The Secret I Learned From a Mathematical Economist

When I first started my career at Goldman Sachs, few people understood what I was doing for the bank... and even fewer cared.

I had to spend hours and hours explaining my job – and probably boring many of my friends and family.

Meanwhile, my group was generating massive profits for the firm.

You see, I was a part of an elite derivatives trading group at Goldman. And we were one of the best in the business...

In my early days, I worked with a mathematical economist named Fischer Black. He was one of the guys who first deciphered the options market. (Options are classified as a type of derivative.)

Black had a PhD in applied mathematics from Harvard. He worked for the famous global policy think tank Rand and taught at the University of Chicago and MIT.

By the time I met him, he had moved to finance and was a newly minted partner at Goldman. Unlike a lot of people at Wall Street's highest echelon, Black wasn't in it for the money. He loved the intellectual challenge.

He liked to point out that of all the partners, he owned the fewest shares of the firm – most Goldman guys bragged about owning the most.

Black wasn't just smart... Everyone at Goldman was smart.

Years earlier, Black, along with Robert Merton and Myron Scholes, published a paper that established the Black-Scholes formula for pricing options. Merton and Scholes eventually received the 1997 Nobel Prize in Economic Sciences for the work. (Black had passed away by then, and they don't award the Nobel Prize posthumously.)

This guy understood options. Plenty of people can follow the math now. But to develop it? That was something else.

You could say, though, that he took it too far. He stood well above the rest. Rather than reading graphs or charts, he preferred to study pure tables of numbers. He refused to use a computer mouse... He considered it clutter. Instead, he coded custom keyboard commands to use on his computer.

Black obsessed over a few decimal points. He tested and retested every assumption. If an option were more than a few pennies off his predicted price, he'd have to figure out why.

That's great. And we do use quite a bit of math behind the scenes in our own options-trading service called Retirement Trader. But we always want to simplify. We don't want an equation with nine variables – like the Black-Scholes equation. We want shortcuts and hacks... things that help us understand how our strategy makes money without causing our brains to overheat.

I launched Retirement Trader in 2010 because I believed I could take what I learned from Black and the rest of the Goldman group and teach it anyone who was interested in receiving a steady stream of income.

Little by little, I believe my team and I helped demystify the options world.

Many thousands of subscribers took me up on my offer. And over the next decade, from 2010 to 2020, we closed more than 500 trades with average annualized gains of 14%.

Still, a lot of people weren't clamoring for options.

Then the pandemic hit... and the retail options market got a shot of adrenaline. Folks were stuck at home and bored. Armed with stimulus cash, they took to the markets to trade anything they could... from meme stocks to options.

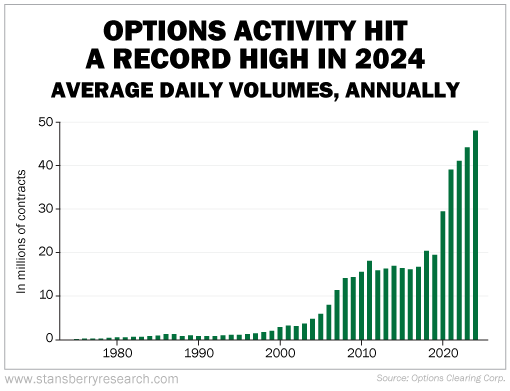

The chart below shows the total volume of option trades over the past few decades. As you can see, it has skyrocketed since the pandemic. It's not slowing down, either...

Options trading may not have been popular among retail investors back when I traded for Goldman... But today, more people than ever are interested in options.

But, as you'd expect, there's a safe way to trade options... and a not so safe way.

If you have any interest in learning how options can help you generate hundreds and even thousands of extra income every month, then I suggest you consider a membership to Retirement Trader.

In this trading service, we teach you everything to become an options master – regardless of prior experience or knowledge. But once you master it, options can help you earn regularly income.

Over the past decade-plus, we've closed 771 trades and 729 of them have been winners – a win rate of 95%.

To learn more about Retirement Trader, click here. Today is the last day to take of my "New Year Money Challenge" and receive a special price for a subscription.

What We're Reading...

- Something different: Los Angeles blaze damage likely to be largest wildfire insured loss in U.S. history.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

January 14, 2025