Update on Sam Bankman-Fried and FTX; Buffett and Munger's warnings about cryptos; Report from the World's Toughest Mudder

1) The news went from bad to worse this weekend for Sam Bankman-Fried ("SBF"), the founder of cryptocurrency exchange FTX, which filed for bankruptcy on Friday.

The odds that my prediction on Friday that SBF "will go to prison for misappropriating customers' funds" went up, as he is currently "under supervision" in the Bahamas, where he lives and FTX is headquartered: Sam Bankman-Fried is 'under supervision' in Bahamas, looking to flee to Dubai. Except:

FTX former CEO Sam Bankman-Fried, co-founder Gary Wang, and director of engineering Nishad Singh are understood to be in the Bahamas and are "under supervision" by the local authorities.

A source familiar with the matter told Cointelegraph that the three former FTX executives, as well as Alameda Research CEO Caroline Ellison, are looking for ways to flee to Dubai. While the plan was made assuming that the United States "doesn't have any extradition treaties" with the UAE, the nations signed a mutual legal assistance treaty ("MLAT") back on Feb. 24, 2022, to work against criminals.

"Right now three of them, Sam, Gary, and Nishad are under supervision in the Bahamas, which means it will be hard for them to leave," said the source, who asked to remain anonymous.

And U.S. prosecutors seem ready to act (as usual, rushing to close the barn door after the horse has fled – and customers have lost billions): FTX, Sam Bankman-Fried Sit in the Crosshairs of U.S. Prosecutors. Excerpt:

FTX's implosion last week and reports that it used customer funds to back an affiliate's risky venture investments have exposed the company and its founder to potential criminal liability, according to attorneys who specialize in white-collar criminal law.

The Manhattan U.S. attorney's office is investigating FTX's collapse, according to people familiar with the matter. One focus for prosecutors, at least initially, is likely to be examining reports that FTX lent customer funds to Alameda Research, a crypto-trading firm that traded on FTX and other exchanges. FTX founder Sam Bankman-Fried, who resigned as chief executive on Friday, also founded and owns Alameda Research.

Mr. Bankman-Fried has acknowledged in tweets that he made mistakes before his company's downfall and bankruptcy.

Using customer funds for proprietary trading or lending them out – without an investor's consent – is generally forbidden in the regulated securities and derivatives markets.

Here's a good summary of the latest events: SBF on the Run? This was the most interesting part:

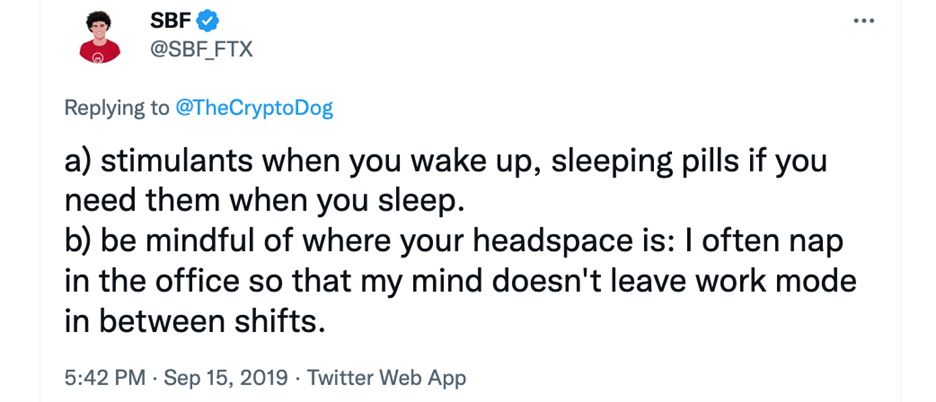

No. 4: MORE WEIRD DRUG STORIES

Former FTX employees are leaking stories left & right.

The newest one? Samuel was on a diet, and it wasn't vegan.

It was a Drug Diet. And he tried to get his new employees on it too.

- Samuel would give presentations on stimulants (+ describe what each one does)

- Advised employees to "give it a try" and see what works best for them

- Followed an "optimal dosing schedule" where they'd take stimulants during the day & sleeping pills at night

And in case you think it all sounds too crazy, Samuel openly talked about this back in 2019...

Employees are even reporting that Samuel used a patch that mainlined the stimulants directly into his blood to give him a constant buzz at all times.

It's all starting to make sense.

You don't typically go from a normal-looking nerd to a goblin that can't sit still unless you're on some strong sh*t.

Remember kids, Just Say No.

