More Lessons from 15 Years of Short Selling; Pitch for Pershing Square Holdings; Accounting Red Flags Are Common Among Public Crypto Companies; Uber driver rescues people from burning building

- Lessons From 15 Years of Short Selling

- My History With Shorting

- 12 Reasons Not to Short

- 10 Reasons to Short

- Wise Advice From a Friend – and Charlie Munger

Today and in subsequent e-mails for the rest of this month, I will share the rest of the presentation...

Here are the next three slides with some important lessons:

2) I forgot to send out this episode of Yet Another Value Podcast when it was posted on September 12, but I think the guest, James Elbaor, makes a compelling case that's still valid today for Bill Ackman's Pershing Square Holdings (PSHZF). Here's a summary:

James Elbaor, founder and CIO of Marlton Capital, discusses his investment thesis for Pershing Square Holdings ("PSH").

PSH is Bill Ackman's closed-end fund. It trades at a discount, James thinks Ackman is on the verge of taking steps that will both increase net asset value and shrink the discount.

James' Twitter: https://twitter.com/jameselbaor

Chapters

0:00 Intro

2:25 PSH Overview

11:50 Why would a U.S. listing close the NAV gap?

20:20 What could PSH buy to relist in the U.S.?

22:55 How does PSH fund an acquisition?

24:55 Responding to the Ackman Blowup Risk

27:30 PSH's management fees and the discount

32:20 Why has PSH's leverage come down this year?

38:30 Discussing PSH's "macro" trades

42:30 The interest rate swaption

46:30 PSH's current portfolio

52:30 How PSH will evolve over time

56:30 PSH's dividend

1:01:30 A little more on a potential relisting

We recommended Pershing Square Holdings in the July issue of our Empire Investment Report newsletter, and we're currently up 10%. To learn more about Empire Investment Report and find out how to gain access to our full report on Pershing Square Holdings – and the full portfolio of open recommendations – click here.

3) The blowup of crypto exchange FTX has led to calls for greater transparency – but it's not clear that this will fix the problem...

As this Wall Street Journal article notes, public crypto companies have plenty of disclosure, but many of them are still very risky due to weak controls and related-party transactions: Accounting Red Flags Are Common Among Public Crypto Companies. Excerpt:

Investors bemoan the lack of disclosure in the crypto industry. But many crypto companies disclose a lot of information, and some of it is worrisome, a review of financial statements shows.

The blowups of FTX and Celsius Network exposed hidden risks that might have raised red flags for investors, including related-party transactions, commingled customer funds, sketchy record-keeping and questionable accounting. Some of these problems often appear in disclosures by public crypto companies, including weak systems used to keep numbers accurate.

A look at 19 of the publicly traded crypto miners showed that 16 disclosed significant internal-control weaknesses in the past four years, some of which were "alarming," according to Bedrock AI, which makes software that analyzes financial filings.

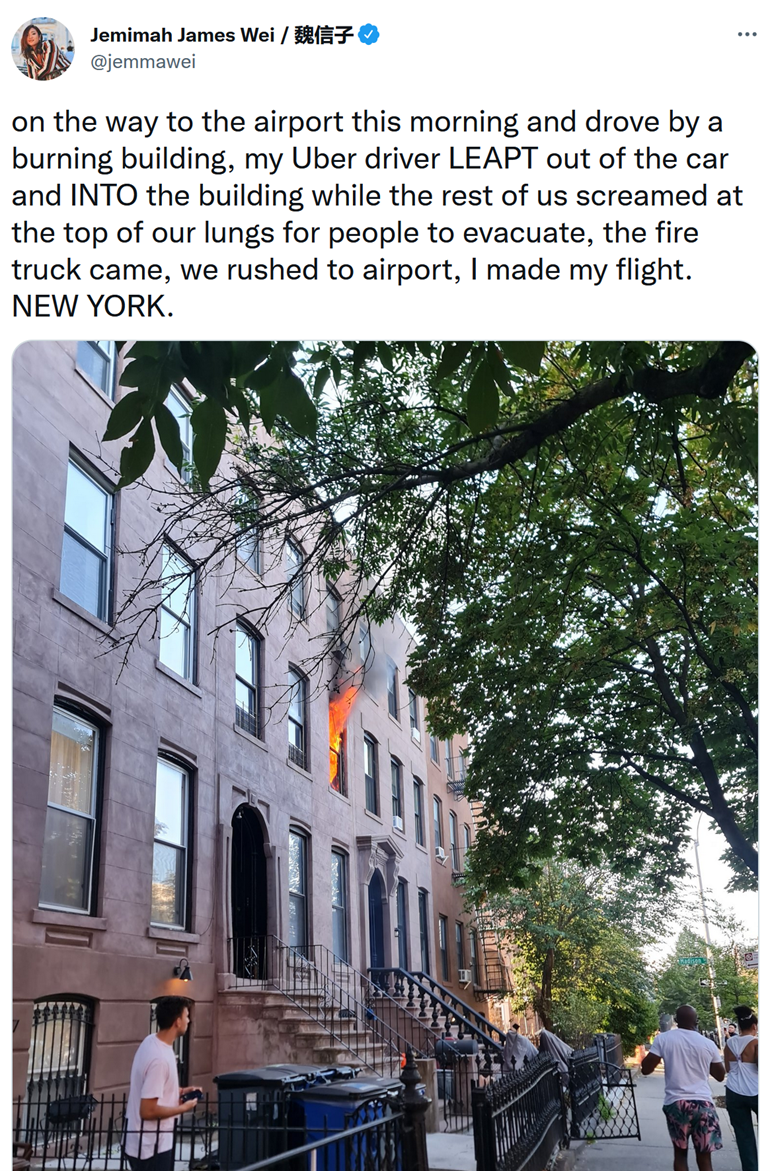

4) This is another wonderful story of an average person becoming a hero: Uber driver paused mid-ride to rescue people from burning Brooklyn building. Excerpt:

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.