More pressure on regional banks; Response to 'Half of America's banks are potentially insolvent'; Bill Ackman's comments; Doug Kass is buying PACW and WAL; Richard Kovacevich on What Really Caused the Financial Crisis; Interesting chart on bank failures

1) The regional banking sector is getting hammered today after this Bloomberg article published shortly after the close yesterday, sending shares PacWest Bancorp (PACW) crashing more than 60% after hours: PacWest Is Weighing Strategic Options, Including Possible Sale. Excerpt:

PacWest Bancorp, a regional bank teetering following the collapse of three rival California-based lenders, has been weighing a range of strategic options, including a sale, according to people familiar with the matter.

The Beverly Hills-based bank has been working with a financial adviser and has also been considering a breakup or a capital raise, said the people, who asked to not be identified because the matter isn't public. While it is open to a sale, the company hasn't started a formal auction process, the people said.

This prompted the bank to issue the following press release shortly after midnight:

In light of recent reporting regarding strategic actions, PacWest Bancorp (Nasdaq: PACW) (the "Company") provides the following update:

Our message remains consistent with what was conveyed last week with earnings. As previously announced, the Company has explored strategic asset sales, including moving the $2.7 billion Lender Finance loan portfolio to held for sale in 1Q23. This planned sale remains on track and upon completion will accelerate our CET1 capital ratio to 10%+ (from 9.21% at 1Q23).

Additionally, in accordance with normal practices the Company and its Board of Directors continuously review strategic options. Recently, the Company has been approached by several potential partners and investors – discussions are ongoing. The company will continue to evaluate all options to maximize shareholder value.

The bank has not experienced out-of-the-ordinary deposit flows following the sale of First Republic Bank and other news. Core customer deposits have increased since March 31, 2023, with total deposits totaling $28 billion as of May 2, 2023 with insured deposits totaling 75% vs. 71% at quarter end and 73% as of April 24, 2023.

In addition, the company recently paid down $1 billion of borrowings with our excess liquidity. Our cash and available liquidity remains solid and exceeded our uninsured deposits, representing 188% as of May 2, 2023.

At the beginning of the year, the Company announced a new strategic plan designed to maximize shareholder value by focusing on various elements, including strengthening our community bank focus, growing our HOA business, exiting non-core products, and improving our operational efficiency.

We have been executing this strategy and have accelerated many of these goals in response to recent market volatility in the banking industry.

PACW shares recovered somewhat but are still down heavily as of midmorning, with other regional bank stocks like Western Alliance (WAL), Comerica (CMA), and Zions Bancorp (ZION) down in sympathy about contagion in the sector.

2) For insights on what's happening and what regulators should do, I reached out to the smartest bank analyst I know (who wishes to remain anonymous). He has been investing exclusively in this sector, long and short, for more than two decades at a hedge fund with an exceptional track record.

Before the PACW news broke yesterday, I asked him what he thought of the article I included in yesterday's e-mail entitled Half of America's banks are potentially insolvent – this is how a credit crunch begins. He replied:

This is simply false to say that 50% of the banks are insolvent. Yes, there are a big chunk that have seen their capital become thin on a mark-to-market basis, but there are very few that are truly insolvent.

I would agree though with all the commentary about the Fed having created a mess and being hell-bent on continuing to throw fuel into the fire by raising rates again today. The crazy thing is that they have really wounded the banking sector and the availability of credit is going to decline sharply, which will help calm inflation.

The other thing that the markets seem to have wrong is they don't realize that banks have reserved for loan losses and are still going to earn some money as we go through a potential credit cycle. Take Zions Bancorp (ZION) for example: they have $618 million of loan loss reserves and are expected to earn another $800 million this year. Even if they only earn half of that they still have the power to cover a lot of credit losses.

Not that analysis seems to matter right now, as sentiment in the bank space is as bad as we can ever remember it.

Then, after the PACW news broke, late last night he added:

I think it was a huge mistake for the Fed to raise rates today. Liquidity on banks' balance sheets was low given the unrealized losses on securities and loans combined with deposits leaving for higher short-term rates, so this just increases those short-term rate options and makes it harder for banks to keep deposits. The Fed has just raised too quickly.

With PACW, if we fair value the held-to-maturity securities and loans, basically all common equity is wiped out. As such, when stocks get smashed like PACW has in the after hours, it likely spooks their depositors and that triggers funding issues.

We are not long or short PACW but have spent a decent amount of time looking at it and although we thought they had the ability to survive, we've had it in a high-risk category given they just didn't have enough capital, so we (thankfully) didn't buy it.

But we also didn't short it because, if they could survive, as of a week or so ago we actually thought it had pretty good earnings power for a stock trading at its valuation. Plus, if interest rates were to come down, as the Fed Funds Futures market suggests they will (July 2024 futures predict that the Fed Fund Rate will be 3.0% to 3.5%), then their balance sheet will get a lot of relief from accretion related to interest rate marks.

As for other banks, we think it does put pressure on the stocks of banks that are the next few tiers down. The sharp declines could then spark depositor fear and lead to a very vicious cycle.

The Fed needs to pause on rate increases and the FDIC needs to push to get Congress to approve increased deposit insurance options (paid for by banks). The FDIC did put out a summary on potential changes yesterday, but we don't feel like it is being pushed forward with the urgency it needs.

If they do nothing with deposit insurance, they are basically saying "we only support the big four banks in the United States and believe all deposits should move there as we are willing to provide unlimited implied deposit insurance for free."

The community and regional banks, many which are very healthy and have been prudent are being punished by the incompetence of the people managing our financial system.

