When investing, set your politics aside; The benefits of dollar-cost averaging; Bosses mean it this time: Return to the office or get a new job!; New York Times history quiz

1) A hat tip to my colleague Enrique Abeyta for reposting this tweet...

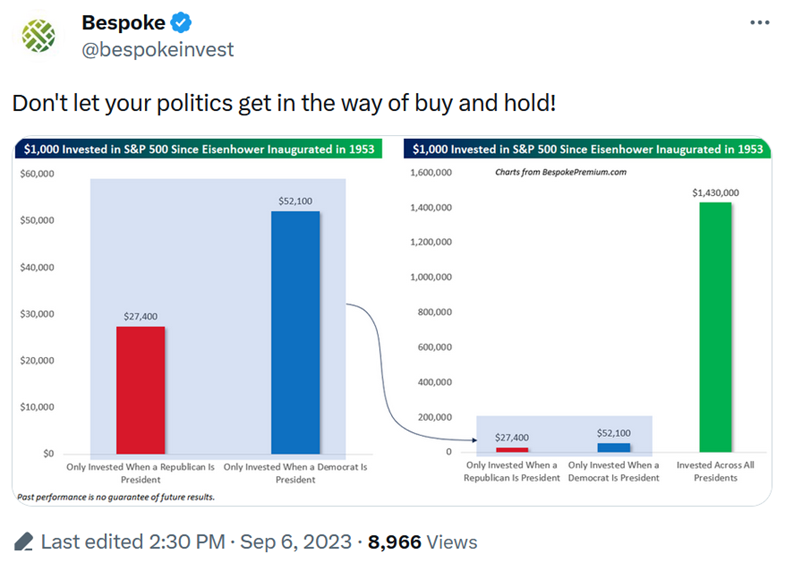

It shows how a $1,000 investment in the S&P 500 would have done over the past 70 years had it been invested only when a Republican versus a Democrat was president – versus being fully invested the entire time. As you can see, it is absolutely deadly to long-term returns to allow partisan political viewpoints to drive your investment decision making:

I bring this up because I regularly hear from readers who tell me how terrible the economy is – and blame President Joe Biden for it – which mirrors what I heard from Democrats when Donald Trump was President. Or they flame me for including an article about New York Times columnist Paul Krugman because of his liberal leanings.

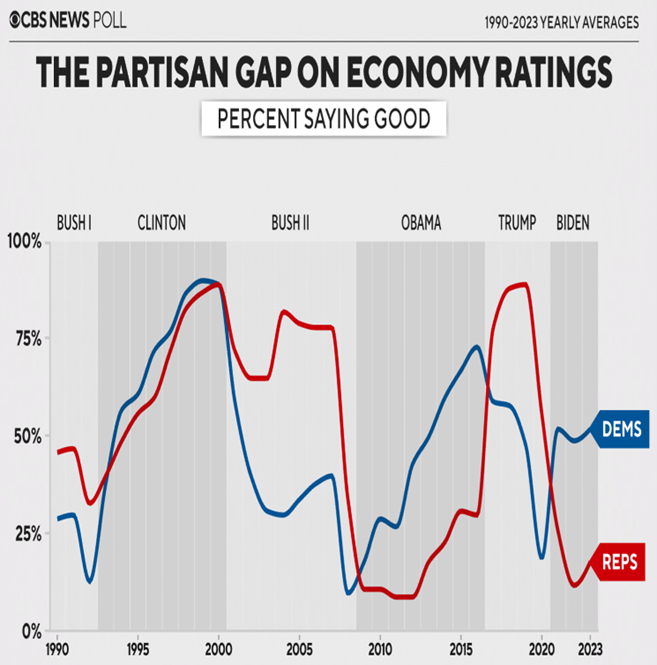

It's especially easy to make this mistake in light of today's extremely polarized political environment. Consider these two charts a friend sent me...

