The Empire Financial Partnership offer expires tomorrow at midnight; HBS webinar; Food Waste of the Pandemic; Strained food supply chains; BYD Opens World's Largest Face Mask Manufacturing Plant; Where is Buffett putting money to work?

1) We're expanding rapidly here at Empire Financial Research...

Berna Barshay has just joined us as the third primary writer (along with me and Enrique Abeyta), we're hiring a fifth analyst shortly, and we're launching multiple new products in the future.

In addition to Empire Investment Report (which I write), Empire Stock Investor (which me and Enrique co-author), and Enrique's weekly Empire Elite Trader, Enrique is launching his new Empire Elite Growth service next week. Each month, he'll share ideas that he thinks have five- to 10-bagger potential over the next three to five years. Then, we'll be launching one or more products with Berna as well.

The best way to access all of our current and future research, for life, is to become an Empire Financial partner. Rather than paying annual subscription charges, simply pay $6,000 once (plus a $399 annual maintenance fee), and that's it. The membership pays for itself in less than two years.

It's like buying an incredible growth stock in its early years: you pay a low up-front price, and then you sit back and benefit for years to come.

It's the best deal we've ever offered. Yes, the price was lower ($5,000) when we launched a year ago... But at the time, we only had a team of two (Senior Analyst Steve Culbertson and me) and one publication. Now, both our team and the number of publications has quadrupled in size – and we're not finished growing by a long shot.

The price for the Empire Financial Partnership goes up by 25% to $7,500 tomorrow at midnight, so please don't wait – you can sign up now by clicking here.

2) Here's Berna's report from a webinar she joined on Tuesday:

I listened in on a webinar for Harvard Business School alumni called "Financial Markets and the Fed in the COVID-19 Pandemic." The professors moderated a panel of several prominent money managers and academics, who debated many interesting points.

But one point that really jumped out at me was offered by Sir Paul Tucker, an economist and market risk expert currently at Harvard's Kennedy School of Government, and a former deputy governor of the Bank of England. He characterized last week's market interventions by the Federal Reserve as extraordinary and unprecedented, saying:

We are seeing the Fed do a lot of things they have never done for the first time right now – for example, buying junk bonds. On the one hand, it's great for the markets. But on the other hand, it's a tell that the Fed is panicked.

Talk about a statement that satisfies both bulls and bears!

3) And here are some more wise words from Berna:

While most people I know have been primarily obsessing over the scarcity of supply in items – such as toilet paper, paper towels, cleaning products, and hand sanitizer – a second wave of shortages is rapidly evolving in the grocery aisle. For some items, there's an actual supply issue due to business closures and worker safety temporarily halting production of food... therefore creating shortages.

We saw this risk come to light last weekend when Smithfield Foods was forced to close a major pork processing facility in Sioux Falls in the wake of a major COVID-19 outbreak among its staff responsible for butchering and packaging. But many of the shortages consumers are experiencing in the grocery aisle stem not from actual production shortages, but instead from blockages in the farm-to-retailer distribution chain.

At the same time that consumers are walking into their local Safeway or Kroger and seeing empty shelves in the dairy aisle, farmers are dumping their milk and eggs because they can't get them to market. The food supply chain in the U.S. is designed to route most products to restaurants, schools, universities, and hotels. And now, it can't pivot fast enough to deliver those same products instead to grocery stores, Target, Walmart, bodegas, and convenience stores.

The New York Times dove into the issue of food waste: Dumped Milk, Smashed Eggs, Plowed Vegetables: Food Waste of the Pandemic. Excerpt:

The closing of restaurants, hotels, and schools has left some farmers with no buyers for more than half their crops. And even as retailers see spikes in food sales to Americans who are now eating nearly every meal at home, the increases are not enough to absorb all of the perishable food that was planted weeks ago and intended for schools and businesses.

The amount of waste is staggering. The nation's largest dairy cooperative, Dairy Farmers of America, estimates that farmers are dumping as many as 3.7 million gallons of milk each day. A single chicken processor is smashing 750,000 unhatched eggs every week.

Here's another NYT article on how smaller businesses are in trouble: Independent Restaurants Brace for the Unknown.

