The Power Gauge Perspective on Big Tech's Demand for Nuclear Power

Doc's note: Nuclear power has been enjoying a renaissance in recent years... one that's only going to accelerate despite the fears surrounding this energy source.

Today, Vic Lederman – editorial director at our corporate affiliate Chaikin Analytics – explains why nuclear energy will become more critical than ever and who is already following this trend…

![]()

I didn't expect this...

You see, as a data guy, I've been a fan of nuclear energy for a long time. I know... It's a hot-button issue for a lot of folks.

But for me, that data was always clear. Nuclear energy is clean, plentiful, and the risks – dramatic as they might be – are relatively minor.

Despite that, I've had to acknowledge that many people don't feel the same way. To this day, a general sense of fear surrounds nuclear energy.

Obviously, the association with the atomic bomb doesn't help. But the accidents are still a source of fear as well...

I'm sure that many readers vividly remember the Fukushima nuclear accident in Japan. That was 13 years ago.

Despite that, it's still the general public's most recent association with nuclear energy.

Not to mention, HBO's hit show Chernobyl reminded millions of viewers of that disaster in 1986 in the Soviet Union. Meanwhile, the partial nuclear meltdown at Three Mile Island happened here in the U.S. back in 1979.

So I simply didn't expect a mainstream push for nuclear energy any time soon... Yet here we are.

Regulators are reviewing Three Mile Island with plans to restart the plant there. Amazon (AMZN) is calling for nuclear energy to power data centers... and so is Microsoft (MSFT).

Bill Gates, a longtime proponent of nuclear energy, has stepped up his public presence as well.

Put simply, the data centers that power AI demand enormous amounts of energy. That means Big Tech needs more and more electricity. And these companies are increasingly looking at nuclear power.

So today, let's see what the Power Gauge can tell us about this new trend...

These days, when people think about nuclear power, they think of uranium. It's the fuel that powers most modern (and not-so-modern) reactors.

Sure, there are other options. China is in the process of testing something called a thorium molten-salt reactor. But when it comes to nuclear, uranium is still king.

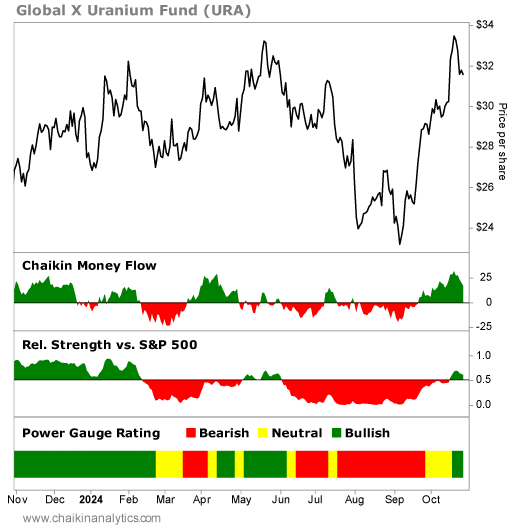

In the Power Gauge, we can check in on the state of uranium with the Global X Uranium Fund (URA). And what we see is a nuanced, yet still "very bullish" view. Take a look at this one-year chart of URA with some data from our system...

First, look at the relative strength panel below the chart. You can see that URA has mostly underperformed the broad market since February.

And in the Chaikin Money Flow panel, you'll notice that the so-called "smart money" on Wall Street ran away from URA in May. After that, things got ugly on the chart. URA shares turned sharply lower.

As a reminder, we measure the smart-money activity with the Chaikin Money Flow indicator. Chaikin Analytics founder Marc Chaikin developed his namesake indicator back in the 1980s.

It looks at the buying patterns of institutional-level investors. Using this tool, we see something interesting is happening in URA...

In September, the smart money came rushing back into the trade.

Not long after that, URA turned "very bullish" in the Power Gauge. And now, we see that it's also just starting to outperform the broad market.

So in the coming weeks, you'll likely hear more media "noise" about nuclear energy. This might be something you would normally dismiss. After all, nuclear energy faces a significant public-relations battle.

But the Power Gauge tells us we should be paying attention. The smart money is in the trade. And the biggest names in tech are now the ones demanding nuclear energy.

As such, I'm keeping a close eye on URA and nuclear energy right now. And I recommend you do the same.

Good investing,

Vic Lederman

Editor's note: Chaikin Analytics founder Marc Chaikin says that today's historic market is causing a massive rotation of capital among the "Smart Money"... giving investors a rare opportunity to capitalize on a rapid-fire, short-term strategy that will be critical to making the biggest potential profits over the next 12 months and avoiding the biggest losses.

Click here for all the details.