Nvidia vs. the World

Editor's note: Nvidia – the darling of the AI revolution – has been competing for the title of world's most valuable company. But can it sustain its high growth of recent years? Today, we're turning to our colleague Joel Litman, founder of our corporate affiliate Altimetry. In this essay, recently published in the free Altimetry Daily Authority e-letter, Joel explains Nvidia's recent ballooning valuation... and explains why it might be short-lived.

Nvidia (NVDA) has been the stock market star of the past two years...

It even surpassed Apple (AAPL) to become the world's most valuable company in early November. The two have been battling for the top spot ever since.

At this point, it's almost impossible to compare Nvidia with other companies. Some have even joked that it would be better to compare its dominance with entire stock markets... and that's not entirely unfounded.

The chip giant's market cap exceeded the combined total of Italy, Spain, and Portugal in May 2023. By January 2024, it had surpassed the market sizes of Australia, Germany, and the Nordic countries.

It didn't end there. During the first half of last year, Nvidia grew bigger than the markets of France, Canada, and Switzerland.

And by June 2024, it had even overtaken the United Kingdom... one of the largest developed markets in the world.

German equity strategist Jonathan Stubbs joked that Nvidia might as well buy Germany.

The comparison is astounding. And Nvidia is undeniably one of the most prominent companies in the world today.

However, its valuation also points to a potential imbalance.

Either Nvidia's valuation is excessively high... or its popularity is causing folks to underestimate major markets.

One of the best ways to gauge valuation is by looking at earnings...

We can compare Nvidia's earnings with those of entire stock markets to see where they stand.

As the world's third-largest economy, Germany is a worthy opponent to the world's most (or second-most) valuable company.

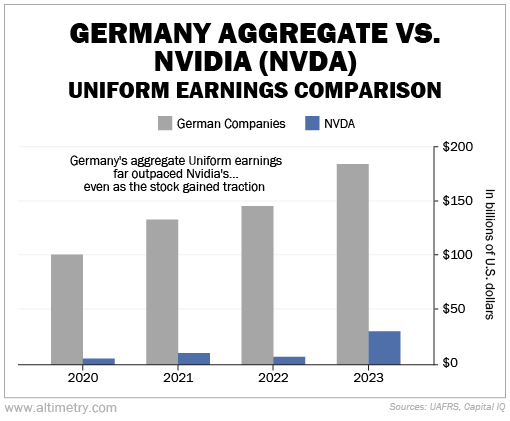

At Altimetry, we analyze earnings with Uniform Accounting to avoid the distortions of traditional accounting methods. And we can compare the aggregate Uniform earnings for all German-listed companies against Nvidia's Uniform earnings to get a better idea of where these giants stand.

First, Germany's Uniform earnings have been far above Nvidia's for most of its history. Aggregate German earnings came in at more than $100 billion in 2020, more than 17 times Nvidia's numbers.

They were slightly below $150 billion in 2022, more than 19 times what Nvidia recorded. And German earnings have been increasing at a healthy annual growth rate of 21% since 2020.

By the end of 2023, both Germany and Nvidia minted record earnings – about $184 billion for the nation and $31 billion for the chipmaker...

However, the chip giant's market cap surpassed Germany's in January 2024.

Let that sink in... German companies as a group earn about 6 times more than Nvidia. And yet, investors think Nvidia should be worth more.

Despite Nvidia's sky-high valuation, investors aren't betting on a slowdown...

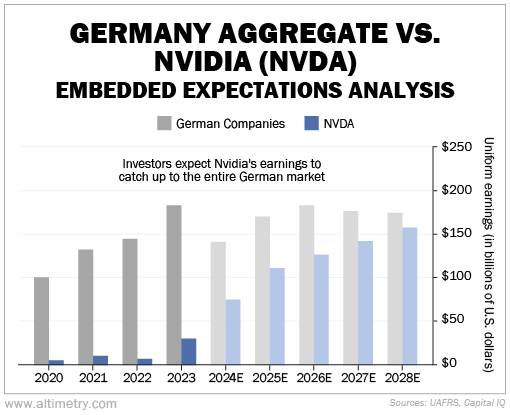

We can see this through Altimetry's Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, this tells us how well a company (or a country) has to perform in the future to be worth what the market is paying for it today.

Right now, investors expect Germany's economy to stabilize around $175 billion in Uniform earnings per year. Yet they expect Nvidia to keep growing... and growing... and growing.

Specifically, investors think Nvidia's Uniform earnings will reach $158 billion by 2028... almost matching the entire German market. Take a look...

To satisfy investor expectations, Nvidia will need to earn as much as the entire German economy – the third-largest economy in the world – by 2028.

There's no doubt that a mature economy will grow more slowly than the center of the AI universe... but expecting this chipmaker to outperform that much is a bit extreme.

Investors often forget that growth eventually slows down...

And that's how you end up with extremely overvalued stocks.

Nvidia is likely the most important stock on the planet today. However, think for a second what it would mean for one company to earn as much as the third-largest economy.

That would be an unprecedented level of dominance in the modern world.

Folks, as great of a company as Nvidia is, there's a clear mismatch in its valuation today. It has had a strong uncontested run in the chip industry.

But investors shouldn't assume it can keep this up for another five years. Growing earnings by 6 times like it's nothing is a high hurdle to cross... even for one of the biggest companies on the planet.

Regards,

Joel Litman

Editor's note: The early days of 2025 could have the power to make – or destroy – your retirement... And what you do with your money before January 20 could determine your wealth for the next decade.

So today, Joel is pulling back the curtain on the "secret sauce" of Wall Street – a remarkable discovery that could usher in a powerful wave of potential wealth. He's also sharing the perfect stock to own for 2025... and the stocks you must sell before January 20. You still have time to catch Joel's urgent message... Click here for all the details.

Further Reading

Investor expectations for giants like Nvidia are sky-high... and unsustainable. A portfolio too heavily invested in market heavyweights is at risk of devastating losses. But you can make one move today to minimize your risk... Learn more here.

"While most everyday investors are jumping headfirst into overpriced stocks, the 'smart money' is waving a warning flag," Porter Stansberry writes. The stock market is near all-time highs, and most investors are greedy. But it's only a matter of time before greed shifts to fear... Read more here.