Two Things to Consider Before Investing in an ETF

Buying individual stocks is not for everyone...

To construct a portfolio of 20 or so different stocks takes a lot of time. Plus, you'll need to keep tabs on the companies you own and look for new opportunities when you have some free cash. (Of course, this is where a company like Stansberry Research comes in and does the heavy lifting for you.)

But if you're looking for an alternative that will save you some time, index funds are a great option.

Index mutual funds and exchange-traded funds ("ETFs") track the performance of a specific market benchmark or index.

The manager of the fund will buy the same stocks or bonds that are in the index, so investors will see roughly the same performance as the index itself. (Some funds will buy a "representative sample" of the index to try and get as close to the index's returns as possible.)

There has been a boom in this so-called "passive investing" over the past few years. Folks want to diversify their portfolios, and index funds allow them to do that with low costs and one simple click of a button.

Over the past 30 years, passive investing has ballooned from less than 5% of the U.S. mutual fund and ETF markets to more than 50%.

Today, the choices of which funds to buy are endless. There's an ETF for just about everything... There's a pet-care ETF, a "sin stocks" ETF, and even an ETF for environmentally friendly companies.

But regardless of the fund's theme, you need to investigate its expense ratio...

An expense ratio measures the annual fees a fund charges its investors. You want this percentage as low as possible. Any fund with high fees (and therefore a high expense ratio) will kill your performance over the long term. You want your profits going into your account, not to a fund manager.

In 2023, the average expense ratio for index equity ETFs was 0.15%. It was 0.11% for index bond ETFs.

Make sure that you keep a close eye on this metric when buying an index fund.

This brings me (Jeff Havenstein) to my next point... Be sure to look closely at the fund's holdings, too. Many funds out there are just replicating the S&P 500 Index. And because they have some fancy name, they'll charge you higher fees than a typical S&P 500 fund.

Consider the Nuveen Winslow Large-Cap Growth ESG Fund (NWLG). It's a fund that strives to hold companies that demonstrate sustainable environmental, social, and governance ("ESG") characteristics.

A noble cause, no?

But look closely at its holdings... Accounting for 42% of the fund, its top five stocks are Microsoft (MSFT), Nvidia (NVDA), Amazon (AMZN), Apple (AAPL), and Alphabet (GOOGL).

I'm no environmentalist, but I don't know if all these companies are the most ESG friendly in the world... It seems a lot like the fund is just cherry-picking some of the most successful names in the S&P 500. And on top of it all, it has a high 0.65% expense ratio.

Be careful of funds like these.

For the most part, equity investors will just want to buy an S&P 500 fund... The SPDR S&P 500 Fund (SPY) and the Vanguard S&P 500 Fund (VOO) are two popular examples.

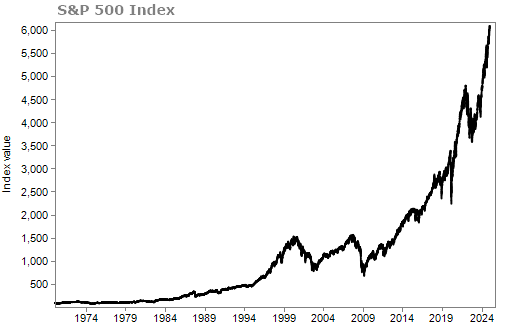

Both have low expense ratios. And the S&P 500 has historically been the best game in town for long-term investors. The index has returned 11% a year since 1970. Just look at how well it has done over the decades...

Of course, as Doc Eifrig and I have written about in previous issues, there are reasons to be nervous for the S&P 500 going forward. It's historically weighted to the largest tech stocks. And valuations are near extreme highs.

I personally would look for an S&P 500 fund that is equal weighted (meaning each holding has the same allocation), rather than market-cap weighted. This way, your portfolio isn't heavily concentrated in today's rich tech names. You can't go wrong buying something like the Invesco S&P 500 Equal Weight Fund (RSP), which tracks the S&P 500 Equal Weight Index.

I also see value in buying funds of smaller companies, specifically mid-cap stocks. Mid-cap stocks have market caps between $2 billion and $10 billion. And on average, they trade for just 18.5 times earnings, versus the S&P 500's 25.5 times earnings.

Because there are a lot of fantastic, cash-generating mid-cap stocks that don't trade for excessive valuations, funds offer you an easy way to take advantage of the opportunity. One such name I have my eye on is the SPDR S&P MidCap 400 Fund (MDY), which tracks the S&P MidCap 400 Index.

In sum, index funds are a great way to get instant diversification. And you don't have to spend as much time investigating and monitoring them as you do with individual companies. But that doesn't mean you should just buy them mindlessly. Always pay attention to a fund's expense ratio and stock holdings before putting any money in.

What We're Reading...

- Something different: New privacy protections are coming to these states this month.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein

January 2, 2025