My 'Whisper Trade' presentation; Icahn Enterprises: The Corporate Raider Throwing Stones From His Own Glass House; Parallels with StoneMor Partners; JPMorgan acquires First Republic; Per-article charging

1) I'll admit that I've been very lucky to have access to some of the best money managers and company insiders in the world...

I'm talking about people like Berkshire Hathaway's (BRK-B) Warren Buffett and my college buddy and one of the largest asset managers in the world, Bill Ackman.

This means I often hear "whispers" that, quite frankly, others will never have the chance to hear in their lifetimes.

But in a special presentation, I'll show you a 100% legal and ethical way to turn insider "whispers" into potentially 10x profits – this year and beyond.

2) One of the best-known activist short sellers, Nate Anderson of Hindenburg Research, just released his latest report and it's a doozy...

In it, he goes after Wall Street legend Carl Icahn and his public holding, Icahn Enterprises (IEP): Icahn Enterprises: The Corporate Raider Throwing Stones From His Own Glass House. Excerpt:

- Icahn Enterprises (IEP) is an ~$18 billion market cap holding company run by corporate raider and activist investor Carl Icahn, who, along with his son Brett, own approximately 85% of the company.

- Our research has found that IEP units are inflated by 75%+ due to 3 key reasons: (1) IEP trades at a 218% premium to its last reported net asset value (NAV), vastly higher than all comparables (2) we've uncovered clear evidence of inflated valuation marks for IEP's less liquid and private assets (3) the company has suffered additional performance losses year to date following its last disclosure.

- Most closed-end holding companies trade around or at a discount to their NAVs. For comparison, vehicles run by other star managers, like Dan Loeb's Third Point and Bill Ackman's Pershing Square, trade at discounts of 14% and 35% to NAV, respectively.

- We further compared IEP to all 526 U.S.-based closed end funds (CEFs) in Bloomberg's database. Icahn Enterprises' premium to NAV was higher than all of them and more than double the next highest we found.

- A reason for IEP's extreme premium to NAV, based on a review of retail investor-oriented media, is that average investors are attracted to (a) IEP's large dividend yield and (b) the prospect of investing alongside Wall Street legend Carl Icahn. Institutional investors have virtually no ownership in IEP.

- Icahn Enterprises' current dividend yield is ~15.8%, making it the highest dividend yield of any U.S. large cap company by far, with the next closest at ~9.9%.

- As a result of the company’s elevated unit price, its annual dividend rate equates to an absurd 50.5% of last reported indicative net asset value.

- The company's outlier dividend is made possible (for now) because Carl Icahn owns roughly 85% of IEP and has been largely taking dividends in units (instead of cash), reducing the overall cash outlay required to meet the dividend payment for remaining unitholders.

- The dividend is entirely unsupported by IEP's cash flow and investment performance, which has been negative for years. IEP's investment portfolio has lost ~53% since 2014. The company's free cash flow figures show IEP has cumulatively burned ~$4.9 billion over the same period.

IEP shares were trading down 20% earlier this morning.

3) I've never looked at Icahn Enterprises closely, but at first glance, it reminds me of a company I shorted way back in 2012: cemetery and funeral home operator StoneMor Partners.

Like IEP, StoneMor paid a huge dividend which attracted naïve retail investors, but such a large payout wasn't supported by the underlying profitability of the business. StoneMor issued lots of stock to raise cash to pay out to shareholders as "dividends" – but, in reality, they weren't returns on capital (which is what dividends are supposed to be) but rather returns of capital.

I published two articles about StoneMor's Ponzi scheme on SeekingAlpha, using an alias, Value Sleuth, because I didn't want the company to be able to sue or otherwise attack me. Here's the first, which I published on July 26, 2012: The Impending Implosion Of StoneMor Partners. I concluded:

StoneMor has a management team with a highly questionable past, weak financials, and doesn't come anywhere close to funding its dividend, which it cleverly covers up. It's a house of cards that will soon collapse when the fundamentals catch up with it.

Bulls argue that the MLP structure of StoneMor should lead one to ignore all of these troubling facts, but this is a specious argument. The company's structure offers tax benefits (distributions are tax free) to partners and allows limited partners to write off the depreciation of the company on a pro-rata basis, but does nothing to warrant such an egregiously high valuation for a barely profitable company with an unsustainable dividend.

Paradoxically, the MLP structure that bulls argue justifies a higher valuation for StoneMor will in fact lead to its downfall, as it gives management and the GP strong incentive to inflate the dividend in every way possible, even if it's simply by round-tripping shareholders' capital by doing equity raises and then paying out the capital in the form of a dividend to a diluted shareholder base.

