Why declining stock prices are good news; Why META is a buy; Why Musk didn't get a discount; Federal Officials Trade Stock in Companies Their Agencies Oversee; World's Toughest Mudder

1) I've pretty much nailed everything on the short side this year, but not so much on the long side (which I suppose isn't too surprising in light of the market's big losses).

That said, though most people fail to understand this, declining stock prices are good news for long-term investors. Warren Buffett explained why in his 1997 letter to Berkshire Hathaway (BRK-B) shareholders:

If you plan to eat hamburgers throughout your life and are not a cattle producer, should you wish for higher or lower prices for beef?

Likewise, if you are going to buy a car from time to time but are not an auto manufacturer, should you prefer higher or lower car prices?

These questions, of course, answer themselves. But now for the final exam: If you expect to be a net saver during the next five years, should you hope for a higher or lower stock market during that period?

Many investors get this one wrong. Even though they are going to be net buyers of stocks for many years to come, they are elated when stock prices rise and depressed when they fall. In effect, they rejoice because prices have risen for the "hamburgers" they will soon be buying. This reaction makes no sense. Only those who will be sellers of equities in the near future should be happy at seeing stocks rise. Prospective purchasers should much prefer sinking prices.

2) With this wisdom in mind, in Friday's e-mail I discussed why I think the huge decline in the price of cannabis stocks is a tremendous buying opportunity.

Today, I'd like to turn to another one of my favorite stocks about which I feel similarly: Meta Platforms (META), the parent company of Facebook, Instagram, and WhatsApp.

META shares have gotten absolutely clobbered, hitting a low not seen since late 2016 yesterday – closing at $128.54. That's down 64% since they hit an all-time high of nearly $400 last August... a staggering $645 billion decline in market cap for the company.

Such dismal performance led one person to post on ValueInvestorsClub ("VIC"), my favorite stock-idea website:

It's the textbook example of a value trap and exactly what one should be looking for in a short – a rapidly melting ice cube where management is lighting your cash flow on fire.

I disagree. To understand why, I'll first cite this VIC post in response:

I think META is likely a big long here. Digging in further over the weekend, it seems to me that price is dictating a lot of the narrative. The stock is priced for a Yahoo-like implosion and I feel overall the business is substantially better than any analog to a Yahoo.

One could likely make the case that if this was in private equity hands, this would likely be a multi-bagger in a few years. One has to wonder if running a handful of apps requires north of $80 billion in costs – my hunch it doesn't require anything near that.

And just recently we've gotten hints that spending might come down substantially (job cuts equal to ~15% of the workforce), along with anecdotal evidence from employees that almost every type of cost at Meta is being looked at in some fashion.

Meta at 6.7x is cheaper on an EV/EBITDA basis than IBM, GM, MO, and around par with XOM – bottom line, a lot is priced in here.

Oh by the way, you've got a big upcoming catalyst on Oct. 11th with Meta Connect, with a possible date for the new release of Quest 3 upcoming (which should incorporate micro OLED, or some version of significantly improved graphics, alleviating some concerns around Minecraft graphics).

We've seen countless mega-caps at very low multiples when the skepticism was close to peaking – Apple, Google, and Microsoft – and those all turned out to be huge winners over the long term.

Also for what it's worth, I think Meta along with the rest of the biggest decliners among tech/growth stocks are experiencing some major tax-loss selling as most mutual funds have a fiscal year end of Oct. 31st and need to part ways with their biggest losers. Meta as one of the biggest losers year to date falls squarely into that category. History also shows that forward returns in the next 3-4 months look very promising.

I could certainly be wrong here, as Meta has its share of major problems and headwinds, but my inclination is that so much of these things have been priced in and the fear/negativity is palpable.

Andrew Walker of Rangely Capital posted similar views on his Yet Another Value Blog: Does Facebook today resemble Microsoft in 2011? Excerpt:

Earlier this year, I did a post on finding stocks that could mirror the "epic" 10-year run that MSFT (and NVDA) had. Alex first bought MSFT in 2011, so he was there for that whole ride. Seeing that purchase date next to a long position in Facebook got me thinking: why couldn't FB be set for the next MSFT-like run?

Maybe that sounds crazy. But consider the checklist that set MSFT up for a big run:

- It was already one of the largest companies in the world.

- It was trading at ~10x earnings.

- People were worried their core product (Windows) was going to zero.

- Analysts were putting a huge capital allocation discount on the company as their CEO clearly didn't understand the tech landscape, was pursuing the wrong strategies, and was lighting money on fire with awful acquisitions.

Compare that to Facebook today:

- It's one of the largest companies in the world (just outside of a top 10 holding for the S&P).

- It's trading for ~10x P/E despite having ~10% of their market cap in net cash (I'm using rough numbers; the numbers are probably closer to 11x P/E and 7% net cash but whatever).

- People are worried their core product (Facebook) is dying, and there's huge concern that all of their products are losing massive share to TikTok.

- People are putting a massive capital allocation discount on FB as they worry the CEO's pursuit of metaverse domination is quixotic.

They say history doesn't repeat, but it rhymes... and the Facebook story above certainly seems like it rhymes quite a bit with the Microsoft story a decade ago.

And it might rhyme even more than you think at a glance. Fears of Windows dying have been around for way over a decade now, yet the core Windows/Office suite is still here and minting money. Similarly, fears of core Facebook dying have been around for years (you might notice the "core Facebook product" link I used above is from 2018; I did that intentionally just to show how long these fears have been around!).

