The Single Best Way to Make a Fortune in the Markets

Pro baseball Hall of Famer Ted Williams didn't bat .406 in 1941 by swinging at every pitch…

He carefully broke the strike zone down and decided to only swing at pitches that were in his favorite spots – his own personal strike zone. He knew he had a much better chance of hitting those pitches than the pitchers had of throwing it into the few places where he wouldn't swing. Ted Williams only struck out 27 times that season.

The more time I spend in the financial markets, the more convinced I become that most investors should only buy stocks in these few "sweet spots." In these areas, outside investors have the tools to decide whether or not a stock is in the strike zone. If you can learn to limit yourself to only making capital commitments in these areas – your personal "strike zone" – I'm certain you can vastly improve your results.

For example, specific types of insurance companies (those with disciplined underwriting) almost always outperform the market. In this essay, I'm going to show you why, as good as insurance stocks can be, they're not where you'll find the very best long-term results.

No, for the very best long-term results, you should focus on what I call capital-efficient stocks. And, lucky for outside passive investors, there's one sector of the stock market that's both easy to understand and crowded with capital-efficient companies. Once you know the trick to identifying them, making a fortune in stocks is as easy as painting by numbers. Let me show you how.

Simple question: Do you think you could name any of the 20 best-performing stocks in the S&P 500 in the 50 years between 1957 and 2007? Wharton economist Jeremy Siegel wanted to answer this question thoroughly. It's not as easy to figure out as you might think, because the composition of the S&P 500 changes frequently. Siegel had to go back and get the actual list of stocks from 1957 and then follow each one, carefully, to see how much they paid out in dividends, spinoffs, mergers, and liquidations.

So... what were the real best-performing stocks over that 50-year period?

| Company | Return |

| Philip Morris | 19.8% |

| Abbott Labs | 16.5% |

| Bristol-Myers | 16.4% |

| Tootsie Roll | 16.1% |

| Pfizer | 16.0% |

| Coca-Cola | 16.0% |

| Merck | 15.9% |

| PepsiCo | 15.5% |

| Colgate-Palmolive | 15.2% |

| Crane | 15.1% |

| H.J. Heinz | 14.8% |

| Wrigley | 14.7% |

| Fortune Brands | 14.6% |

| Kroger | 14.4% |

| Schering-Plough | 14.4% |

| Procter & Gamble | 14.3% |

| Hershey Foods | 14.2% |

| Wyeth | 14.0% |

| Royal Dutch Pet. | 13.6% |

| General Mills | 13.6% |

| Source: Jeremy Siegel, The Future for Investors | |

What I'm sure you can see for yourself is that, almost without exception, these companies sell high-margin products (some are extremely high-margin), in stable industries that are dominated by a handful of well-known brand names. Look at the top 10 names on the list – the ones that produced 15%-plus annual returns. My bet is that most of you have at least three or four of these companies' products in your house at all times. (Crane, by the way, is the obvious exception.)

What is it that Crane (a maker of high-margin industrial parts) has in common with these other companies? It's extraordinarily capital-efficient. Because of Crane's excellent, storied reputation (it has been in business since 1855), the unique, proprietary nature of its products, and the stable, long-term nature of its business, Crane doesn't have to spend a fortune on brand advertising or building new manufacturing plants to come up with new products every few years.

This means that as sales grow, the amount of capital that must be reinvested in the business doesn't grow much – or at all. From 2004 to 2014, Crane earned gross profits of nearly $8 billion and spent just $312 million on capital investments.

I learned the basic concepts behind capital efficiency by carefully studying the few large investments Warren Buffett made in the 1970s and 1980s. If you read his 1983 letter to shareholders, he basically gives the whole strategy away. But it's hidden... at the very end of the letter... underneath the headline: "Goodwill and its Amortization: The Rules and the Realities."

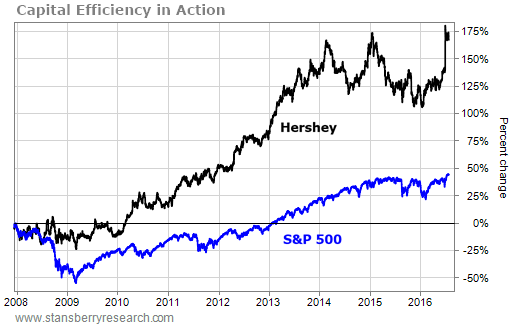

I've said many times, and in many places, that I believe my recommendation of capital-efficient chocolatier Hershey (HSY) will likely be the best stock pick I make in my entire career. I fully expect the investment to deliver 15% annual returns over the long term – the very long term. As I said when I recommended it, "The longer you hold this stock, the more rapidly your wealth will compound and you'll never have to sell – ever."

