Retail Buys the Dip

It seemed like the world was on fire...

From mid-February to early April, President Donald Trump's trade war caused a panic in the investing community. Suddenly, everyone started talking about a recession. As a result, the S&P 500 Index fell 18.9%, almost entering bear market territory.

But I (Jeff Havenstein) hope you stayed calm and heeded my advice over the past few months...

On March 12, I made the case that investors were too bearish. When we had seen this extreme level of bearishness in the past, it had been a great time to buy. So I told everyone to take a deep breath and remember that corrections are just a normal part of the market cycle.

Of course, things got worse from there... Markets plunged after "Liberation Day."

But it wasn't all bad news. On April 9, I showed you that markets have historically rebounded after a two-day double-digit drop... One year after a drop, stocks rise 27% on average. Two years after a drop, stocks are up 40% on average. So I reminded investors not to panic, since things were likely to improve.

And I was right. Not long after, stocks started to rally on hopes of the trade war being shorter and less brutal than expected...

On May 7, I wrote about the historic nine-day winning streak the S&P 500 had just seen. But even though stocks were recovering, investors were still very nervous, and bearish sentiment was hitting extreme levels. I once again pointed out that it was a great time to buy stocks.

Fast-forward to today, and the S&P 500 is just 3% off its all-time high.

I hope you bought the dip when you had the chance.

You always want to look for extreme situations in the market so you can take the opposite side of the bet. That's how you make money.

As we've proved, investor sentiment is a useful indicator for spotting extremes and making investment decisions. But it's also helpful to look at where the money is actually flowing...

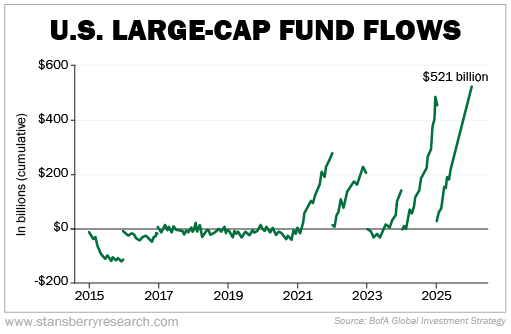

While the talking heads in the media spent the past few months calling for doomsday, money kept flowing into U.S. equities. The chart below shows the fund flows for U.S. large-cap stocks. As you can see, they're on track for a record high of $521 billion this year – with no sign of panic or slowdown in recent months in the fund flows...

Even in the face of bad news, fund flows have held strong. Just this Monday, stocks fell 1% during morning trading in response to Moody's Ratings downgrading the U.S.'s credit. Specifically, Moody's cut our sovereign credit rating from "Aaa" to "Aa1."

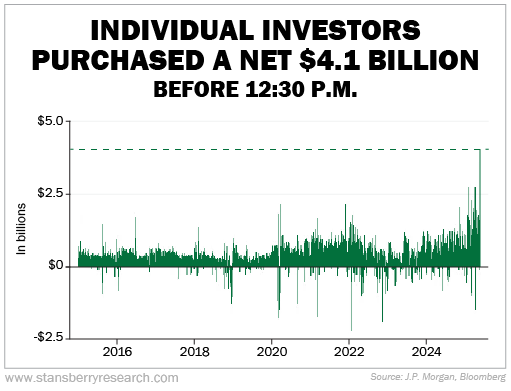

Individual investors weren't fazed by the news, though. Instead, they backed up the truck to buy U.S. stocks.

From a recent Bloomberg article...

Individual investors purchased a net $4.1 billion in U.S. stocks through 12:30 p.m. in New York, the largest level ever for that time of day – and broke the $4 billion threshold by noon for the first time ever, according to data compiled by JPMorgan Chase & Co. quantitative and derivative strategist Emma Wu.

The S&P 500 fell almost 1.1% in early minutes of Monday's session, but by the afternoon the benchmark had flipped into the green, before trading roughly flat as of 2:50 p.m. in New York. The retail crowd accounted for 36% of trading volume, surpassing late April to reach the highest level in history.

Here's the chart the article showed...

Clearly, despite what everyone says and all the fears surrounding a recession, money continues to move into U.S. stocks.

It's just another reason to stay optimistic about the markets.

We could very well see the S&P 500 hit a new all-time high soon – even if there are pockets of volatility along the way.

One particular area of the market that's primed to surge from here is artificial-intelligence ("AI") companies.

It all has to do with a new breakthrough "super chip" that's 50 times faster than Nvidia's chips. This innovation could upset the market's status quo, reshape the American economy, and impact your wealth for decades.

If you missed it, Stansberry's Investment Advisory lead editor Whitney Tilson and his friend Jeff Brown, founder of our corporate affiliate Brownstone Research, just discussed how you can profit from this unique opportunity. Get all the details here.

What We're Reading...

- Something different: China launches the first of 2,800 satellites for an AI space-computing constellation.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein

May 21, 2025