Nasdaq falls into correction territory; My Short Squeeze Bubble Basket is now down 41%; SPAC-Man Chamath Palihapitiya; Questions about a SPAC mogul's stock sales; Eric Rosen on stocks trading above 10 times sales

1) The rotation I predicted when I was pounding the table on bank stocks late last year continues...

Yesterday was another rare yet increasingly common day in which the tech-heavy Nasdaq Composite Index fell 2.4% while the old-economy-heavy Dow Jones Industrial Average rose 1%. The Nasdaq is now down 10.5% since its record high on February 12, putting it in correction territory (though it's only down 2.2% year to date).

Market darling ARK Innovation Fund (ARKK) and its largest holding, Tesla (TSLA), were both down 5.8% yesterday and are down 29.6% and 36.2% from their all-time highs last month, making them down 20.2% and 11.4% year to date, respectively.

2) Usually, when the Nasdaq sells off hard, the most over-hyped, speculative, and/or fraudulent stocks take an even bigger tumble, but yesterday was weird...

Some of the very worst stocks, which are in my Short Squeeze Bubble Basket, were up big, including Express (EXPR) (up 63.8%), GameStop (GME) aka "GameStink" (41.2%), Koss (KOSS) (27.5%), AMC Entertainment (AMC) (15.4%), and one of the most terrible stocks I know of, Workhorse (WKHS) (12.9%). This is a classic "dead-cat bounce."

Nevertheless, the 25 stocks in my Bubble Basket finished the day down an average of 41% since I warned about them on January 27. 24 are down, 21 are down by 27% or more, and 18 are down by 37% or more.

3) The reigning king of hype and speculation is undoubtedly Chamath Palihapitiya. The Wall Street Journal did a fawning profile of him over the weekend: When SPAC-Man Chamath Palihapitiya Speaks, Reddit and Wall Street Listen. Excerpt:

Mr. Palihapitiya is the man of the market moment. The founder of tech-investing firm Social Capital Holdings has charmed Wall Street to raise billions of dollars to bring startups public. Amateur traders hang on his every word for clues about his next target – and for the insults he hurls at the high-finance elite. (Hedge funds, he said last April, deserved to get wiped out when coronavirus shutdowns devastated the economy.)

Wall Street has always had its rock stars. Warren Buffett's carnival-like annual meeting, after all, is nicknamed "Woodstock for Capitalists." But Mr. Palihapitiya, a former Facebook (FB) executive who now has 1.4 million Twitter (TWTR) followers, belongs to a new class of market influencers – social-media savants who've figured out how to take shots at the establishment while taking its money.

No one has marshaled the twin forces reshaping markets – the blank-check boom and the retail-trading surge – quite like Mr. Palihapitiya...

Mr. Palihapitiya's skills as a hype man, though, are particularly well-suited to the features of SPACs. Unlike in a traditional IPO, executives and sponsors of SPAC transactions can make projections about the company's future revenue and profits. Because such deals are structured as mergers, SPAC sponsors don't have to worry about restrictions on talking openly about a business before its shares start trading.

Mr. Palihapitiya takes advantage of these loopholes. He talks his deals up on Twitter, which his lawyers then submit to the Securities and Exchange Commission to comply with stock-solicitation rules. Mr. Palihapitiya arranged with CNBC extended airtime on the days his deals were announced and went through slides from his investor presentation, according to people familiar with the matter. CNBC declined to comment. YouTube and Amazon's (AMZN) Twitch have also approached him about moving his deal announcements to their live-video streaming services, some of the people said.

4) If Palihapitiya is the king of hype and speculation, ARK Invest's Cathie Wood is the queen. The recent pullback in the most richly valued tech stocks is hitting both of them hard, as it looks like Palihapitiya got a margin call last week.

