Mark your calendar for Thursday at 1 p.m.; My analyst Kevin DeCamp's bull case for Tesla; Bed Bath & Beyond Files for Bankruptcy; Air and Shoe Dog

1) This coming Thursday, I'm launching a special project unlike anything we've ever done in the history of Empire Financial Research...

In short, I'll show you a 100% legal and ethical way to make big gains thanks to "whispers" by company insiders.

Make sure to mark your calendar for 1 p.m. Eastern time on Thursday for the big reveal... and keep an eye on your e-mail inbox. See you then!

2) Though Tesla (TSLA) CEO Elon Musk's fanboys and haters (I sometimes wonder if there are any folks in the middle) no doubt disagree, I really try to be balanced in my coverage of this fascinating, unpredictable man and the many incredible companies he's built.

In Thursday's e-mail, I shared a friend's bearish take on Tesla's first-quarter earnings and the outlook for the stock, so today I'd like to share my analyst Kevin DeCamp's bullish take. (I first shared this last week with my Tesla e-mail list, which you can join by sending a blank e-mail to: tsla-subscribe@mailer.kasecapital.com.)

As background, Kevin has been very bullish – and very right – on Tesla since he bought the stock in 2012 (which he still owns – hence my nickname for him: "50-Bagger"... It used to be "100-bagger"!). He is also the happy owner of a Model S, which he bought in 2014, and a Model Y, purchased in 2020.

If you have questions or comments for Kevin, you can send an e-mail right here.

Tesla investors shouldn't be surprised by the way the market reacted to its first quarter earnings. Gross margins came in well below CFO Zack Kirkhorn's projections from just a few months ago and he made it clear we have likely not seen the floor in these numbers (now below the 20% minimum he projected).

Even worse, Musk claimed that Tesla has the "uniquely strong strategic position because we're the only ones making cars that technically we could sell for zero profit for now, and then yield actually tremendous economics in the future through autonomy."

So Tesla's recent market-leading operating margins could potentially go to zero or negative and that is the advantage? Long-term Tesla bulls understand what Musk is getting at here, but nobody should be surprised that Wall Street didn't like this.

Before we revisit the pricing issues, let's discuss the positive developments:

Tesla's in-house battery 4680 production ramp appears to be gaining steam as per CTO Drew Baglino's comments on the call. More evidence for this can be seen by Tesla's new Model Y trim finally available for order, which includes these 4680 cells in structural packs manufactured in the Austin, Texas factory.

These 4680 cells are crucial for the Cybertruck launch and I believe this was the major factor causing the truck's delay since its 2019 debut. It is currently being manufactured in Austin on a pilot line (see photos in the earnings deck) and is scheduled tentatively for a late third quarter delivery event this year.

Love it or hate it, the Cybertruck is going to change the look of our roads and will generate such a buzz that Tesla will likely continue its run of not needing traditional advertising. In addition, this will expand Tesla's total addressable market substantially, helping the company maintain its long-term growth targets.

Tesla's energy business is growing fast with energy and storage revenue up 148% YoY, from 3.3% up to 6.6% of total revenues. With Tesla's "Megapack" factory in Lathrop, California continuing to ramp production and its new Shanghai Megapack factory soon to be up and running, Tesla Energy will continue to grow faster than the auto segment and will eventually rival its size.

With a business line less susceptible to macroeconomic headwinds and a huge backlog with the world's push for renewables, the energy segment will be a massive business that Wall Street will eventually have no choice but to give Tesla credit for.

In response to an analyst question regarding opening Tesla up to new markets, Musk said that "it's high time that Tesla offers its cars to the rest of the world, and that is something that we intend to do."

Although bears will likely look at this as more evidence that there are demand issues, I see it as a great use of its lowest cost of production Shanghai plant export hub and laying the groundwork for its next phase of growth (especially the generation 3 platform). With $22.4 billion in cash, Tesla has the resources to invest in the next phase.

Now, for the bad news.

I don't think I've ever heard Tesla's management so negative about the macro environment on an earnings call. This is a very "uncertain" environment, margins are very "difficult to predict," "I don't have a crystal ball," etc. The tone of the call did not instill confidence. It's almost as if Tesla was trying to reset expectations and prepare investors for the worst.

