The best testimonial ever; Indexes at or near 52-week highs; My 'lethargy bordering on sloth'; He has flown 23 million miles. Here are his travel secrets

1) I get many nice e-mails from my readers, thanking me for giving them good investment (or life or parenting or travel) advice, but this is a first...

Wayne recently sent me a chart showing the balance in his Fidelity account, labeling the key points, starting with "Wayne scrambles together enough money to buy Whitney's Junior Partnership," and ending with "TODAY: Roth is up 120% seven months after taking Whitney seriously."

Thank you, Wayne (whom I had the pleasure of meeting at one of my Ukraine events)!

Joining the Empire Junior Partnership grants you all the research Empire Financial Research publishes for 30 days... plus our "Essential Research" for LIFE. After 30 days, you get to choose your favorite premium service and keep it forever, too.

And you're never locked into that choice – you can switch your premium service to another one for a small fee, anytime you want.

I had to twist some arms to get the Empire Junior Partnership approved... but it's an incredible deal for getting access to all of our research. You can learn more about it right here.

2) Both the S&P 500 Index and Nasdaq Composite Index hit 52-week highs yesterday and the Dow Jones Industrial Average came within 1.4%...

So investors who have heeded my advice to ignore the ever-present gloom-and-doomers and stay long – especially ones who, like Wayne, loaded up on Meta Platforms (META) and other big-cap tech stocks when I pounded the table on them near their lows last November – have been well rewarded.

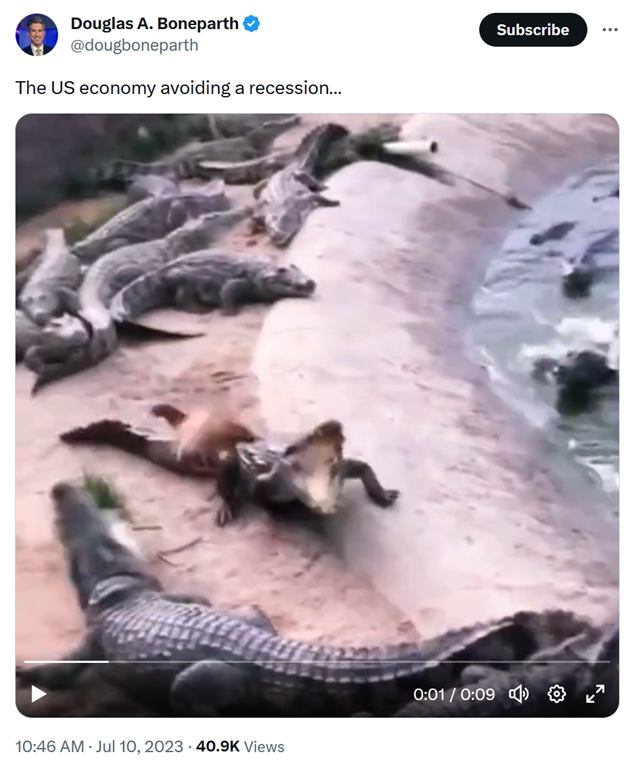

Speaking of which, this nine-second GIF is pretty funny – and accurate!

3) Wayne is a more active and aggressive investor than I am, which is fine. As my colleague Enrique Abeyta says, you should either trade a lot or almost not at all.

Enrique is a trader, and he's very good at it – you can learn more about his excellent newsletter, Empire Elite Trader, right here – whereas I'm the opposite.

I long ago took to heart what Warren Buffett wrote in his 1990 letter to shareholders:

Lethargy bordering on sloth remains the cornerstone of our investment style: This year we neither bought nor sold a share of five of our six major holdings.

In part, I've always implemented a low-turnover, long-term-oriented strategy... but ever since I started Empire more than four years ago, my trading has declined even further because my hands are tied: to prevent conflicts of interest, no-one here is allowed to own any stocks that they write about, so that our subscribers always get our best ideas first.

My "lethargy bordering on sloth" is so extreme that when I recently opened up the spreadsheet I use to track my personal investments, I saw that the last time I made a trade of any sort – buy or sell – was last October 28, nearly nine months ago when I doubled my position in the First Trust Dow Jones Internet Index Fund (FDN), which was the best proxy I could find for the big-cap tech stocks I was regularly pounding the table on to my readers (that position is up 33% since then versus 16% for the S&P 500).