Here's Andrew Ross Sorkin in yesterday's New York Times: Questions about a SPAC mogul's stock sales. Excerpt:

One of the most prominent names in SPACs, Chamath Palihapitiya, faced backlash last week after regulatory filings showed that he had sold his entire personal stake in Virgin Galactic, which he took public through a blank-check fund. (He will stay on as chairman, and will indirectly remain a shareholder through an investment firm that owns a stake in the company.) The news – coming as shares of many SPACs, as well as Virgin Galactic's, tumbled amid a broader market decline – added to concerns about a blank-check bubble.

Mr. Palihapitiya insists that he's still right. After describing what he called a "super tough week," he tweeted: "I re-questioned my goals and concluded my strategic view is still right." He added that he had sold his Virgin Galactic shares to free up capital to keep investing in companies that address inequality and climate change, themes he said were "a once in a lifetime opportunity." (He previously told Reuters that he would put the proceeds from the stock sale toward a "large investment" focused on fighting climate change, the details of which "will be made public in the next few months.")

But the move still raises concerns. Among them: How committed – financially and otherwise – are Mr. Palihapitiya and other SPAC sponsors to the companies they buy with their blank-check funds? And do other investors sufficiently understand the risks associated with these still unproven companies?

5) For more on what's happening in the tech sector, here's an interesting analysis by Eric Rosen of The Rosen Report:

Valuation Today-10x Sales

I have had countless calls, texts, and emails regarding the recent "carnage." Let's put this recent volatility into perspective for the hardest hit index, the Nasdaq. In 2020, the Nasdaq was +44.1% and +36.3% in 2019. How much is it down YTD in 2021? 2.2%. After being up 96%+ cumulatively in two years, it is -2% in 2021 and is -10.5% from the record close on February 12.

Selloffs are healthy. To me, valuations have become crazy in some respects.

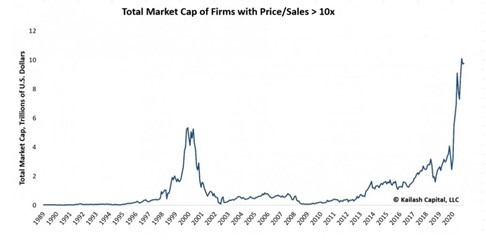

An avid reader sent me an article with this chart included from Kailish Concepts. It shows that the market capitalization of companies trading at greater than 10x price-to-sales now exceeds $10 trillion. Yet people are freaked with a little volatility?

The article had this quote from Scott McNealy, former CEO of Sun Microsystems, which traded at 10x revenue at one point only to drop 95%:

At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don't need any transparency. You don't need any footnotes. What were you thinking?

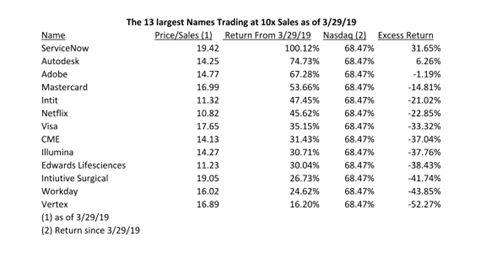

One study I read from a couple years ago (Buying Stocks Trading Above 10x Sales – A Good Idea?) looked at the largest companies (by market cap) trading at 10x or more price/sales. My research department (me), spent time running the data on performance since the study outlining the largest companies selling at 10x+ price/sales.

There were 14 companies in total, but one, Red Hat, was acquired by IBM (IBM) in 2019, so I took it off the list. My chart below is in order of excess return over the Nasdaq which was up +68.47% since 3/29/19. Had I used the S&P, more companies would have outperformed as the S&P was +36.46% during the period. Using the Nasdaq, only two companies beat it and using the S&P, six of the 13 outperformed. Using the Nasdaq as a benchmark, the 13 stocks in total under performed by 306.37% for an average underperformance of 23.57%.

Interestingly, the two top performers, ServiceNow (NOW) and Autodesk (ADSK) were among the smallest companies on the list as of 3/29/19 from a market cap perspective. It suggests you can pay up, but when you are paying such a huge multiple, it is hard to beat the market. Obviously, a larger data set would tell us a lot more, but I only have so much bandwidth.

Thank you, Eric!

Best regards,

Whitney