Analyst 2024 earnings estimates have been cut (red line below) and the big question that investors have is how much lower will they go? Will this be a permanent step-down in margins or a temporary blip during these "uncertain" times? If Tesla's margins remain closer to legacy auto companies, why should it trade at a much higher multiple?

This quarter reminded me of the first quarter of 2019. Tesla had recently cut prices and announced they would not make a profit as the older $7,500 federal tax credit was cut in half. Along with this, they announced they would close a bunch of stores to focus on online purchases, which came across in the media as desperation. At the same time, Tesla was starting to focus on selling its lower-priced Model 3 trims, which further pressured margins.

The "demand cliff" talk from bears was at full steam as Tesla only sold 63,000 cars, lost $702 million, and ended the quarter with $2.2 billion in cash. The company reaffirmed its guidance of 360,000 to 400,000 total vehicle deliveries for 2019 (delivering 367,500).

Fast forward to today, and Tesla had a GAAP income of $2.5 billion in the first quarter – more than its total cash balance four years ago and delivered 422,000 vehicles – 15% more than it delivered in all of 2019. And don't forget, this was a disappointing quarter – even for us Tesla bulls.

Another thing to remember about 2019 is that nobody foresaw what came in 2020 and nobody really knows what 2024 will bring, but that's what makes the stock market game fun (and the only reason you actually have a chance to make money).

If you still have confidence in the Tesla team and its ability to deliver on its mission and FSD, this year may be a time to add to your position or start a new one as the uncertainty – and volatility – is likely to persist. But you need to do your homework, have conviction, and understand the risks.

I know I will be adding to my position and am confident that we will likely look back in four more years at these "tiny" delivery and profit numbers when Tesla is a much bigger auto, energy, AI, and robotics company.

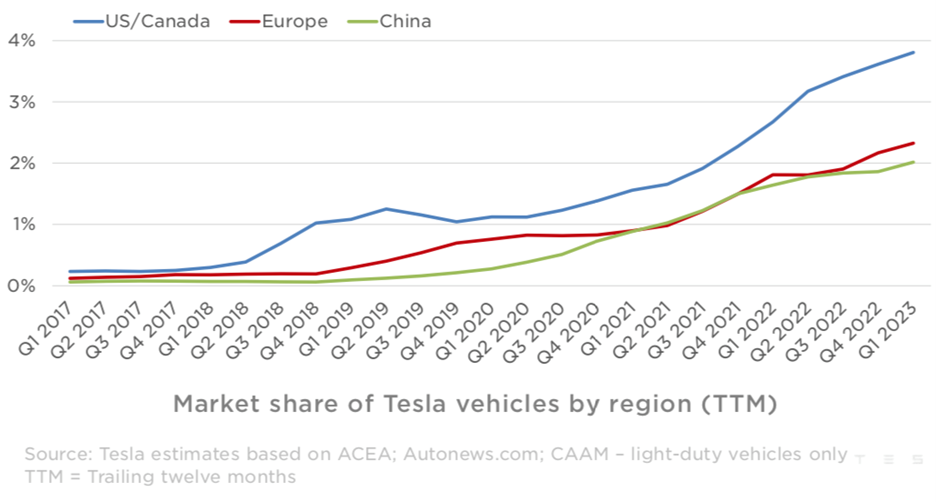

EV market share is one of the media's obsessions – among many other dumb things – but what really matters is total market share of the auto market (see below chart). As the world continues to wake up to the fact that the hundreds of millions of cars on the road will be obsolete, who will benefit most?:

Thank you, Kevin!

3) Eight months ago on August 18, 2022, I wrote that Bed Bath and Beyond (BBBY) "is in a death spiral because it likely doesn't have enough liquidity to build inventory for the holidays and will therefore have to file for bankruptcy."

Well, it took a bit longer than I expected, but my prediction came to pass over the weekend: Bed Bath & Beyond Files for Bankruptcy. Excerpt:

Bed Bath & Beyond filed for bankruptcy protection to wind down its business after years of losses and failed turnaround plans left the once-powerful retailer short of cash.

