The Aftermath of a Historic Market Run

The historic winning streak is officially over...

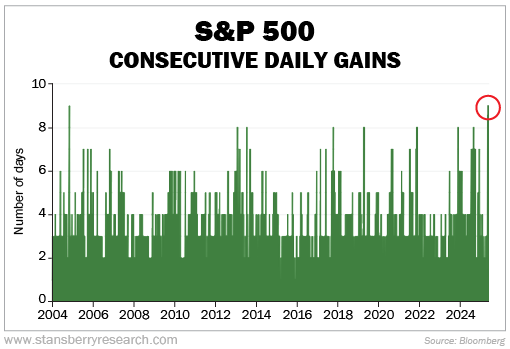

On Monday, the S&P 500 Index fell 0.6%, ending a nine-day winning streak. This was the longest streak in more than two decades. Take a look...

So what happened after such an impressive and historic run for the market?

Folks became even more bearish.

Bank of America's Bull & Bear Indicator measures investor sentiment and positioning on a scale from 0 to 10. Readings below 2 are considered a bearish extreme. Readings above 8 are considered a bullish extreme.

While we're not at any extreme yet, the indicator just fell from 3.9 to 3.6... after the market went up for nine straight days.

Folks, this is what I (Jeff Havenstein) have been talking about lately. Investors are too scared at the moment.

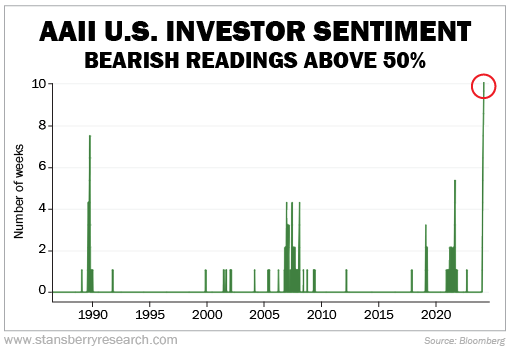

While the Bank of America indicator is getting closer to extreme bearish territory, the American Association of Individual Investors' ("AAII") Investor Sentiment Survey is already there.

I've written about this indicator before. AAII members answer the same simple question each week: "Do you feel the direction of the stock market over the next six months will be up (bullish), no change (neutral), or down (bearish)?"

Historically, 31% of investors have answered that they are bearish. Today, that level is nearly double – with 59.3% of investors feeling bearish.

According to this survey, we're at an extreme...

Bearish readings have been above 50% for 10 weeks in a row. As you can see, this is an all-time high...

In other words, there's a more sustained level of bearishness today than during even the dot-com bust of the early 2000s or the great financial crisis. That's madness.

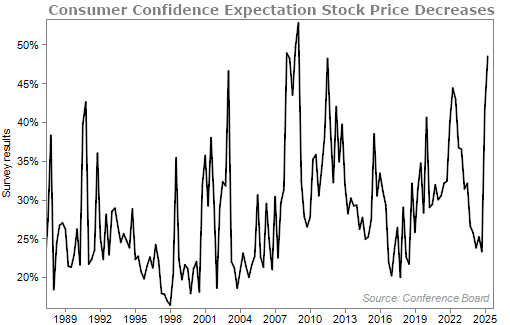

The Conference Board also has an indicator to gauge what folks expect the market to do. Its Consumer Confidence Expectation Stock Price Decrease survey takes a random sample of approximately 3,000 households. As the name suggests, the Conference Board asks if stocks will go up or down over the next 12 months.

According to the most recent results, 48.5% of participants expect stock prices to decline over the next 12 months. This is close to the highest level in a few decades...

The survey hit an all-time high of 52.8% on March 31, 2009.

Interestingly, the market bottomed not long before that – on March 9, 2009.

While everyone was still terrified at the end of March, stocks went on to soar 46% over the next 12 months.

The point here is that you want to buy when folks are scared and pessimistic. That holds true today.

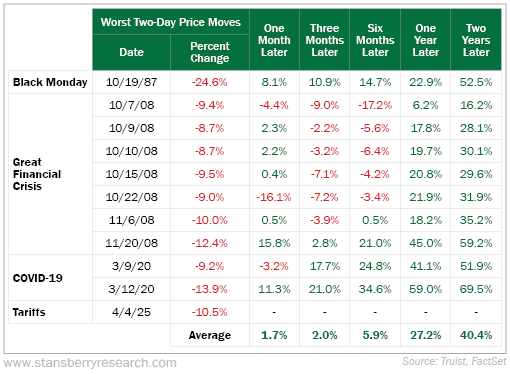

I also want to reiterate something I said four weeks ago after the market dropped 10.5% in two days... While you should expect some short-term volatility from such a sudden drawdown, stocks are usually much higher six months and one year later.

Here's the table again...

Things are scary today. I'm not going to act like everything is rainbows and sunshine... I don't know how the tariff situation will play out. I also don't know if we'll see a second consecutive quarter of negative gross domestic product growth, thereby signaling a recession.

What I do know is that now is the time to look for extremes in the market. When things seem the most bleak, that's when you want to buy.

No one understands this concept better than 50-year Wall Street veteran Marc Chaikin, founder of our corporate affiliate Chaikin Analytics. He's great at predicting and exploiting market turbulence.

Just earlier this year, Marc warned about a crash... And then 13 days later, the market crashed. Using a short-term, rapid-fire strategy during the chaos, he booked his subscribers a quick 52% gain.

Now, he's sounding the alarm for the second time this year.

Marc believes a huge market reset could be headed our way on May 9. And he's prepared to once again take advantage of the fallout and make his subscribers money. With his help, you could double your portfolio over the next 12 months – all while avoiding major losses.

Click here to prepare yourself before the reset hits.

What We're Reading...

- In case you missed it: Here's what comes after the bloodbath.

- Something different: Gold's golden moment dazzles better-value rivals.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein

May 7, 2025