Policing American Tech Giants; Stock Idea of the Day: Criteo (CRTO); More from Scott Galloway

1) News broke over the weekend related to the U.S. government taking a harder look at the tech giants, Amazon (AMZN), Facebook (FB), Alphabet (GOOGL), and Apple (AAPL). I continue to recommend the stocks of the first three, favoring Alphabet over Apple for reasons I outlined in my May 1 e-mail.

But all shareholders need to carefully follow these investigations (and similar ones happening all over the world) and consider their implications. For now, I believe they are unlikely to derail the dominance of these companies, but I'm open to changing my mind if the facts change.

Personally, I think they should all be broken up, which would be good for society – and for shareholders. But barring a President Elizabeth Warren, this is extremely unlikely to happen...

Here are two front-page articles from today's Wall Street Journal and New York Times:

- The Big Challenge for Policy Makers: Policing American Tech Giants. Excerpt:

They all have dominant market shares in their sectors – from search to social media, e-commerce, online advertising and smartphone apps – and are protected by practices and conditions that make it hard for new rivals to challenge them.

And yet they don't fit neatly into the old formulas that signal harm from such power: higher prices and less choice for consumers. On the contrary, these companies offer many of their core products to customers for no charge. And they have vastly expanded the ability of consumers to search, compare and buy a newly broad range of products from all over the world with a quick click, search, or download.

- Google and Amazon Are at the Center of a Storm Brewing Over Big Tech. Excerpt:

The regulators' moves are small and preliminary, and could easily come to nothing. But if the agencies pursue cases, Google and Amazon will almost certainly face reams of bad publicity, rising consumer distrust and falling employee morale. An inquiry would remind everyone that Google, with its early motto of "Don't be evil," held itself to standards it sometimes could not match.

"This is more of a warning to the companies that they're being carefully scrutinized and they need to be careful not to play fast and loose given their dominant positions in the digital marketplace," said Gene Kimmelman, a former senior antitrust official at the Justice Department who is now president of the consumer group Public Knowledge.

2) Today's Stock Idea of the Day is ad firm Criteo (CRTO), which is around $18 a share and is trading near its all-time low in the five-and-a-half years it's been public. It was recently written up on Value Investor's Club. (For those of you who are members, click here; for those who aren't, here are links to the 2016 long and 2017 short posts.)

For the many readers who are new to this list, my Stock Idea of the Day is not a recommendation – just something I've found that I think is interesting enough to be worth further investigation...

Here's my analyst, Steve Culbertson, on CRTO:

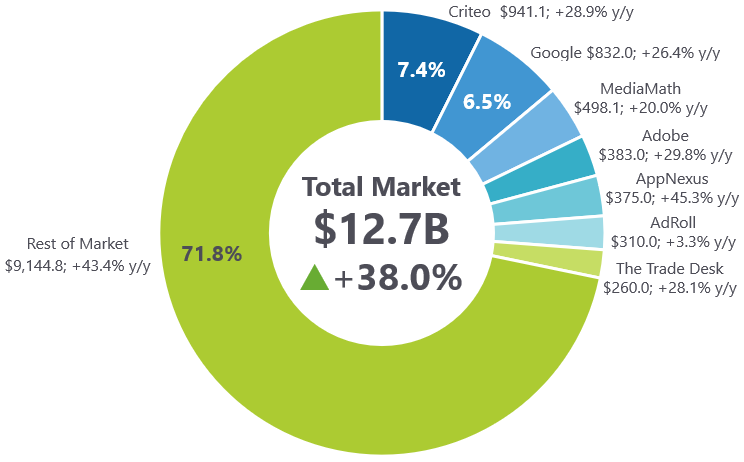

If you're anything like me, when you hear "online ads," you immediately think of tech behemoths Google, Facebook, and Amazon. So I was surprised to learn that this obscure company was a major player in this industry.

Criteo launched in France in 2005 and has grown into a global company with 2,700 employees in 31 offices serving nearly 20,000 clients. The company analyzes more than $800 billion of online sales transactions and serves more than 1 trillion online ads annually.

Criteo's business is in retargeting ads. Let me explain what that means...

Every day, millions of people browse many e-commerce sites. Some know exactly what they want and complete their purchases, while others don't and are essentially "window shopping."

Yet another group is undecided. They know what they're looking for but haven't committed. These shoppers might have several shopping carts with the same or similar products for later consideration. You can imagine how online retailers want them to follow through with a purchase. Criteo helps them by retargeting personalized ads toward these high-intent shoppers.

The company's software is embedded in thousands of retailers' websites. Each time someone visits a site, Criteo gathers small pieces of information and weaves them into an online profile that it can then use to target ads.

It's important to note that Criteo doesn't gather sensitive information, such as names or home addresses. Instead, it relies on analyzing data from more than 1.5 billion users to learn when and where to show the most appropriate ads.

Criteo boasts a 90% customer retention rate, which it claims is a result of its system beating the competition 90% of the time in head-to-head tests. Supporting this claim is that 73% of the company's revenues come from uncapped budgets. In other words, its customers entrust Criteo to deploy ad dollars on their behalf – a sure sign of how valuable its service is.

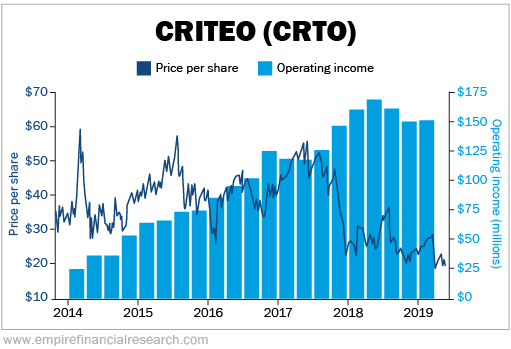

The stock went public in October 2013 and, as you can see in this chart, it's now close to an all-time low despite trailing 12-month operating income rising sixfold:

What explains the stock's weakness? It started in June 2017, when Apple rolled out its Intelligent Tracking Prevention ("ITP") policy. This effectively made it impossible for Criteo and other ad tech companies to track Safari users across different websites.

The stock took another dive in March after this Adweek article, Google Mulls Third-Party Ad-Targeting Restrictions, which speculated that Google would implement its own ITP into its market-leading Chrome browser.

The author of the VIC write-up argues that Google will not deploy ITP on its browser because it would be hurting its own ad business in the process. What's more, he thinks the company can return to a moderate rate of growth.

If he's right, there could be substantial upside, as the stock is trading at low trailing multiples of 0.5 times EV/revenue, 4.6 times EV/EBITDA, and 14 times P/E.

3) Following up on last Thursday's e-mail about Scott Galloway... If you don't have time to read his new book that I enjoyed so much, The Algebra of Happiness: Notes on the Pursuit of Success, Love, and Meaning, here are two interviews he did recently on YouTube and a podcast (I recommend listening to both at double speed).

Best regards,

Whitney