Americans used to have roughly similar views on the economy, but that has increasingly disappeared, especially in the past two administrations:

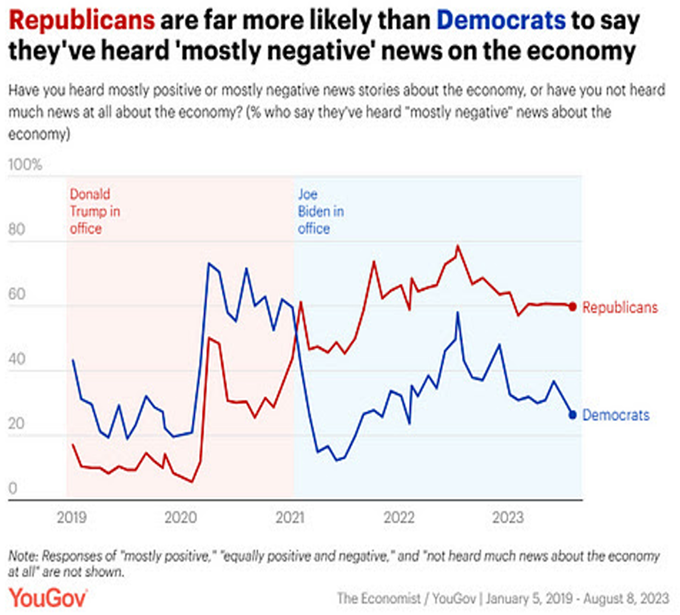

The next chart explains why – it's the media they're consuming (note that this phenomenon exists in both directions, depending on who's president):

There are three key lessons here:

- Try to read, watch, and listen to a wide range of media so you hear both sides of issues.

- Stick to high-quality news sources. For example, I rely heavily on the Wall Street Journal, the New York Times, the Washington Post, and the Financial Times.

- Don't let your political viewpoints affect your investment decision making.

Here at Empire Financial Research, we have certainly stayed invested... and in fact, I've been recently pounding the table on a specific opportunity in advance of an extremely rare convergence of two economic forces.

In a special presentation, I share all the details – including what you can do to take advantage. Check it out right here.

2) Related to this discussion of the benefits of long-term, buy-and-hold investing is dollar-cost averaging – another critical tool that should be in every investor's toolkit.

Ben Carlson in his A Wealth of Common Sense blog just posted this: Dollar Cost Averaging in a Bear Market Wins Again. In it, he analyzed what would have happened to two people who invested at the beginning of 2022 (close to the market peak), which turned out to be the seventh-worst year for the S&P 500 since 1928, through July of this year.

Someone who invested at the beginning of this period and simply held on would have lost just 1.2%, thanks to the strong market rally this year.

That's not bad... but consider someone who started with zero and invested $500 at the end of each month – 18 investments totaling $9,000. This person would have ended the period with $9,934.30, a gain of 13.1%.

You can use this calculator to cover any time period and monthly investment amount you wish, dating back to 1871. If you play with it, you'll see the power of dollar-cost averaging...

So what's the best way to do this? Make it automatic. As I wrote in my September 20, 2021 e-mail, Financial advice to a recent college graduate:

Ideally, set up automatic withholding from your paycheck into your IRA (or another retirement fund) – this makes it easier to save because you never see the money.

Then, set up a plan such that the moment the money hits your account, it's automatically invested in an S&P 500 Index fund. (If you want to set aside some money to invest on your own, that's fine – sign up for my newsletters at Empire Financial Research to help you do so – but index most of it.)

Finally – this is key – don't look at it! Just let it build, year after year, decade after decade. Whatever you do, don't panic during times of market turmoil and sell – just about everybody who does this has terrible timing, selling at exactly the wrong time (for example, in March 2009 or 2020).

Consider the extreme case of my sister, who had a retirement account at her old employer, then switched jobs – and forgot about it! Years later, she remembered it – and discovered hundreds of thousands of dollars (!) because she'd done everything right up front: her employer automatically withdrew the maximum retirement contribution from her paycheck and then invested all of it in an S&P 500 Index fund.

