What to Expect for the Markets in 2025

There's no crystal ball in investing.

Any analyst who claims to know what stocks will do next is talking out of his or her you-know-what. Markets have a mind of their own.

Still, as analysts, our job is to give our opinion on what we think will happen. I've been in this game a long time and am a student of financial history.

In general, I tend to be a bit more conservative these days. As I detailed in the September issue of Retirement Millionaire, storm clouds are forming over the economy and market.

For folks who aren't subscribers, I'll recap the bad omens...

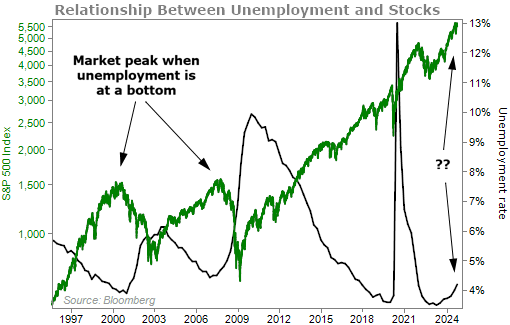

First, unemployment is rising, which is a great predictor that the market is close to a top. Just take a look at the inverse relationship between the unemployment rate and the S&P 500 Index...

|

Next, folks are having trouble paying off their credit cards... Credit-card companies wrote off $46 billion in seriously delinquent loan balances during the first three quarters of 2024. This is up 50% compared with the same period in 2023. And it's the highest level in about 14 years.

In the same vein, many families cannot afford the record-high prices of homes today. And making matters worse, the yield curve has un-inverted. The yield curve is the difference between the yields on fixed-income securities maturing at different times. As this is my No. 1 recession indicator, the fact that it has been triggered signals a recession is looming.

Finally, when it comes to stocks, the problem is twofold... The S&P 500 is near its highest valuation ever, and a small group of tech stocks is doing the heavy lifting for the Nasdaq Composite Index. I've also talked about the heavy concentration of the "Magnificent Seven" in the S&P 500 many times before.

My senior analyst, Jeff Havenstein, is more bullish than I am. He's aware of all the dangers lurking behind the scenes. But he doesn't see signs of "euphoria" in stocks just yet. He's calling for another move higher in 2025 as investors escalate from a state of optimism and excitement to that euphoria.

He believes sentiment is the key to predicting future returns.

When we reach a point where stocks are all your neighbors want to talk about, then you'll know we're at that euphoric stage. That'll be the bright, flashing sign telling us that markets are living on borrowed time.

Jeff doesn't believe we're there yet, but he thinks we're close.

Now, I'm not ruling Jeff's outlook out. I certainly believe stocks could move higher this year. But I'm a lot nearer to retirement age than Jeff. I see a not-so-distant future where I'm on a beach sipping on a cocktail with a little umbrella in it. So I'm naturally more conservative. But don't worry... I plan to write Health & Wealth Bulletin and my other publications for a long time.

(If you agree with my conservative outlook, be sure to check out today's issue of Retirement Millionaire. In the issue, which will publish this evening, we recommend one of the safest stocks in the market. This monopoly plans to grow its dividend payments 7% to 9% a year. And even better, it's trading at its cheapest valuation in eight years.)

Jeff and I do agree on one thing, though... We're overdue for a market correction.

As I always like to say, corrections – that is, drops of 10% to 20% – are a normal part of the market cycle.

Even during the last great speculative market run during the dot-com boom, the tech-heavy Nasdaq fell roughly 10% four times on its way to posting a return of 255%. Again, corrections are normal. They're nothing to fear... even in bull markets.

Stocks were up 24% in 2023 and another 23% in 2024. With that in mind, I want to end today's essay by sharing Matt Weinschenk's opinion on stocks having another banner year in 2025. Matt is our company's director of research and has been leading my team of analysts for many years.

Matt believes the key to excellent returns in 2025 will come from artificial intelligence ("AI"), a technology that hasn't translated into much earnings growth just yet. As he recently wrote in an issue of This Week on Wall Street...

Three-peats are rare. The only time we've seen one, it went on to become an effective five-peat... and it did so on the back of a generational shift in technology.

The question is this... With AI as an analogy to the Internet, are we in 1995 or 1999? Are we set for another few big years? Or are we due for a correction? Perhaps the lack of earnings suggests we're earlier in the cycle.

The only way the market tacks on another big year is if the advances in AI support the rising excitement about the technology.

That's to say, AI doesn't need to generate true profits just yet. But if the technological advances continue at a rate that keeps excitement rising, the market can follow a similar path to the 1990s for a while.

In the end, my game plan is to stay in the market in 2025. Stocks can absolutely have another positive year.

But I'm not going "all in." I'm going to continue investing cautiously, holding only the highest quality stocks. Also, I've tightened a lot of my stop losses so that if the selling does start, I'll be able to book gains on many of my longer-held positions.

This brings us to TradeSmith's new breakthrough system... If you're concerned about what 2025 may have in store for the markets, this technology is for you. Using 33 years of back testing, TradeSmith has developed a system to tell you when a stock is most likely to soar.

All you have to do is type in a ticker to get that specific stock's "green date" – meaning when you should buy it, according to historical data. Boasting an overall success rate of 83%, this technology is worth giving a try today. Get the details here.

What We're Reading...

- The dam is about to break on record-high consumer debt as U.S. credit-card loan defaults soar.

- Something different: Online holiday spending rises nearly 9%, as deep discounts and AI-powered chatbots fuel purchases.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

January 8, 2025