The pros and cons of precision railroading; U.S. Factory Boom Heats Up as CEOs Yank Production Out of China; Trump SPAC fails to pay proxy firm; Lessons from 15 Years of Short Selling; My dad appears to be back to 100%

1) The recent threat of a strike by railroad workers has focused attention on precision railroading, which Wikipedia defines as:

Precision railroading or precision scheduled railroading ("PSR") is a concept in freight railroad operations pioneered by E. Hunter Harrison in 1993, and adopted by nearly every North American Class I railroad (except BNSF).

It shifts the focus from older practices, such as unit trains, hub and spoke operations and individual car switching at hump yards, to emphasize point-to-point freight car movements on simplified routing networks.

Under PSR, freight trains operate on fixed schedules, much like passenger trains, instead of being dispatched whenever a sufficient number of loaded cars are available.

In the past, container trains and general merchandise trains operated separately; under PSR they are combined as needed. Inventories of freight cars and locomotives are reduced and fewer workers are employed for a given level of traffic.

The result is often substantial improvement in railroad operating ratios, and other financial and operating metrics, at the cost of criticism of poorer service, long-term capacity issues, more derailments due to longer trains (among other safety issues due to trains of this length), and crew fatigue.

PSR has been extremely lucrative for railroads and their shareholders, but at what cost? The New York Times recently published two articles about this...

Workers Say Railroads' Efficiency Push Became Too Much. Excerpt:

To defuse a labor dispute that brought the nation to the brink of a potentially catastrophic railroad strike, negotiators had to resolve a key issue: schedules that workers say were punishing, upending their personal lives and driving colleagues from the industry.

Workers, industry analysts and customers say the practices emanate from a business model that focuses relentlessly on holding down expenses, including labor costs. They say this leaves rail networks with little capacity to work around a disruption, whether it be a personal issue for an employee or a natural disaster like a hurricane – or, for that matter, a pandemic.

Negotiations in which the Biden administration took an active role produced a tentative contract deal announced early Thursday. The agreement included a significant pay increase for the workers, whose base wages typically start around $50,000 and top out around $100,000, excluding overtime and benefits. But scheduling was the sticking point.

Unions complained that to manage a shortfall of employees, the carriers effectively forced their members to remain on call for days and sometimes weeks at a time, partly through the use of strict attendance policies that could lead to disciplinary action or even firing. They said the policies pushed workers to the limits of their physical and mental health.

And this article on the front page of today's business section: Railroads' Strategy Thrilled Wall Street, but Not Customers and Workers. Excerpt:

America's first commercial railroads were built almost two centuries ago. Freight rail has been a symbol of the nation's economic might and ingenuity ever since.

In recent years, some of the biggest names on Wall Street have made significant investments in railroads, reaping big stock gains as railroads reported higher profits. But the underlying strategies that strengthened railroads' bottom lines have caused friction with customers, regulators and particularly workers – giving rise to a contract dispute that threatened a nationwide shutdown of the railway system.

After losing ground to trucking in the mid-20th century, the rail industry managed to recover through decades of consolidation and a push for efficiency. Critics say those same dynamics created a system with thin staffing and minimal competition, making it particularly vulnerable to shocks like the coronavirus pandemic.

"It's a trend that's been going on for years," said Martin J. Oberman, the chairman of the Surface Transportation Board, the federal agency charged with regulating freight railways. "The pendulum swung pretty far and it allowed these people to exercise tremendous power over their customers and over their labor force."

The efficiency drive began in the 1990s. It spread slowly before reaching most of the major American railroads over the past five years.

"They all are doing the same thing roughly at this point, but they started at different times," said Colin Scarola, an analyst at the research firm CFRA who covers railway stocks. "Once this success started coming through, the copycat effect really took hold."

The strategy is evident in head count, which has fallen at nearly all of the major railway companies in the United States and Canada. At CSX, for example, the number of employees plunged by a third over the past decade. This helped expand the company's profit margins, and its stock is up over 300% since the end of 2011, far exceeding gains in the wider stock market.

To respond to these articles, I asked a friend who's familiar with PSR for his thoughts. He wrote:

The articles could have been worse, but also could have been more fair.