The shorts are being very aggressive in some of the banks like MCB, WAL, ZION, etc. If there is even a hint of an improvement in deposit insurance, we could see a short squeeze for the ages that sends these stocks up 20%-plus in a matter of minutes, and many of them would still be dirt cheap.

3) I totally agree... as does Bill Ackman of Pershing Square. In a tweet (before the PACW news), he called for a "systemwide deposit guarantee regime" in the U.S.

Here's a Fortune article about Bill's tweet: Legendary investor Bill Ackman warns America's regional banks are at risk: 'At this rate, no regional bank can survive bad news.' Excerpt:

Billionaire hedge fund founder Bill Ackman called for a "systemwide deposit guarantee regime" in the U.S., as regional banking stocks were pummeled in the wake of this weekend's sale of First Republic Bank to JPMorgan.

"The regional banking system is at risk," the founder and CEO of Pershing Square Asset Management tweeted on Wednesday evening. "The failure to update and expand its insurance regime has hammered more nails in the coffin"...

"Banking is a confidence game," Ackman wrote on Twitter. "At this rate, no regional bank can survive bad news or bad data as a stock price plunge inevitably follows"...

Ackman suggested on Wednesday that First Republic Bank "would not have failed if the FDIC temporarily guaranteed deposits while a new guarantee regime were created."

The hedge fund manager has consistently supported stronger government intervention in the banking sector since turmoil began in early March, calling for a government bailout of Silicon Valley Bank when customers first started to abandon the struggling lender.

4) My friend Doug Kass of hedge fund Seabreeze Partners sees opportunity in two of the most bombed-out regional bank stocks:

Off the WAL: Two Bets on Two Banks

I am taking a very small speculative buy of both PacWest ($2.65) and Western Alliance Bancorp ($18.90).

WAL is down 35% and PACW is down 65% in the after hours.

I am not certain that the rumor on PacWest is accurate.

That said, I don't recommend following me on these trades for obvious reasons.

I am just being transparent.

Doug added:

WAL officially put out a few highlights late last night:

Stable Deposits: WAL did not experience unusual deposit flows following FRC. Total Deposits were $48.8 billion as of May 2, up from $48.2 billion as of May 1. Quarter-to-Date deposits are up $1.2 billion. Management reaffirmed $2 billion quarterly deposit growth guidance. Loan-to-Deposit ratio is currently at 95% (as of May 2).

Insured Deposit Strength: As of May 2, insured deposits represent over 74% of total deposits. Of the top 20 largest deposit relationships, over 88% of deposits are insured.

Loan Sales on Track: Of the $3 billion HFL loans contracted to sell in 2Q23, $2.1 billion have settled, with the remainder expected to close in coming weeks. Asset disposition marks are within the 2% cited previously.

Adding to WAL.

And in the latest issue of our Empire Investment Report newsletter, I recommended a basket of five banking stocks that look like classic "babies thrown out with the bathwater" situations.

Subscribers can access the full issue right here... And if you aren't a subscriber, you can learn more about Empire Investment Report and find out how to gain instant access to these five recommendations by clicking here.

5) For more on how misleading mark-to-market ("MTM") accounting is, one of my readers sent me this 2011 Forbes interview with the CEO of Wells Fargo (WFC) during the global financial crisis: Richard Kovacevich on What Really Caused the Financial Crisis . Excerpt:

You and I are probably the two people in the world who hate mark-to-market accounting the most. What role did it play in the crisis?

A huge role. People thought the world was coming to an end because everyone was reporting huge book but not actual losses because of MTM accounting.

We had to write off $900 million on a prime mortgage portfolio that we thought had a maximum loss exposure of $100 million. Our current loss estimate for that portfolio is now just $35 million. But we had to report nearly a billion-dollar loss that never came to fruition. And that was just one relatively small portfolio. I could give you many more examples.

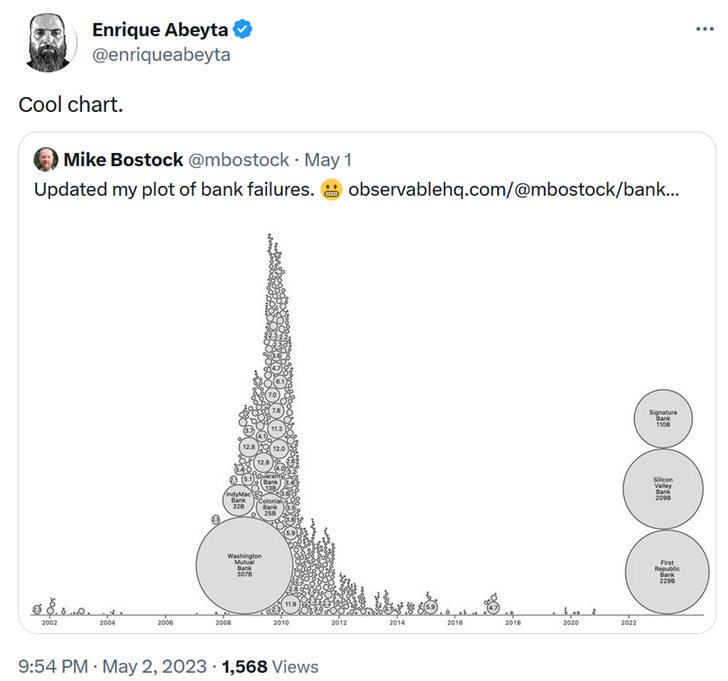

6) Lastly, my colleague Enrique Abeyta tweeted this interesting chart showing how narrow the current banking "crisis" is relative to past ones:

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.