We're Not in a Recession... Right Now

Folks are worried about a recession... There's no doubt about that.

And a lot of that fear comes from President Donald Trump's trade war.

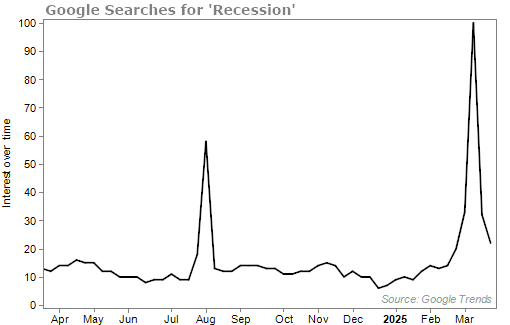

Before the flurry of news surrounding more tariffs on several of America's major trading partners, not many people feared a recession. But in just a couple short months, that's changed.

The chart below comes from Google and looks at the popularity of search queries for "recession" over the last 12 months. A reading of 100 represents the peak popularity for recession searches.

Average folks aren't the only ones with recession on the brain. Many economic analysts are pricing in slower economic growth...

Bloomberg gives the odds of recession at 25%.

A new survey from Deutsche Bank says the probability of a recession over the next 12 months is higher than that, at 43%.

So, how do we know if we're in a recession?

The general rule of thumb is that we're in a recession when we see two consecutive quarters of negative gross domestic product ("GDP") growth – the value of all goods and services a country produces.

Since GDP data comes out a couple months after the fact, a lot of analysts look at the Federal Reserve Bank of Atlanta's GDPNow tracker. This indicator uses real-time economic data to give us a "nowcast" of current GDP growth. Over time, it works pretty well.

Earlier this month, the GDPNow tracker caused quite a kerfuffle. It took a huge nosedive, going from around 2% real GDP growth to a near 3% contraction...

That chart screams possible "recession."

But if you dig deeper into the components of the GDPNow data, it looks like the decline comes from a cooldown in net exports.

Again, this is a result of Trump's tariffs. Goods imports are up – perhaps due to U.S. buyers getting ahead of tariffs – and exports are way down. That downward trend in net exports is the exact opposite of what Trump wanted to see.

While net exports are important, this GDPNow reading doesn't necessarily mean recession. It's more like an accounting quirk. And for now, things like consumer spending and residential investment are on the positive side of the ledger.

Not Every Indicator Is Pointing to a Recession

While two consecutive quarters of negative GDP growth is the general rule for a recession, the National Bureau of Economic Research ("NBER") uses a broader definition. It looks for a "significant decline in economic activity spread across the economy, lasting more than a few months."

The NBER considers other factors beyond GDP to call a recession. It looks at things like employment, industrial production, and real income.

In February, the U.S. added more than 150,000 jobs – about par for the economy. And the unemployment rate sits at 4.1% (below the historical average of about 5.6%).

For even more real-time jobs data, you can look at initial unemployment claims. These come out every week. And as of the week ending March 15, they sit at 223,000. Recessions don't typically start until unemployment claims hit 300,000 to 400,000.

Based on this data, we're not in a recession... right now.

And that's good news for stocks. We don't typically see a nasty bear market unless there's a recession attached to it.

Things can obviously change. So we'll keep a close eye on the data in the coming months.

But in most markets, individual investors shouldn't fret over daily economic releases. That's the business of day traders and folks on the interest-rate desk at a big bank or hedge fund. (And writers of financial newsletters.)

To help you prepare if the worst should happen, my friend and colleague Marc Chaikin is hosting his first-ever Crash Summit. Marc will detail how to navigate this volatile market and the extraordinary moneymaking opportunity for folks who understand what's coming – as well as money moves you should make today.

Be sure to reserve your spot here.

What We're Reading...

- The probability of a recession is approaching 50%, Deutsche markets survey finds.

- Federal Reserve Bank of Atlanta – GDPNow.

- Something different: Why you need to watch this 'spot-on,' star-studded takedown of modern Hollywood.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

March 26, 2025