The Stocks to Own Following a Fed Cut

Back in September, the Federal Reserve surprised many market watchers...

Most of these folks had predicted a 25-basis-point reduction in interest rates, yet the Fed slashed rates by 50 basis points, or half a percentage point.

The Fed clearly made this move because it saw trouble brewing in the economy... My team and I have been seeing the same worrying signs.

Regular readers know that we've been growing more cautious of the economy and market lately. In late September, we noted a recession might be closer than expected because my No. 1 recession indicator flashed a warning sign. And overall, economic growth is slowing while stock valuations are near record highs.

Buying stocks after a rate cut usually isn't a good thing, according to history. After all, a rate cut typically happens to try to prevent a recession.

Since 1973, the average return for the S&P 500 Index three months after an initial rate cut is negative 1.1%. And one year after the first cut, the average return is about 4.9%. That lags the S&P 500's historical average of more than 10% by a wide margin.

Of course, returns vary depending on if a recession immediately follows the Fed cut. If one does, then returns will typically be negative. But if a recession takes a bit longer to appear, then returns will be higher. For example, the Fed started to lower rates in 1998, yet the country didn't see a recession until 2001. So the one-year return after the 1998 rate cut was 27.3%.

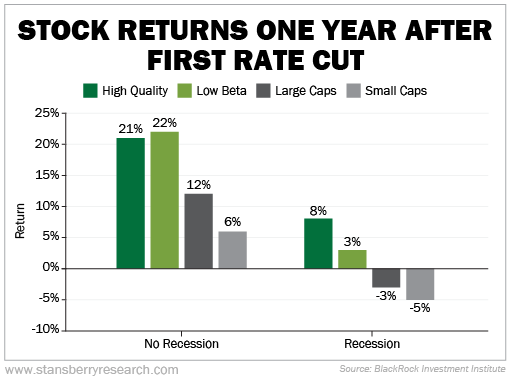

All these numbers we've mentioned so far are for the broad S&P 500, though. When we take a closer look, we find that there are some stocks that outperform after rate cuts... and some that underperform.

Let's dive in...

After a rate cut, you typically want to avoid small-cap stocks. Smaller businesses are the ones that suffer the most if economic growth stalls.

Large-cap stocks don't do much better, either.

The stocks you want to own following a rate cut are "low beta" and "high quality" stocks. Take a look...

In stock market parlance, "beta" measures how much an individual stock is correlated with the market as a whole. A beta of 1.0 means the stock's price moves in tandem with the market. So if the market is up 5%, the stock is up 5%.

A beta of more than 1.0 means the stock's price is more volatile than the market (with more pronounced rises and falls). And a beta of less than 1.0 means the stock's price is less volatile than the market.

You want to own stocks with a beta of less than 1.0 following a rate cut. Low-beta stocks are typically boring, slow-growth businesses that can hold up well in times of economic turmoil. A consumer-staple stock like Procter & Gamble (PG) is a prime example.

On average, low-beta stocks posted one-year returns of 22% following a rate cut with no recession. And they even churn out a small gain during recessions.

Moving on, you also want to own high-quality stocks. They average 8% returns during recessions...

But defining what makes a stock high quality is not as simple as defining a low-beta stock. Ask 100 different analysts to define business quality and you'll get 100 different answers.

Here's how my team and I described quality in a 2020 issue of Income Intelligence...

University of Rochester (New York) business professor Robert Novy-Marx proposes "gross profitability" as a quality measure. It's simply gross profits (revenue minus cost of goods) divided by the assets of a firm. His research finds that a portfolio that buys the highest gross profitability stocks and shorts the lowest (the typical test for a factor) will earn an annual return 2.7% above the market. (That's a very significant number in financial markets.)

Using gross profits is an easy, simple-to-find number. It normally appears as the third entry on the income statement. And it includes very few assumptions or accounting manipulations.

Using gross profitability is a great starting place to determine if a stock is high quality or not.

The late, great Charlie Munger also thought about quality and putting a number to it. Here's an excerpt from a 1994 speech Munger gave at the University of Southern California Marshall School of Business...

Over the long term, it's hard for a stock to earn a much better return than the business which underlies it earns. If the business earns 6% on capital over 40 years and you hold it for that 40 years, you're not going to make much different than a 6% return – even if you originally buy it at a huge discount. Conversely, if a business earns 18% on capital over 20 or 30 years, even if you pay an expensive-looking price, you'll end up with a fine result.

Return on capital ("ROC") refers to the profit on an investment in relation to how much was invested. Basically, it's the cash you earn per year divided by the cash you put in per year.

The higher the ROC, the better quality of a stock you are buying.

I also have my own "magic formula" for buying the highest quality of stocks. You can read about it here.

In conclusion, it's very possible that we could see a recession in the next 12 months. And if we do, all of this information will be crucial for you to know when deciding which stocks to stay in or buy.

As we showed you today, make sure you have exposure to low-beta and high-quality companies. These are the stocks that are proven to grow your wealth no matter what happens next in the economy.

Our friend Marc Chaikin is also seeing the warning signs...

After dozens of record highs in the S&P 500 this year – and some serious shake-ups – lots of folks are acting foolishly with their money... Either they're still recklessly investing in AI stocks or they're hiding out in Treasury bills.

According to Marc, today's historic market is causing a massive rotation of capital among the so-called "smart money"... giving readers a rare opportunity to capitalize on a rapid-fire, short-term strategy that will be critical to making the biggest potential profits over the next 12 months and avoiding the biggest losses.

Click here for the full details.

What We're Reading...

- Did you miss it? A recession might be closer than you think.

- Something different: Apple released Apple Intelligence, and you can get it on your iPhone.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

October 30, 2024