Meta's Moat; Kerrisdale Capital short report on Carvana; Stock-Market Rally Costs Bears $120 Billion; Inside the Escalating Feud at One of Wall Street's Biggest Hedge Funds; Susan removed the staples from my scalp

1) Meta Platforms (META) shares have more than tripled since the fall...

The parent company of Facebook, Instagram, and WhatsApp has been my favorite tech stock ever since I pounded the table on it in six consecutive e-mails from October 31 through November 7. On November 3, it closed at a seven-year low of $88.91 per share (see summary in my March 30 e-mail). Yesterday, they closed at $284.33... a 220% gain.

So is it time to declare victory and exit?

I think not, in part because, unless you're in a stock for a trade, it's critical to let your winners run. That's especially true with a high-quality business with a bright future – which is what I think describes Meta.

For more on this, I recommend reading this recent post by Abdullah Al Rezwan, who does a deep dive on one stock each month on his MBI Deep Dives blog: Meta's Moat. Excerpt:

Here's what I am going to do: I will show the unit economics of Meta (then Facebook; they also had just "Facebook" website/app back then) in 2009-11 and then show the unit economics of Snap, Pinterest, and Twitter in 2019-2021 period.

Snap, Pinterest, and Twitter somewhat resemble Meta in terms of userbase 10 years apart and this exercise is indeed quite revealing to gauge what exactly is Meta's moats against today's and future set of competitors in their social networking business. I will briefly comment on TikTok later...

Considering almost constant negative press coverage and the difficulty of forecasting/underwriting social media businesses for 5-10 years, the stock may persistently trade at below market multiples.

Despite +134% YTD, the stock still trades at ~17x NTM EV/EBIT which is ~8-10 turn lower compared to Nasdaq 100 (when you include SBC in EBIT calculation) and ~3-4 turn lower than S&P 500 (again, similar SBC adjustments to QQQ). To the extent my opinion about Meta's management is correct is what will likely drive shareholders' long-term return.

P.S. I know any piece on Meta's moat may seem incomplete without any discussion on Metaverse or AR/VR segment. It is simply too early to form any rigid opinion there, but for curious readers, I encourage you to read this Benedict Evans piece which I thought was perhaps the most thoughtful piece on Vision Pro/Quest post WWDC.

You can also read a bit more detailed analysis on Meta here (March, 2023).

2) Even after yesterday's 7% pullback to $23.52, used-car seller Carvana (CVNA) is up 563% from the 52-week low it hit in December at $3.55.

My friend Sahm Adrangi of Kerrisdale Capital, who's one of the best short sellers I know, thinks the stock is destined for oblivion for reasons he outlines in his new 24-page report, Carvana: Running on Empty. Here are excerpts from his recent Twitter thread:

Carvana is insolvent, its equity is worthless. Nothing more than a poorly run auto retailer, the company will never generate sustainable positive cash flow until its debt is equitized.

$CVNA has never produced profitable growth. Even during the pandemic when demand soared, interest rates were low and used car prices were mooning, $CVNA couldn't generate consistent profits – now none of those conditions exist.

With $6b of high cost bonds, negligible "adj" EBITDA, significant capex, shrinking revenue (down -25% y/y) and dwindling liquidity, $CVNA is destined for a debt restructuring.

I think it's likely Sahm will be proven right...

3) That said, I don't recommend the most investors engage in short selling for the many reasons I've outlined in previous e-mails.

The best short sellers in the world have gotten massacred this year, as this article in today's Wall Street Journal notes: Stock-Market Rally Costs Bears $120 Billion. Excerpt:

Investors have been ramping up bets against stocks – and they are getting burned.

