What Markets Do Post-Inauguration

It's official...

Donald Trump was sworn in on Monday to become the 47th president of the United States.

Trump kicked off his second term with a declaration that "the golden age of America begins right now."

Many people are excited about what changes he'll bring to our country... Others are not so excited.

All the major news sites have predictions about how his second term will go, so I (Jeff Havenstein) won't get into all that. Our focus here is not on politics but on growing your wealth (no matter who is in the Oval Office).

So today, I want to look back and see how stocks have reacted following a new president...

As I've written before, stocks usually rally after elections. There's less uncertainty about future policy and, therefore, markets tend to rise in November and December.

We saw that at the end of 2024. Stocks jumped nearly 6% in November (though they did give back some of those gains in December).

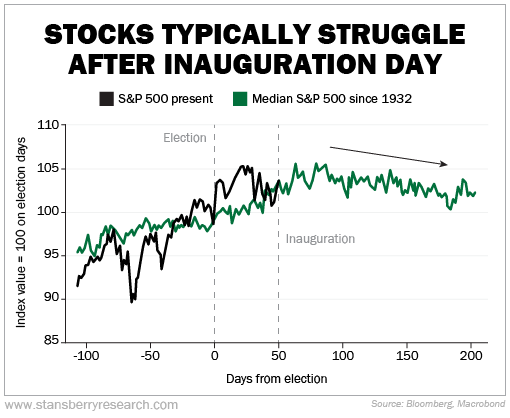

Looking past Inauguration Day, however, it's a different story. Stocks typically struggle.

The chart below reveals how the S&P 500 Index has historically performed following a presidential election and Inauguration Day. The data for the green line goes all the way back to 1932, so it gives us a good macro view...

As you can see, we could be in for a bumpy few months. This makes sense, as investors will be reacting to Trump's actions, not just promises on the campaign trail.

Of course, Trump is not the typical president. He's wildly outspoken. And unlike a lot of politicians, he does make drastic changes...

In his first term, Trump delivered on the biggest corporate tax cuts in our nation's history, cracked down on international trade, and eliminated a bunch of environmental regulations.

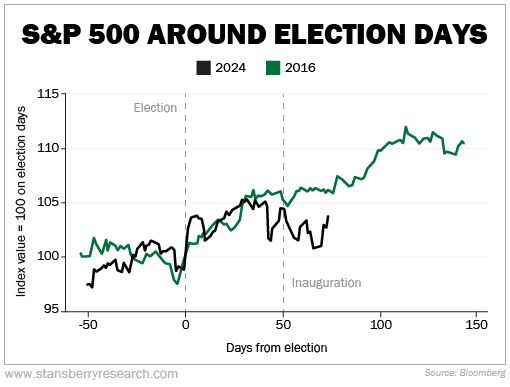

Stocks did very well with him at the helm. Even though markets have historically struggled following Inauguration Day, they shot up in the weeks and months after Trump took office in 2016.

Take a look...

I believe we could see something similar this time around, too...

As I've said before, I'm bullish on the markets in 2025. There are some troubles brewing in the economy, but sentiment is high. A lot of folks want to see change, and I think that's just what they'll get under Trump. So that could push sentiment even higher.

My guess is that market performance will more closely resemble early 2016 than the historical median.

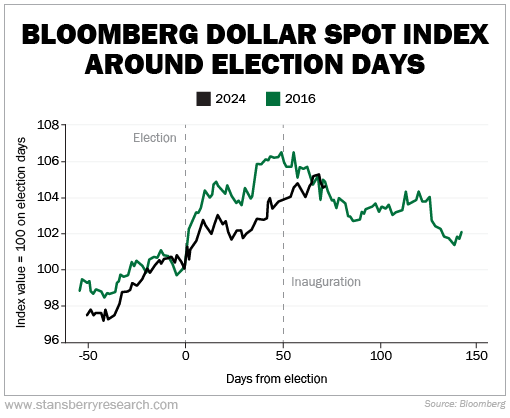

And before I sign off today, I also want to briefly talk about the U.S. dollar... Not only has the dollar been on a tear recently, but it's also closely tracking its 2016 movement. Check it out...

In 2016, the dollar rallied after the election and into Inauguration Day. But then it gave back some of those gains over the next few months.

I think we could see a repeat performance this time around. The dollar is due for a pullback in the coming months. And if this happens, you'll want some exposure to emerging-market stocks.

You see, the U.S. dollar has an outsized effect on emerging markets. When the dollar is strong, you don't want to own such stocks.

That's because foreign companies typically hold a good portion of their debt in U.S. dollars. And when they bring in sales, it's typically in their local currency. So a stronger dollar means their debt pile grows while their revenues become less valuable.

Plus, emerging markets rely on foreign investment. These investors lose interest in emerging markets when U.S. companies are doing well.

The opposite is also true. When the dollar weakens, emerging markets usually do better. And since we expect a weakening dollar, this is where our opportunity lies.

One of our favorite ways to get exposure to emerging markets is though the iShares MSCI Emerging Markets ex China Fund (EMXC).

EMXC is a broadly diversified exchange-traded fund that holds 688 stocks across many different countries. Its biggest geographic exposures are Taiwan (27.5%), India (25.2%), and South Korea (13.2%).

If the dollar does pull back over the next several months, EMXC should rise.

As Doc has preached for many years, smart investors should diversify their portfolios. You don't want all your eggs in one basket.

It's important to own stocks from countries outside of the one you're living in. And EMXC is a great one-click way to do that.

What We're Reading...

- Six takeaways from Trump's inaugural address.

- For Retirement Millionaire subscribers: Don't trap yourself in the next disaster.

- Something different: Inside Iceland's futuristic farm that's growing algae for food.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein

January 22, 2025