Then, two weeks later, I published as follow-up article, StoneMor's Misleading Press Release: The Short Case Continued, in which I began:

In response to my recent article, "The Impending Implosion of StoneMor Partners," the company issued a press release that fails to refute my key arguments and further misleads investors. StoneMor's frantic attempts to deceive investors into ignoring the obvious – its terrible business model and financial situation – reminds me of the scene in The Wizard of Oz when the wizard tells Dorothy to "pay no attention to that man behind the curtain." StoneMor's financial statements don't mislead – they tell a clear (and damning) story – but the company's management sure does...

False Comparison to Other MLPs

In the third paragraph of its press release, StoneMor writes: "Because MLPs pay out most of their cash flow to unit holders, StoneMor, like every other MLP, finances these acquisitions with debt and periodic equity offerings." This is cleverly worded to be a true statement, but is highly misleading. Most MLPs pay out genuine profits/free cash flow as dividends, and then raise capital to fund expansion. However, in StoneMor's case, as I wrote in my last article, the company over the last 13 quarters:

"has averaged a mere $1.4 million in free cash flow per quarter, yet has paid a dividend averaging $8.9 million per quarter (and nearly $12 million in each of the last four quarters), resulting in a cash burn that has averaged $7.5 million per quarter. This is clearly absurd and unsustainable."

I concluded:

The company writes: "We believe that we are ideally positioned to carry on our growth strategy and bring value to our unitholders." In truth, StoneMor's terrible business model, rising debt load, increasing reliance on highly dilutive equity offerings, and disingenuous management have put the company on the brink of a meltdown.

As I look back on my analysis from more than a decade ago, it was exactly right and everything I predicted came to pass.

So did I make a bundle on my short position?

Alas, no...

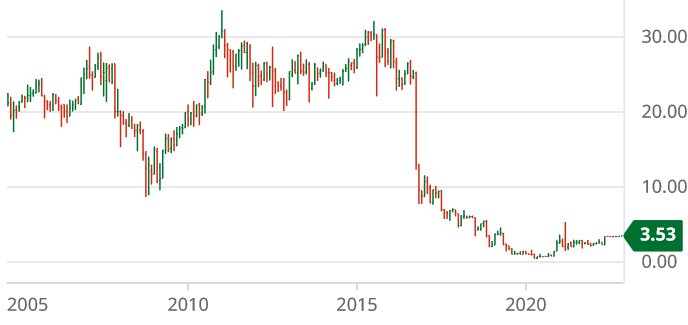

As you can see from this long-term stock chart, StoneMor's share price traded in a range between $20 and $30 for more than four years after my reports:

This position became so annoying and costly (when you're short a stock, you have to pay the dividend) that I covered long before it finally paid off.

What did I miss? The fact that when investors are willing to buy a company's stock at 3 times book value and then it pays back much of that cash as a "dividend" (equal to book value, of course), the game can go on for a long time... and so it did.

Eventually, of course, the fundamentals caught up to StoneMor...

In late 2016 it was forced to slash its dividend and the stock collapsed. It eventually suspended its dividend altogether and almost went bankrupt, but ended up being taken private last year at $3.50 per share.

4) A hat tip to both JPMorgan Chase (JPM) and regulators, who pulled off an extremely difficult transaction over the weekend. It's a real win-win-win for markets, taxpayers, and JPMorgan. Here are the best articles I've read about it:

- Bloomberg's Matt Levine: JPMorgan Got a Deal on First Republic

- WSJ "Heard on the Street": JPMorgan's Role as Savior

- WSJ: Jamie Dimon Wins Again in First Republic Bank Deal

- WSJ: JPMorgan Eyes the True Prize in First Republic Deal: Wealthy Customers

Full disclosure: I am one of those wealthy customers!

5) Almost every day, a friend or reader sends me a link to an article that's behind a paywall... but I don't want to subscribe because it's a site I'll likely never go back to, so if my often-successful trick of saving it to Pocket (about which I wrote here) doesn't work, I just don't read it and move on...

But I'd be happy to pay a one-time fee of, say, $0.99 to just read that one article, so I hope Elon Musk follows through with this and it becomes widely adopted: Elon Musk says Twitter will introduce per-article charging in May. Excerpt:

Twitter might provide publishers with a new way to earn from their content outside of the typical recurring subscription option. According to company chief Elon Musk, Twitter will allow media publishers to charge users for access to individual articles they post on the website as soon as next month. Users will end up paying a higher per-article price than what the cost of access to every article would amount to if they had a subscription instead. But Musk said it's for those who want to read the occasional story from a specific outlet, so each article probably wouldn't cost as much as a monthly subscription.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.