The company had warned of a potential bankruptcy for months. It needed a $375 million loan to get through the holidays. It struck an unusual $1 billion financing deal with a hedge fund in February to put off a bankruptcy filing, then scrapped the deal and tried this month to raise $300 million from other investors.

None of the moves were enough. Nor were efforts to stem losses by closing hundreds of stores. Sales evaporated and its stock price tumbled well below $1 in recent weeks, as the rescue efforts dimmed.

The retailer filed for chapter 11 bankruptcy Sunday in the U.S. Bankruptcy Court in Newark, N.J., and said it expects to close all of its 360 Bed Bath & Beyond and 120 Buybuy Baby retail locations eventually. Top lender Sixth Street Partners has put up $240 million in financing to keep Bed Bath & Beyond operating through the liquidation process, the company said.

Bankruptcy gives Bed Bath & Beyond the breathing room to conduct going-out-of-business sales at its physical stores and solicit interest from potential buyers for its remaining assets, such as its branding. Individual investors who continued to back Bed Bath & Beyond during its final months, when it was flooding the market with shares, will likely be wiped out in chapter 11, which prioritizes the repayment of debt over shareholder recoveries.

I'd like to correct the last sentence above: "Individual investors who continued to back Bed Bath & Beyond during its final months, when it was flooding the market with shares, will likely be wiped out in chapter 11, which prioritizes the repayment of debt over shareholder recoveries."

It's certain that the stock is a zero. There will be no miracle like Hertz (HTZ) was...

As for the speculators who are getting wiped out, I have mixed feelings. Generally, I think people who behave badly deserve what happens to them.

But I think one of the main jobs of the SEC is to protect people from themselves, so regulators should have stopped Bed Bath & Beyond and its hedge fund accomplices from flooding the market with shares as the company entered its death throes...

4) I don't go to movies much anymore, but I'm glad I did on Wednesday when I went to see Air, which traces then-underdog Nike's (NKE) pursuit of Michael Jordon, who was just entering the NBA.

Even though I knew how the story would end, I enjoyed it – as did critics, who gave it a 92% on Rotten Tomatoes and 73 on Metacritic. Here are reviews by Roger Ebert and the New York Times, and here's the trailer.

And after watching to movie, I suggest reading Shoe Dog: A Memoir by the Creator of Nike, by Nike's founder, Phil Knight. Here's a summary:

In this candid and riveting memoir, for the first time ever, Nike founder and board chairman Phil Knight shares the inside story of the company's early days as an intrepid start-up and its evolution into one of the world's most iconic, game-changing, and profitable brands.

Young, searching, fresh out of business school, Phil Knight borrowed fifty dollars from his father and launched a company with one simple mission: import high-quality, low-cost running shoes from Japan. Selling the shoes from the trunk of his Plymouth Valiant, Knight grossed eight thousand dollars that first year, 1963. Today, Nike's annual sales top $30 billion. In this age of start-ups, Knight's Nike is the gold standard, and its swoosh is more than a logo. A symbol of grace and greatness, it's one of the few icons instantly recognized in every corner of the world.

But Knight, the man behind the swoosh, has always been a mystery. Now, in a memoir that's surprising, humble, unfiltered, funny, and beautifully crafted, he tells his story at last.

It all begins with a classic crossroads moment. Twenty-four years old, backpacking through Asia and Europe and Africa, wrestling with life's Great Questions, Knight decides the unconventional path is the only one for him. Rather than work for a big corporation, he will create something all his own, something new, dynamic, different. Knight details the many terrifying risks he encountered along the way, the crushing setbacks, the ruthless competitors, the countless doubters and haters and hostile bankers – as well as his many thrilling triumphs and narrow escapes.

Above all, he recalls the foundational relationships that formed the heart and soul of Nike, with his former track coach, the irascible and charismatic Bill Bowerman, and with his first employees, a ragtag group of misfits and savants who quickly became a band of swoosh-crazed brothers.

Together, harnessing the electrifying power of a bold vision and a shared belief in the redemptive, transformative power of sports, they created a brand, and a culture, that changed everything.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.