In my initial recommendation, I noted how capital efficient Hershey is...

Over the last 10 years, the company's annual capital spending has remained essentially unchanged. In 1997, the firm invested $172 million in additions to property and equipment. By the end of 2006, the annual capital budget had only increased to $198 million – a paltry 15%. Meanwhile, cash profits and dividends nearly doubled.

This is the beauty of capital-efficient businesses: As sales and profits grow, capital investments don't. Thus, the amount of money that's available to return to shareholders not only grows in nominal dollars, it also grows as a percentage of sales. In 1999, dividends paid out equaled 3.4% of sales. But by 2006, the company spent $735 million on dividends and share buybacks, an amount equal to 14.8% of sales.

Today, Hershey's sales have ballooned to more than $7 billion, but capital investments remain incredibly small – less than 5% of sales. Hershey recently distributed nearly $1 billion to shareholders on gross profits of more than $3 billion. That's nearly 30% of gross profits and far more capital than Hershey invested in its operations ($330 million).

That's another hallmark of capital-efficient companies: They almost always return more capital to shareholders each year than they spend in capital investments. Why doesn't Hershey distribute even more? It could... Cash flows from operations were more than $1.2 billion. But companies like Hershey will wait to buy back lots of stock (or make wise acquisitions) when prices are low.

How can you do the same? How do you know when is the right time to buy these stocks, which almost always trade at rich premiums to the average S&P 500 stock?

You want to buy these stocks during the rare times they're cheap enough to safely take themselves private. I explained the concept in my December 2007 issue...

Hershey's enterprise value is $11.5 billion. That's the amount of money it would require to pay off all of the company's debts and buy back all of the outstanding shares of stock at the current price.

The company earns more than $1 billion before taxes, interest, and depreciation. Its earnings are very consistent, and its brand places it in the upper tier of all businesses around the world. It could easily finance a bond offering large enough to buy itself – or "go private."

Thus, I think it is extremely unlikely that investors will lose money buying the stock at today's price... Given the company could easily finance the repurchase of all its stocks and bonds, I believe buying this stock is no more or less risky than buying its bonds.

That is the true definition of a "no risk" stock – an analysis of its cash flow shows it could afford to buy back both all of its debts and all of its shares... These situations are extremely attractive because, while you're only taking a risk that's similar to a bondholder's, you're getting ownership of all of the company's future earnings.

You know when it's safe to buy these businesses by figuring out if they could finance a debt issuance in excess of their enterprise value. That can be a little tricky. So use a rule of thumb. These stocks are safe to buy (and likely to produce incredible long-term results) when you can buy them for around 10 years' worth of current cash flows from operations.

You can find businesses like these by looking in the portfolios of high-quality investors. I've noticed that Mario Gabelli's GAMCO team loves these kinds of businesses.

Here's another big helpful hint when it comes to this type of investing: It's critical to avoid companies that are returning huge amounts of capital to investors simply because their businesses have become obsolete. Companies like Western Union, for example, might look good on paper, but its future cash flows are seriously in jeopardy by new technologies.

If you're going to invest using this strategy, you want to stick to the very highest-quality businesses whose products are timeless. I always ask myself this question: "Are my grandkids likely to want this brand and this product?" There's no brand or business in the world that will last forever, but you should try to focus on the stuff that's as close to forever as possible.

Here's another valuable tip. This is one of the few, genuine secrets to investing that I've ever learned. In fact, it's a little creepy. Our former Editor in Chief Brian Hunt first pointed it out to me: A lot of the companies that fit into our model of capital efficiency sell products that are highly addictive. Says Hunt...

If you look at the list of the 20 best-performing S&P 500 stocks during that time frame that kept their general corporate structure intact, you'll note many of them sold habit-forming products. It jumps right out at you. For example, Philip Morris is at the top of the list. It was the top-performing S&P 500 stock from 1957 to 2007. It sold cigarettes, which contained addictive nicotine. Fortune Brands, which was called American Brands for a while, is on the list. It sold cigarettes and alcohol. Coca-Cola and PepsiCo are on the list. They sold soda, which is a sugar-delivery vehicle. Hershey Foods and Tootsie Roll are on the list. They sold chocolate and sugar. Wrigley is on the list. It sold sugary gum, like Big Red and Juicy Fruit. People love to get a little sugar rush. It's habit-forming.

