those banks are offering personal lines of credit to the employees. The banks are apparently targeting them based on the payroll processing through the bank. The bankers are apparently being rewarded somehow for making loans.

This is where the story takes a very interesting turn...

The banks are now expanding into being investment houses and are promoting investments in mutual funds (and life and health insurance). It is the very same people who are pushing the personal lines of credit who are also selling the mutual funds. If a customer takes a loan on their personal line of credit and uses it to buy mutual funds through the bank, the same person at the bank gets rewarded for both sides of the transaction.

I can't imagine this ending well...

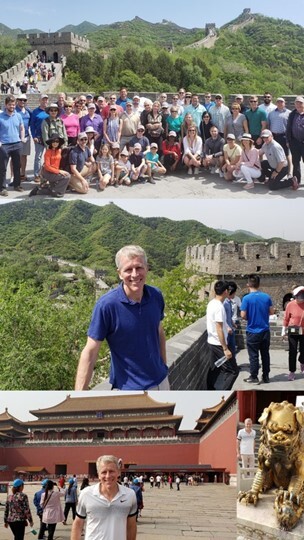

6) My last trip to China was in May 2019, when I spoke at a Stansberry Research conference in Beijing. Here are some pictures from my visits to the Great Wall and the Forbidden City:

Best regards,

Whitney