I don't have time to rebut all the false and misleading stuff in these articles, but here are a few thoughts...

First, people need to understand that many of the complaints stem from the reality that neither labor nor the freight shippers can extract economics from the railroads unless they create the impression, especially among labor and transportation regulators, that they have been horrifically abused. How sympathetic would the Surface Transportation Board be if the shippers cheered the enormous improvements railroads have delivered? Similarly, how much sympathy would labor get if they celebrated how much more employees were earning?

Let's look at each critique from the Wikipedia blurb: "poorer service, long-term capacity issues, more derailments due to longer trains (among other safety issues due to trains of this length), and crew fatigue."

Poorer service: false. Railroads are paid to move freight from one spot to another quickly, reliably, and at low cost. They are paid to fulfill their promises to the customer. PSR railroads do all of this materially better than traditionally run railroads, while burning much less fuel per gross ton mile, and also while requiring many fewer locomotives, rail cars, and employees.

CSX and Canadian Pacific had service disruptions for a few months as they effected their transformations to PSR, but since then, it's been much better for shippers than it used to be.

Long-term capacity issues: false. Because PSR runs everything like clockwork, and consolidates traffic onto fewer longer trains, it materially expands the capacity of the network.

More derailments: false. Also, longer trains aren't due to PSR. Rather, they are a byproduct of an innovation called "distributed power," whereby multiple locomotives are spaced throughout a train. It is used by both PSR and traditional railroads. It enhances network capacity and reliability and leads to less congestion by consolidating traffic on fewer locomotives and trains.

Crew fatigue: if crews are fatigued, it's not because of their work on the railroad. Work schedules are strictly observed (unions wouldn't tolerate anything less), and the total workload is eminently manageable.

Lastly, what about the incredibly positive impact PSR has had on greenhouse gas emissions?

Where is the emphasis on improvement of train speed and on-time performance – both of which enhance the competitiveness of U.S. businesses versus the rest of the world?

Where is the reference to the positive externalities that come from shifting freight from the highways, which relieves suffocating traffic congestion, excessive , road accidents, and wear and tear on taxpayer-funded roads?

The deal labor has gotten improves all the time – funny how that didn't make it in there. Nor the improvement in safety.

And of course the articles demonized capital return to shareholders rather than emphasizing the disciplined levels of capex, which is much better for the environment and productivity for our country.

My take: I think PSR has, overall, been a big win for our country, but I'm glad that labor and customers have the power to rein it in when it goes too far (see, for example, this recent Wall Street Journal article: Railroads Reverse Years of Streamlining to Improve Freight Service).

2) It's more important than ever that our rail system is efficient and reliable now that manufacturing is moving back to the U.S., which is a wonderful development. Here are two articles about it...

From Bloomberg: U.S. Factory Boom Heats Up as CEOs Yank Production Out of China. Excerpt:

There has been a sense in financial circles that the fever among American executives to shorten supply lines and bring production back home would prove short-lived. As soon as the pandemic started to fade, so too would the fad, the thinking went.

And yet, two years in, not only is the trend still alive, it appears to be rapidly accelerating.

Rattled by the most recent wave of strict Covid lockdowns in China, the long-time manufacturing hub of choice for multinationals, CEOs have been highlighting plans to relocate production – using the buzzwords onshoring, reshoring or nearshoring – at a greater clip this year than they even did in the first six months of the pandemic, according to a review of earnings call and conference presentations transcribed by Bloomberg. (Compared to pre-pandemic periods, these references are up over 1,000%.)

More importantly, there are concrete signs that many of them are acting on these plans.

The construction of new manufacturing facilities in the U.S. has soared 116% over the past year, dwarfing the 10% gain on all building projects combined, according to Dodge Construction Network.

And from the WSJ: Tesla Shifts Battery Strategy as It Seeks U.S. Tax Credits. Excerpt:

Tesla (TSLA) is pausing its plans to make battery cells in Germany as it looks at qualifying for U.S. electric vehicle and battery manufacturing tax credits, people familiar with the matter said.

