Sam Bankman-Fried's trial is underway; Michael Lewis' book on him; SmileDirectClub files for bankruptcy; Three customer service experiences

1) At long last, disgraced crypto tycoon Sam Bankman-Fried ("SBF") is going to get his day in court, as jury selection in Manhattan began on Tuesday: Crypto Goes on Trial, as Sam Bankman-Fried Faces His Reckoning. Excerpt:

A year ago, Sam Bankman-Fried was a fixture on magazine covers and in the halls of Congress, a tousle-haired crypto billionaire who hobnobbed with movie stars and bankrolled political campaigns.

On Tuesday, the founder of the failed FTX digital currency exchange is set to leave the jail where he has been confined for more than seven weeks and stand trial in a Manhattan courtroom on federal charges of fraud and money laundering, capping one of the largest and swiftest corporate collapses in decades.

The charges against Mr. Bankman-Fried, 31, have put the rest of the crypto industry on trial with him. He has emerged as a symbol of the unrestrained hubris and shady deal-making that turned cryptocurrencies into a multitrillion-dollar industry during the pandemic. The demise of FTX in November helped burst that bubble, sending other high-profile companies into bankruptcy and provoking a government crackdown.

The trial will offer a window into the Wild West-style financial engineering that fueled crypto's growth and lured millions of inexperienced investors, many of whom lost their savings when the market crashed. Lawyers on both sides of the case are expected to lay bare the culture of scams and risk-taking that surrounded FTX and to dissect the often-misleading publicity campaigns that helped drive years of crypto hype.

On the same day, Michael Lewis released his much-anticipated biography of SBF, Going Infinite: The Rise and Fall of a New Tycoon, which I have just started listen to. Here's a New York Times article about it: Takeaways From a New Book on Sam Bankman-Fried. Excerpt:

Mr. Lewis does not offer a "yes" or "no" answer. He depicts Mr. Bankman-Fried as delusional and often callous in his treatment of co-workers, a young entrepreneur who "thought grown-ups were pointless" and left messes for other people to clean up.

But Mr. Lewis also expresses skepticism about the lawyers and executives who were brought in to manage FTX's bankruptcy and have become some of Mr. Bankman-Fried's fiercest public critics. Toward the end of the book, Mr. Lewis writes that Mr. Bankman-Fried's explanations for the collapse of FTX, as implausible as they sound, have "remained irritatingly difficult to disprove."

Here's a 26-minute interview 60 Minutes did with Lewis, Rise, fall of Sam Bankman-Fried, FTX at center of Michael Lewis' new book, which 60 Minutes summarized here: Sam Bankman-Fried "thinks he's innocent," author Michael Lewis says ahead of book about FTX founder. Excerpt:

"It unravels because the depositors at FTX want their money back and it's not all there," Lewis explained.

In large part, the money wasn't there because investors' funds intended for FTX wound up in Bankman-Fried's Alameda Research to the tune of more than $8 billion.

Bankman-Fried lost virtually everything over a matter of days last November.

Lewis told 60 Minutes he does not believe Bankman-Fried knowingly stole customers' money, and explained that in the early days of FTX, the company couldn't get a bank account, so customer funds were sent to Alameda Research, which could get a bank account. Those funds were never transferred over to FTX.

Lewis asked Bankman-Fried how he could not know that $8 billion of investors' money was in Alameda Research instead of on FTX. Lewis told 60 Minutes that Bankman-Fried said: "''You have to understand that when it went in there, it was a rounding error. That it felt like we had infinity dollars in there and that I wasn't even thinking about it.'"

I keep thinking to myself, "Man, this is one weird dude"...

He reminds me a bit of Elon Musk, in that he's socially awkward (clearly somewhere on the spectrum), works crazy hours, behaves erratically (due to drugs and/or sleep deprivation?), is addicted to video games, lies like a central banker on the eve of a devaluation, has grandiose visions of saving humanity, and is totally full of himself.

On the plus side, SBF doesn't appear to have Musk's "demon mode" mean streak. But he also doesn't have Musk's genius in actually creating amazing companies like Tesla (TSLA) and SpaceX.

The two businesses SBF built, FTX and Alameda Research, were nothing but total scams and houses of cards that collapsed the moment the crypto craze encountered even mild turbulence, which is why I say humanity owes Musk a debt of gratitude, whereas SBF deserves nothing but jeers – and a jail cell.

I think SBF knowingly committed massive fraud, stealing $8 billion from FTX depositors so he could live large and speculate in his Alameda hedge fund. When (not if) a jury convicts him of this, he will be sentenced to at least 20 years in prison.

As for his defense, it's a joke – I'm shocked that Lewis appears to have fallen for it, at least partially. Here's a post on X rebutting it:

2) This is another notch in the belt of activist short seller Nate Anderson of Hindenburg Research:

3) I recently had three experiences with good and bad customer service...

Regarding the former, a zipper recently fell off my favorite travel wheeled backpack, made by a company called Matein:

I went to the customer service page of Matein's website, described what happened, and they quickly sent me a replacement. It was an "A+" experience.