The supply chain breakdown as end markets shift is particularly apparent in NYC, as Gothamist reports: NYC Grocers Grapple With Soaring Prices, Strained Supply Chains. Excerpt:

A large commercial produce grower, who didn't want to be named, broke down New York's complicated food distribution system: There are the wholesalers at Hunts Point, many of whom service restaurants and hospitality (a massive market in New York). And then there are the wholesalers, some outside New York, that service the independent grocery stores; bigger businesses like Amazon (which owns Whole Foods), often have their own warehouses.

"Since restaurants disappeared, the wholesale orders dropped like a stone," grower said, referencing the suppliers that service restaurants, schools, and hotels.

The net effect is that one system is being stretched thin, while the other has lost its client base altogether.

Consumers are suffering not just from out of stock items, but also from rising prices, at exactly the time most people are least able to bear them.

What Brooklyn grocer Kareem Dolah calls "Styrofoam, white eggs" used to cost him between 75 cents to $1.10 a dozen wholesale. Now, he said, that price has gone up about 300 to 400 percent, hovering around $4.

The good news here is that we have more than enough food being produced in order to feed everyone. The bad news is getting it to where it needs to be is not a quick and easy fix.

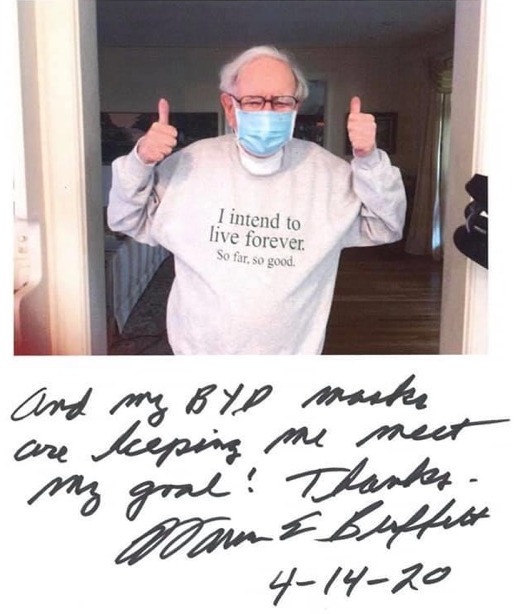

4) Someone posted this picture of Berkshire Hathaway (BRK-B) CEO Warren Buffett:

Here's a related article: BYD Opens World's Largest Face Mask Manufacturing Plant. Excerpt:

Today, BYD is proud to announce that it has created the world's largest mass-produced face masks plant. The plant is now running at full capacity and is able to produce 5 million masks and 300,000 bottles of disinfectants per day. This allows the firm to help alleviate severe shortages that have affected hospitals and agencies across China in the face of the global COVID-19 outbreak.

On February 8, the newly-built production lines in one of BYD's industrial parks in Shenzhen started to produce these critical supplies, with hundreds of staff working both day and night shifts along with machines working around the clock.

5) Speaking of Buffett, I'll be very curious to see where he's allocated capital in the past six weeks. All we know right now is that he's trimmed positions in Bank of New York Mellon (BK), Delta Air Lines (DAL), and Southwest Airlines (LUV), but this is probably nothing more than him wanting to retain flexibility regarding trading those stocks.

Here's an article by William Cohan in Vanity Fair, "Maybe He Doesn't Want to Be the Hero". Excerpt:

Buffett has been radio silent. No words of optimism. No high-profile investments in troubled companies that could surely use his endorsement at this difficult time. In years past, he has been a faithful correspondent. But when I emailed him the other day asking him why he had been so quiet these past few weeks, there was no reply.

Maybe he was trying to pass the torch to a new generation of investors. If so, one of Buffett's longtime admirers, Bill Ackman, the founder of Pershing Square Capital Management, a hedge fund on the rebound after around four years in the wilderness, took up the mantle...

As for what he thought Buffett was doing, Ackman said he suspected his mentor was quietly putting his $125 billion in cash to work buying stocks. He was keeping a low profile to make sure the stocks stayed cheap while he is buying. "After he invests that $100 billion and change," Ackman says, "he'll let everybody know."

I think Ackman is right. I'll be disappointed if Buffett hasn't put tens of billions to work, including major share repurchases.

Best regards,

Whitney