Trump's Agenda Could Spark an Energy Boom

Editor's note: President Donald Trump is promising to kick-start the energy sector. But for now, according to Joel Litman of our corporate affiliate Altimetry, the industry is still undervalued – and ignored by the market. In this piece, adapted from a recent issue of the Altimetry Daily Authority e-letter, Joel reveals why this sector is so hated right now... and explains why this is setting up a huge opportunity for energy stocks.

Also, the markets and our offices will be closed on Monday in observance of Presidents Day. So keep an eye out for your next issue of DailyWealth on Tuesday, February 18, after the Weekend Edition.

The energy industry couldn't be happier with President Donald Trump's "day one" promises...

The president has set the stage for a transformation of America's energy sector.

He has outlined plans to cut through the regulatory red tape, ramp up domestic production, and drive economic growth through energy exports. He has signed executive orders to reopen Alaska's Arctic National Wildlife Refuge for drilling and declare a national energy emergency.

In short, Trump's agenda is laser-focused on unleashing the power of American energy to fuel the economy.

Yet despite these sweeping promises, the market isn't paying attention...

Today, we'll look at why the energy sector is still undervalued – and how Trump's policies could create a massive opportunity for investors.

The energy sector has been stuck in a rut for years...

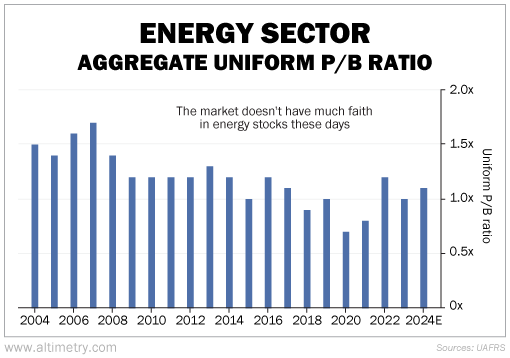

We can see this through the Uniform price-to-book (P/B) ratio. At Altimetry, we analyze earnings with Uniform Accounting to avoid the distortions of traditional accounting methods.

The Uniform P/B ratio compares a company's – or in this case, an entire sector's – total value with the value of the assets on its balance sheet (or "book"). Basically, a Uniform P/B ratio of 1 shows that a company's stock is trading in line with its book value.

Levels less than 1 show the stock is trading at a discount... Meanwhile, the higher the Uniform P/B ratio, the more investors are willing to pay for its assets.

The average Uniform P/B ratio for energy companies has hovered around 1 since 2015. Said another way, investors haven't expected energy companies to make a profit in nearly a decade.

Take a look...

The market hasn't rewarded energy companies for their investments and growth potential... even as U.S. energy exports reached record levels in 2022.

But that could soon change. Trump's plan to cut regulatory barriers and supercharge production could finally unlock the growth that investors have been waiting for.

By opening up more land for drilling and encouraging new investments, the Trump administration could create a ripple effect across the economy.

The U.S. has cemented its role as a global energy leader over the past decade...

Meanwhile, energy valuations have remained flat.

But in the coming months, U.S. energy companies should finally start seeing some benefits from their investments.

Trump has been clear that the U.S. will ramp up energy exports, giving the sector yet another way to make money. The energy industry could return to profitability for the first time in almost a decade.

Investors may start to expect better efficiency and growth potential from these companies... which should drive higher valuations.

The president's broader economic agenda also ties directly into energy. Higher production doesn't just benefit energy companies – it fuels growth in manufacturing, transportation, and infrastructure.

In short, energy stocks have been sitting in the bargain bin for years, ignored by the broader market...

With supportive policies on the horizon and investment set to take off, the sector is primed for a long-awaited transformation.

This is a rare opportunity for investors to get ahead of the curve. Energy valuations remain near historic lows... making it one of the few corners of the market where the potential upside far outweighs the risks.

And as these policies take hold, the industry's growth could become a cornerstone for the entire market.

Regards,

Joel Litman

Editor's note: President Trump signed 54 executive orders during his first two weeks alone – more than any president in recent history. Now, Joel predicts Trump is about to upend one little-known regulation... which could trigger triple-digit gains in a selection of tiny stocks.

So, if you're wondering how stocks will react during the new administration, make sure you learn what Joel expects... and exactly which types of stocks he says to buy and sell. Click here to find out more.

Further Reading

"The bond market loves all the proposed new policies coming out of the Trump administration's first few weeks," Corey McLaughlin writes. The 10-year Treasury yield reveals what folks expect for economic growth and inflation. And this signal has been falling since Inauguration Day... Read more here.

"President Donald Trump's second term could turn the tide on American manufacturing," Sean Michael Cummings says. Trump's likely tax cuts will be a tailwind for manufacturers. And that means one hated business could be ready to make a comeback... Learn more here.