At the time, my portfolio (excluding the one piece of real estate I own, my apartment in Manhattan) was 20% cash and 80% equities: roughly half in the S&P 500 (via SPY), a handful of stocks that weren't good fits for any of our newsletters, and four venture capital investments in private companies run by people I know (one of which, by far my largest, looks to be a home run... two haven't done much... and one is a wipeout).

Today, the percentages are roughly the same – and I'm not inclined to change anything. As Charlie Munger once said, "Investing is where you find a few great companies and then sit on your ass."

Longtime readers who follow my various travel and athletic never-a-dull-moment adventures may laugh at this because my personality is pretty much the exact opposite of "sit on your ass," but I try my best to channel my "Energizer Bunny" nature in other areas, not investing!

I couldn't be happier with my strategy: it consumes no time, inflicts no brain damage, and I'll bet that my portfolio has done significantly better than most other investors...

4) Boy, I thought I traveled a lot! He has flown 23 million miles. Here are his travel secrets. Excerpt:

So what advice does the Very Frequent Flier have for you this summer?

- Lie to the first flight attendant you meet inside the door when you board. "She's the head attendant. I always say, 'I remember you! You gave us such great service last time. I wanted to thank you again.' Even if I've never met her. I guarantee she'll bring you all kinds of free stuff."

- If you couldn't book the seat you wanted, keep your phone open on the seat map app as you board. If a blocked seat that you wanted opens up, just take it. "They won't care," he says. "They never sold it."

- Never check a bag. Never, ever, never. And under-pack. "Every town has laundromats. And stores."

- Don't be a jerk and use your cell without headphones. That way, people won't hate you. "Whenever somebody takes a long business call on speaker, I always say, 'Hey, next time you're going to have all of us to your business meeting, bring doughnuts.'"

Here are some other tips I would add:

- Not only should you never check a bag, pack light enough that everything can fit into a roller bag like this one I use that can fit under the seat on an airplane (so discount airlines won't charge you for a bag that has to go in the overhead compartment) and has shoulder straps (so you can rent a bicycle or scooter to get around, as I did in Stockholm on Sunday, which I described in yesterday's e-mail).

- Since I almost never check a bag and rarely even have a standard carry-on, I usually book the cheapest Basic Economy ticket. The airlines then try to charge me for an assigned seat, but I usually decline. This means I run the risk of getting stuck in a dreaded middle seat, but I have many tricks to avoid this...

In addition to the Very Frequent Flier's idea of "keeping your phone open on the seat map app as you board" (which I've never tried), I ask the gate agent at the last minute if they can give me a better seat (being very polite and nice helps). Lastly, I try to be the last person to board the plane – that way I can take the best open seat and not worry about getting displaced.

I did this on Sunday for the eight-hour flight home from Stockholm. Though the flight was 95% full, I scored an aisle seat with an empty middle seat next to me (the seat I was assigned to), so I was able to open my laptop, put my mousepad on the tray table next to me, and got a ton of work done.

- If I'm traveling with one other person (usually my wife) and we're not charged for picking seats, we select a window (her preference) and an aisle (mine) with an empty middle seat between us.

More than half the time, the seat remains empty, giving us more room – and, if not, whoever is in the middle seat is always happy to switch to a better window seat so Susan and I can sit together. Hint: selecting a row far back in the plane, which is less desirable, increases your odds of an empty middle seat.

- If you need to book a one-way flight, always check to see if a round-trip is cheaper, even if you won't use the return leg.

This saved me a bundle flying home on Sunday... The one-way prices from Stockholm to New York City were hideous: $920 on two ultra-low-cost carriers with a stop in Berlin or $1,159 for a nonstop on United. But to my delight, when I searched for a roundtrip, the same nonstop flight on United dropped by more than half to only $555!

(To be clear, this is different from "skiplagging," in which, say, you want to go to St. Louis, but it's cheaper to take a flight from New York City to St. Louis to Dallas, so you book that, and just get off in St. Louis. There are a lot of pitfalls of this strategy, outlined in this recent Washington Post article: What is skiplagging? All about the travel hack airlines hate.)

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.