The company, which has been working to produce its own batteries, has discussed shipping cell-making equipment it had intended to use at its Berlin-area factory to the U.S., the people said.

Making more batteries domestically could help Tesla qualify for additional tax breaks available under the Inflation Reduction Act, also known as the IRA, which President Biden signed into law last month.

3) Here's the Financial Times with the latest bad news about Truth Social, which is one more reason to avoid Digital World Acquisition (DWAC): Trump SPAC fails to pay proxy firm despite tough hunt for votes. Excerpt:

Executives behind a blank-cheque company that plans to take Donald Trump's media business public have failed to pay their proxy solicitors even as they struggle to drum up support for an extension to complete the deal.

Digital World Acquisition Corporation, a special purpose acquisition company set up by Patrick Orlando, has not paid Saratoga Proxy Consulting for its work helping to rally shareholders, according to people familiar with the situation.

DWAC owes the New York-based firm a six-figure sum but Orlando has informed it that there is no money to pay the bill, one of the people said.

4) Though I'm highly confident that DWAC shares will soon plunge to around $10 when the deal breaks, I don't recommend shorting the stock – at least for 99% of investors – because shorting is so risky. As Warren Buffett said in 1996:

It's very tough to make money shorting even obvious frauds. We tried a few times in our innocence of youth. It's not tough to find obvious frauds and it's not tough to be right over 10 years. But it's very tough to make money being short them.

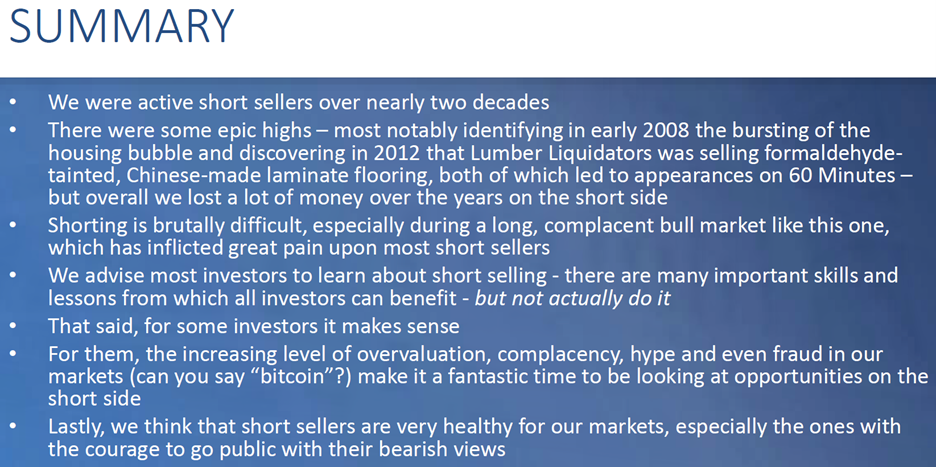

Years ago, I put together a presentation entitled, "Lessons From 15 Years of Short Selling." Here's the opening slide:

I'll share more of the presentation in future e-mails...

5) I'm pleased to report that your thoughts and prayers worked!

As I mentioned in two recent e-mails, my dad developed atrial fibrillation (A-fib) after getting COVID at the beginning of this year. To address it, his doctor recommended a surgical procedure called a "catheter ablation," which took place on Friday afternoon at Dartmouth Health.

Susan and I drove up that morning to be there when he checked in, and we spent the weekend with my parents.

The procedure went perfectly and my dad appears to be back to 100%. His EKG no longer shows the heart flutter in between beats – see this short video.

He got out of bed and walked around with no problem, so we took him home around 9 p.m. Friday.

He was up early yesterday morning and put new panes of glass in the storm windows.

In the afternoon, we drove an hour to Tunbridge, Vermont for the 150th Tunbridge World's Fair, which was classic Americana: rides, every form of unhealthy food, lots of animals, pig racing, and oxen pulling (short video here).

The highlights for me were the historical exhibits: an original 1840 one-room schoolhouse, a blacksmith shop, a sawmill, and a collection of old carriages and farm equipment.

Here are four pictures:

I posted additional pictures on Facebook here.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.