What to do with your busted growth stocks?

Sometimes you gotta laugh to avoid crying, so in light of the beating growth stocks have taken, I decided to laugh at this meme that someone tweeted (it refers to the hit Netflix series, Squid Game):

It does raise a serious question, however, that millions of investors (myself included) are grappling with: If you have the misfortune of owning some of these stocks and are sitting on big losses – in many cases, exceeding 50% in just the last four months – what should you do?

Here are some of my thoughts...

Generally speaking, if I like a stock at one price, I like it a lot more after it's been cut in half.

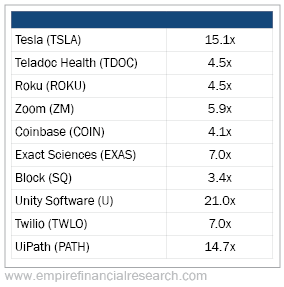

But here's the problem: By any historical and/or objective measure, most high-growth stocks are still not anywhere close to cheap. For example, let's take a look at the enterprise-value-to-revenue (similar to the price-to-sales) multiple of the top 10 holdings of go-go-growth darling Cathie Wood's ARK Innovation Fund (ARKK):

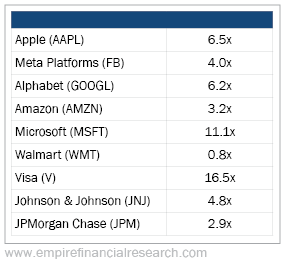

For comparison, here are the revenue multiples for some of the companies with the largest market caps in the world:

My takeaway from this is that while some of the most popular growth stocks are trading at much less crazy multiples, there's nothing to stop them from going down a lot more, as their valuations are still well above where value investors like me would step in to buy...

Remember: What's the definition of a stock down 90%? One that's down 80% – and then gets cut in half!

Also, from a flow-of-funds perspective, Wood and other growth investors are only in the early innings of what will likely be a huge hemorrhaging of assets resulting from their horrific returns.

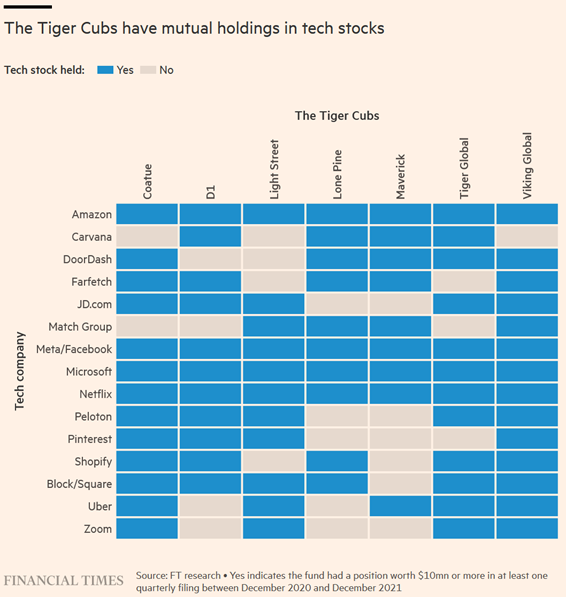

The biggest hedge fund in the space, Tiger Global Management, which had $95 billion in assets as recently as October (about two-thirds in private investments), I hear is down 50% in its stock funds since then. Look at the overlap in holdings among the "Tiger Cub" hedge funds (from this Financial Times article: 'Brutal' selling in speculative tech stocks knocks Tiger Cub hedge funds):

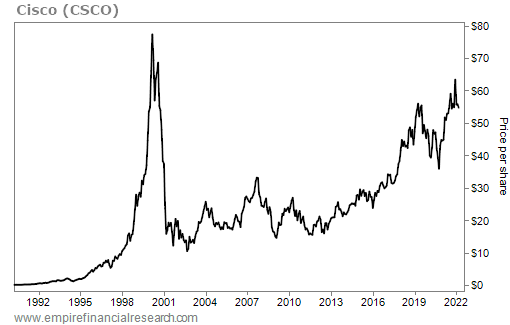

Lastly, there's no guarantee that fallen growth stocks will ever surpass their previous highs.

After 21 years from 2000 to 2021, during which operating income rose from $4.6 billion to $14.1 billion, plus 20 years of share repurchases that decreased the share count by 40%, Cisco's (CSCO) stock is still below its early 2000 high:

So that's the bear case on the high-growth stocks. What's the bull case?

Some of them have insanely great underlying businesses, with huge growth runways and/or fabulous recurring revenue business models, so they may well be worth 10 times revenue or more.

But you'd better be right on this, because if competition emerges and/or management makes missteps on execution, resulting in slowing growth and/or weakening margins, look out below...

So that's your challenge: to separate the wheat from the chaff.

If you're looking for help with this, I recommend checking out my colleague Enrique Abeyta's Empire Elite Growth newsletter. He has identified a handful of fabulous businesses whose stocks, he believes, are likely to rebound strongly from here. (Click here to learn more about it.)

In summary, I think it's too early to start buying across the sector. Rather, I'd exit my low-conviction stocks, hang onto my high-conviction ones, and add to my absolute favorites.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.