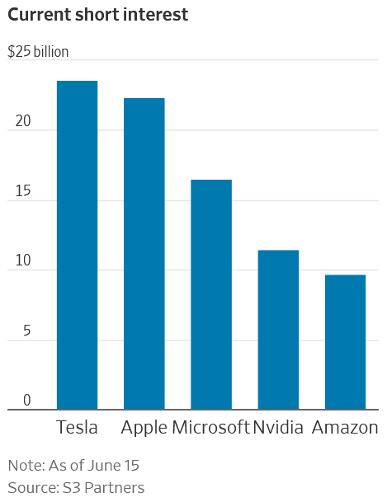

Total short interest in the U.S. market topped $1 trillion this month, hitting the highest level since April 2022, according to data from S3 Partners. That is up from $863 billion at the start of the year and represents about 5% of all shares that are available to trade.

Short sellers borrow shares and then sell them, hoping to buy them back at a lower price later and pocket the difference. They have added to their bearish wagers in recent weeks, while the S&P 500 climbed to a 14-month high. The index is up 14% in 2023 and 5% in June alone.

That rally has been punishing: Short sellers have incurred roughly $120 billion in mark-to-market losses this year, including $72 billion in the first half of June, according to S3.

4) This story on the front page of today's WSJ covers the conflict between the two co-founders of Two Sigma, one of the biggest and most successful hedge funds in the world. What a mess! Inside the Escalating Feud at One of Wall Street's Biggest Hedge Funds. Excerpt:

A long-running rift atop one of the world's largest hedge funds has burst into the open, raising questions about the firm's future.

Over the last 22 years, John Overdeck and David Siegel built Two Sigma Investments into a $60 billion quant-trading behemoth. But behind the scenes, the billionaire co-founders have clashed over the firm's direction, succession planning and more, people familiar with the matter said.

The relationship has deteriorated to the point where Two Sigma felt the need to disclose the friction in a March 31 securities filing. In a little-noticed section on "material risks" related to its investments strategies, the firm warned that Two Sigma's management committee – which includes only Overdeck and Siegel–is having difficulty making key decisions, a disclosure that lawyers, investors and others say is virtually unprecedented in the investment world.

Two Sigma, according to the filing, is experiencing "a variety of management and governance challenges," and the management committee has "been unable to reach agreement on a number of topics." These include "defining roles, authorities and responsibilities for a range of C-level officers, including for the various roles of the members of the Management Committee," as well as "organizational design and management structure of various teams" and "succession plans," among other disagreements.

"I've never seen anything like this," said Jamie Nash, a partner at law firm Kleinberg Kaplan who advises hedge funds. "Disagreements among founders aren't uncommon, but I've never heard of a disclosure like this."

The operating agreement the two men drew up decades ago specifies they must agree on most decisions, say people familiar with Two Sigma. So when they disagree, little gets done.

5) Following up on last Monday's e-mail about mashing my head at a Tough Mudder race 10 days ago, which required seven staples...

My scalp is healing up nicely and the staples were itchy and annoying, so I decided I wanted them out (even though the doctor said to wait two weeks).

The question was: how?

I Googled "Can I remove staples from my head?" and various websites all said:

No, you should not remove surgical staples at home. It is a difficult and painful process that requires a special tool. Let a doctor with proper training remove the staples. Doctors need to assess if the wound has healed enough to warrant removing the staples.

Even if a doctor gave you a specific date or week for removing the staples, that is only an estimate, and they will require examination. Removing the staples early could cause scarring, infections, or even cause the wound to open back up.

While this is undoubtedly good advice, I ignored it for two reasons: a) I'm sick of getting hit with unexpected medical bills that my insurance decides not to cover, and b) that advice applies to mere mortals!

The same Google search revealed that "if you have the proper training and decide to remove your staples at home, you can use a skin staple remover." I found one on Amazon for $4.60, ordered it on Sunday, and it arrived yesterday.

After some coaxing and cajoling (and of course, not reading the paragraph above to her!), I persuaded Susan to go along with my harebrained idea. She ended up being an excellent doctor, as you can see in this video I took and these pictures I posted on Facebook. (WARNING: You may find the video and/or pictures gross.)

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.