And here's an exclusive report from Reuters: At least $1 billion of client funds missing at failed crypto firm FTX. Excerpt:

- FTX founder Bankman-Fried secretly moved $10 billion in funds to trading firm Alameda

- Bankman-Fried showed spreadsheets to colleagues that revealed shift in funds to Alameda

- Spreadsheets indicated between $1 billion and $2 billion in client money is unaccounted for

- Executives set up book-keeping "back door" that thwarted red flags

- Whereabouts of missing funds is unknown

And here's more from CNBC: Sam Bankman-Fried's Alameda quietly used FTX customer funds for trading, say sources. Excerpt:

- Alameda Research, a trading firm founded by Sam Bankman-Fried, was trading billions of dollars from FTX accounts and leveraging the exchange's native token as collateral, according to a source.

- Many employees and outside auditors were unaware that FTX did not have enough money to match customer withdrawals, the source says.

- Three sources familiar with the company told CNBC that they were blindsided by FTX's missteps and that only a small cohort knew about the potential misuse of customer deposits.

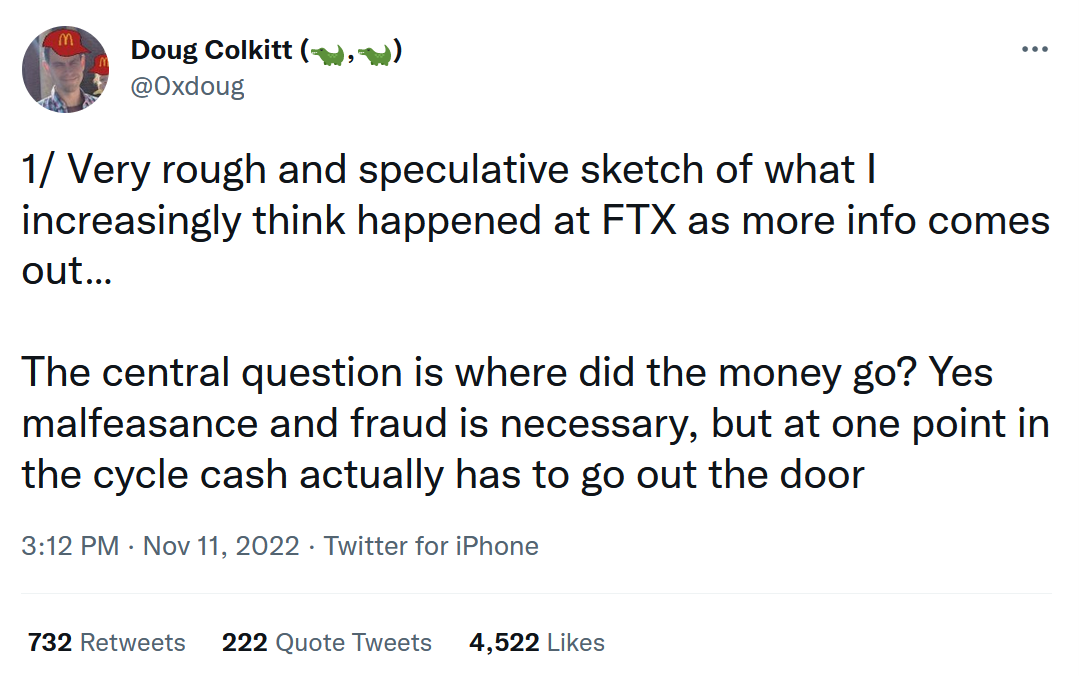

There's a lot of speculation about exactly what kind of activities Alameda and FTX were doing... This Twitter account has trenchant insights:

As does this thread:

2) As usual, Berkshire Hathaway (BRK-B) chairman Warren Buffett and vice chairman Charlie Munger nailed it: Bitcoin 'stupid and evil,' Berkshire Hathaway vice chair Munger says and this video from Berkshire's 2018 annual meeting:

I love what Munger says when Buffett asks him if he has anything to add:

Well, I like cryptocurrencies a lot less than you do. To me, it's just dementia. I think people who were professional traders that go into trading cryptocurrencies, it's just disgusting. It's like somebody else is trading turds and you decide, "I can't be left out."

3) This weekend, I ran my sixth World's Toughest Mudder, a 24-hour obstacle course race, which took place from noon Saturday to midday Sunday in Atmore, Alabama, about an hour north of Pensacola, Florida.

The goal is to complete as many five-mile laps as possible, each with 20 obstacles, including mud, freezing water, monkey bars, crawling under nets and barbed wire, over walls, etc.

I had a great race, completing 13 laps (65 miles and more than 200 obstacles), which was good enough for second place in my age group (55 to 59 – I recently turned 56).

Below are pictures of me with my friends before the race and afterward.

I'm wearing a neoprene hood, two of my ski jackets, and my ski pants to maintain my body temperature and fight off hypothermia, as the low temperature on Saturday night was in the mid-30s, plus there were 10 to 15 mph gusts of wind and I was wet for 23 hours.

Right now I feel like a fleet of trucks ran over me – it seems like every muscle in my body is aching! But the worst pain is from the terrible chafing on my upper legs because I forgot to apply GurneyGoo – rookie mistake!

I've posted more pictures and details on my Facebook page here.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.