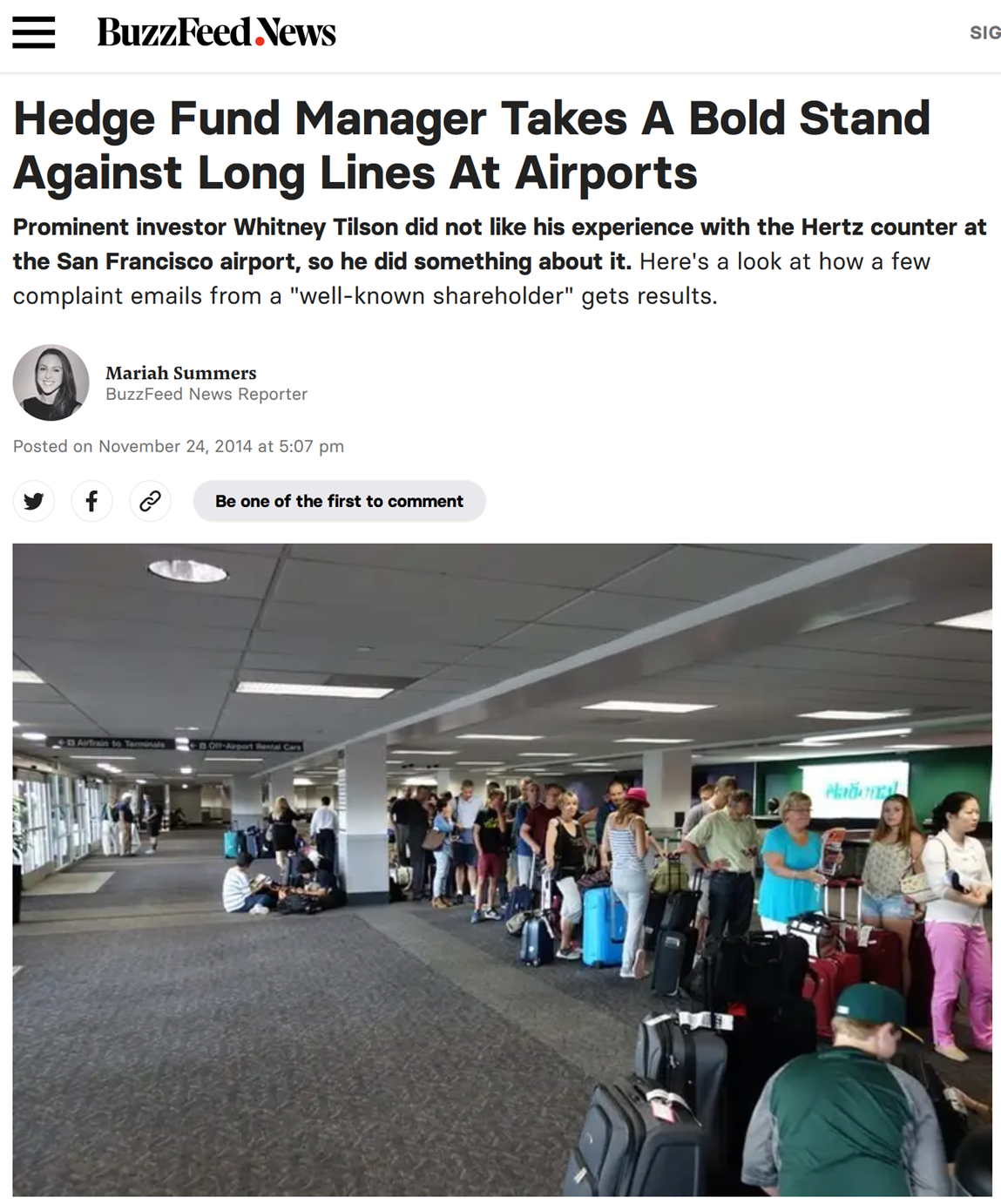

At the other end of the spectrum, when I showed up at the Avis counter at the San Francisco airport to pick up my rental car on Friday at 11 a.m., there was a huge, hour-long line, with a poor woman explaining to the infuriated customers that some employees hadn't shown up for work, so they were understaffed. Here's what it looked like (the line at Budget, which is owned by Avis, was just as long... meanwhile there was no line at all at the neighboring Hertz counter):

After I returned the car on Monday, I got a standard mass e-mail asking about my experience, so I filled it out. To Avis's credit, I got a personal e-mail back yesterday, but after wasting an hour of my time, I feel like I should have gotten, say, a $50 credit on a future rental, not just an apology:

Dear Whitney,

Thank you for letting us know about the delay you experienced at our Avis location at SAN FRANCISCO AIRPORT. We know that waiting for a rental vehicle is frustrating, and I sincerely apologize for any inconvenience or distress this may have caused.

Please give us another chance to exceed your expectations with Avis soon. We are determined to earn your trust. Thank you again for responding to our survey so that we can improve our service.

Sincerely,

Kristopher Motor

Avis, Operations Manager

My experience gave me such a feeling of déjà vu, as I had an almost identical experience nine years ago at Hertz and, when I wrote about it, it contributed to the CEO getting fired shortly thereafter! Here's a Buzzfeed News article about it at the time:

I wonder if my write-up of this experience will cost the current CEO of Avis Budget (CAR), Joe Ferraro, his job? Not likely!

Lastly, I've had a weird experience with Shokz, which makes my favorite headphones I use when running:

I paid $130 for a new pair in April. When the speaker in one ear stopped working in mid-August, I e-mailed customer service at hello@shokz.com and quickly got a reply telling me to mail in my broken unit and the company would immediately send out a replacement.

This would have been an "A+" experience... except six weeks later, they still haven't sent the replacement and haven't responded to a half-dozen follow-up e-mails I've sent. Jeers to Shokz for ghosting me!

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.