Many drug companies are also on the list. These names include Abbott Laboratories, Bristol-Myers Squibb, Merck, Wyeth, Schering-Plough, and Pfizer. People get very, very accustomed to taking certain drugs. Much of the time, those drugs are useful, although sometimes they are not. I'm not saying they are good or bad, I'm simply pointing out that people get very accustomed – even addicted – to taking them.

You can make the case that some fast foods are addictive as well. Fast food is loaded with fat and sugar – stuff that makes people crave it. This is part of the reason McDonald's has been such a corporate success. McDonald's has returned an average of 13% a year for three decades, making investors extremely rich.

And the reason why it did so well is simple. When people form a habit around a product, it goes a long way toward ensuring repeat business. People get used to brands, and they grow resistant to switching. Also, when people get used to a product and the brand surrounding it, they are more likely to continue buying the product, even if the price increases a little.

Both of these help companies sustain sales growth and healthy profit margins. That's good for shareholders. It's also important to know that when these companies hit upon the right recipes or the right mix of whatever it takes to make good products, they don't have to make large, ongoing investments in the business. They don't have to spend tons of money on further research and development. Once Coca-Cola hit upon Coke, it didn't have to change it. The same goes for Budweiser, Hershey, and Tootsie Roll.

When you develop a product that people love and develop habits around, you don't tinker with it. You don't have to spend a lot of money on new research and development. You don't have to buy expensive, high-tech equipment. This means a larger percentage of revenues can be sent to shareholders – it's a capital-efficient business.

One more thing... I don't expect all (or even most) of the market's leaders from 1957 to 2007 to remain at the very top of the performance charts. But what I hope you'll notice is that the characteristics of the leading companies are the same.

New brands come along and make small changes... and get very popular. New medicines are invented. New forms of addiction are marketed successfully. If you keep your eyes open, it's not all that hard to figure out which of these products and businesses are likely to do extremely well over the long term.

Here's the list of the 10 best-performing stocks in the S&P 500 over a recent 20-year period (on an annualized basis):

| Company | Return |

| Biogen | 37.9% |

| Keurig | 37.0% |

| Monster Beverage | 36.9% |

| Gilead | 33.3% |

| Celgene | 32.6% |

| KC Southern | 26.9% |

| Apple | 25.7% |

| Ross Stores | 24.3% |

| Express Scripts | 24.2% |

| Qualcomm | 24.0% |

| Time Warner | 23.4% |

| Regeneron | 21.7% |

| Precision Cast | 21.0% |

| O'Reilly Auto | 20.7% |

| Autonation | 20.5% |

| Tractor Supply | 20.5% |

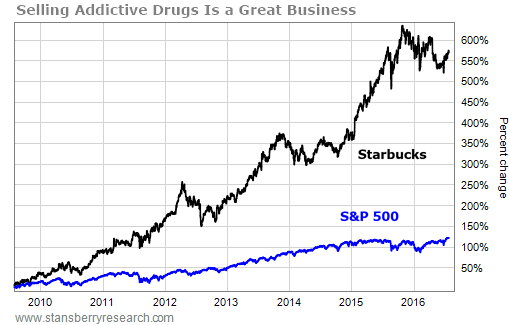

| Starbucks | 20.4% |

| TJX | 20.0% |

| Expeditors International | 19.9% |

The top five firms sell high-margin, branded drugs – as long as you agree that caffeine is a highly addictive drug. Likewise, although most people don't think about Starbucks as being a drug company, the company's decaf coffee contains more caffeine than McDonald's regular coffee does.

What is Starbucks really selling? From 2003 to 2013, the company produced gross profits of $57 billion. It spent just $7.3 billion on capital investments. It spent $5.5 billion buying back stock and another $1.7 billion on cash dividends. In short, even though it had to pay for a huge international build out, it was able to spend almost as much on its shareholders as it did on growing its business. That's pretty remarkable and an excellent indication that long-term shareholders in Starbucks will do very well...

Regards,

Porter Stansberry