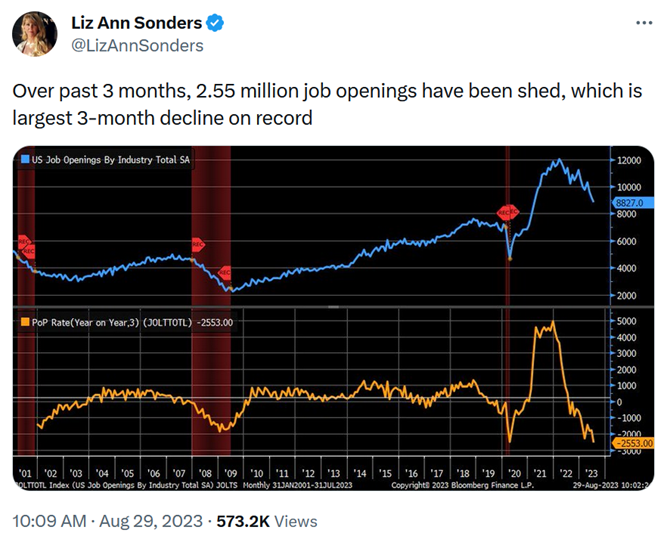

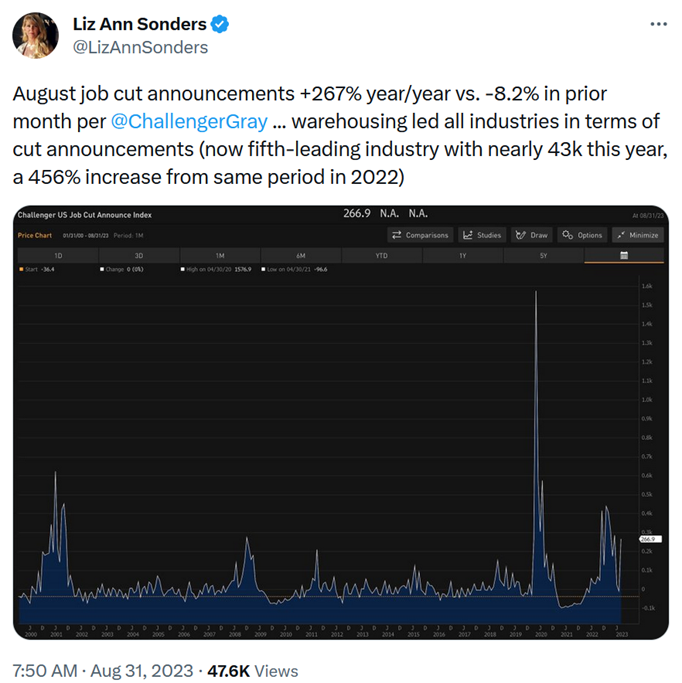

3) The labor market remains strong, but is definitely softening a bit, as shown in these two charts by Liz Ann Sonders that I included in yesterday's e-mail:

As a result, more and more employers are feeling like they can force employees to starting coming back into the office, as this Washington Post article notes: Bosses mean it this time: Return to the office or get a new job! Excerpt:

After more than two years of trying to coax workers back into offices, bosses are losing their patience.

The days of enticing employees with free food, laundry services and yoga classes are largely over. Now, executives are resorting to threats – and it's forcing some workers to decide whether they're willing to give up the flexibility they've gotten used to.

The new pushes for in-person work mark a major shift as executives directly acknowledge the challenges with the model – in some cases saying productivity has declined, and citing fewer opportunities for spontaneous collaboration, mentorship, and connection-building. Meanwhile, employers have new leverage as the labor market has cooled, leaving workers less room to be choosy.

"The pendulum has shifted from employees having all the power," said Matt Cohen, founder and managing partner of Ripple Ventures, a venture fund in Toronto that works with early stage companies across North America. The bulk of start-up founders he works with are requiring employees to be in offices a few days a week, although there's pushback.

Some employers are being clever about it, as this Wall Street Journal article about J.M. Smucker (SJM) notes: This Company Created a Return-to-Office Plan That Employees Actually Like. Excerpt:

Smucker has adopted a return-to-office strategy that is unusual among U.S. companies. The company expects its roughly 1,300 Orrville-based corporate workers to be on site as little as six days a month, or about 25% of the time, depending on their roles.

Employees are told to hit that threshold by coming in during 22 "core" weeks a year. Many employees can live anywhere in the U.S. so long as they pay their own way to get to Orrville for core weeks. This has led to a growing group of super-commuters who reside elsewhere but work in Orrville.

The lasting tectonic change from the pandemic is how Americans work – including whether they show up to offices at all. The issue is rattling employers and vexing public officials in cities such as San Francisco, which is struggling to keep its downtown afloat, and New York, where subway ridership remains below its prepandemic weekday average. At major companies, otherwise-compliant employees keep flouting directives to show up, frustrating bosses.

As Labor Day approaches, many companies are again issuing stern memos to workers or handing down new in-person edicts to repopulate spaces this fall. Smucker executives say there is something remarkable about its return-to-office approach: Employees are mostly following it, with limited grumbling. Core weeks also appear to be eking more work out of employees in some circumstances.

4) The New York Times recently launched a new weekly history quiz, which (as a history buff) I'm enjoying – though I'm annoyed that I misplaced two of eight historical events in the latest quiz, after acing the initial one. You can try it here.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.