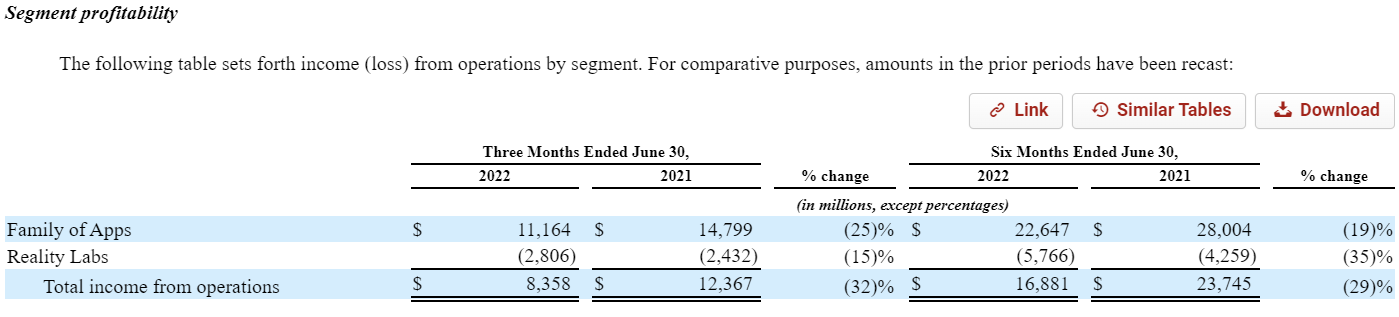

Plus, the Facebook story today might be even better than that headline "rhymes with MSFT" story. As mentioned above, Facebook today trades at ~10x P/E... but that's after accounting for an enormous investment into its (possibly failing) metaverse strategy. I've got a screenshot of their segment profitability for H1'22 below; you'd have to imagine that if their execution remains this poor, eventually the vast majority of those Reality Labs expenses are going away/getting cut aggressively. Adjust for that, and Facebook is even cheaper!

And I'd argue both Instagram and especially WhatsApp remain under monetized, so you probably have several growth/profitability levers that will get pulled at each of those in the long run (making Facebook's steady state multiple even cheaper!).

When blue-chip stocks like META go on sale, you should buy them hand over fist. My colleague Herb Greenberg has assembled a world-class portfolio of stocks that have gone on sale recently that he's pounding the table on today. See how to gain immediate access to these names with a 100% risk-free trial by clicking here.

3) In Monday's e-mail, I shared a theory from the New York Times DealBook that the reason Elon Musk wasn't able to negotiate a discount on his acquisition of Twitter (TWTR), which I expected, was because:

Had Musk pushed Twitter to redo the deal, the banks could have tried to reprice their loans at higher interest rates, pushing financing costs up for the billionaire. Or they could have pushed to reduce the total amount of debt they funded, making Musk – who is on the hook for all of the remaining equity – personally responsible for a larger portion of the deal.

A friend of mine disagreed and I think he's right, so I wanted to share what he wrote:

The issue of why the deal didn't actually get recut 10% lower a month or two ago is mostly separate from the issue of whether it will close in October at $54.20.

The simplest explanation for why it didn't get recut is that Twitter became less and less willing to do so as its litigation position got stronger and stronger with each court hearing, each court ruling, and each revelation of evidence hurting Musk and lack of evidence helping Musk.

The simplest reasons for why Musk is likely to close in October are that (1) a financing out is unlikely and (2) it is increasingly true that, if Musk he doesn't, he will face the wrath of this judge, aka from Musk's perspective, God.

I continue to think TWTR shares are a buy anywhere under $50.

4) Kudos to the Wall Street Journal for this outstanding piece of investigative journalism exposing this scandalous behavior: Federal Officials Trade Stock in Companies Their Agencies Oversee. Congress needs to expand the bill that it has shamefully failed to pass to rein itself in (see: House Puts Off Vote to Limit Lawmakers' Stock Trades, Casting Doubt on Prospects) to include all government officials. Excerpt:

Thousands of officials across the government's executive branch reported owning or trading stocks that stood to rise or fall with decisions their agencies made, a Wall Street Journal investigation has found.

More than 2,600 officials at agencies from the Commerce Department to the Treasury Department, during both Republican and Democratic administrations, disclosed stock investments in companies while those same companies were lobbying their agencies for favorable policies. That amounts to more than one in five senior federal employees across 50 federal agencies reviewed by the Journal.

A top official at the Environmental Protection Agency reported purchases of oil and gas stocks. The Food and Drug Administration improperly let an official own dozens of food and drug stocks on its no-buy list. A Defense Department official bought stock in a defense company five times before it won new business from the Pentagon.

5) I just signed up to run the 24-hour World's Toughest Mudder for the sixth time, so I've ramped up my training... I'm now jogging five to six miles a day on top of my usual tennis and working out in the gym.

It's taking place in less than five weeks on November 12 to 13 on a farm in Atmore, Alabama, about an hour drive from the nearest airport in Pensacola, Florida. As usual, the race will start at noon on Saturday and end at noon on Sunday (with a 90-minute grace period to finish the last lap, so it's really a 25-and-a-half-hour race). Each lap is five miles with 20 to 25 obstacles, and the goal is to complete as many laps as possible (no credit for partial laps).

I set the all-time 50-plus age group record of 75 miles (15 laps) a few days after my 50th birthday in November 2016... In 2017, I got chilled and crashed so only did 55 miles... In 2018, in which the overnight temps dropped to below freezing and half the field quit due to hypothermia, I stayed out there and mostly walked 60 miles, again winning the 50-plus age group by 10 miles... In 2019, I did 70 miles... And last year (no race in 2020), I did it for the first time as a four-man relay, where we won second place overall with 75 miles (I did 50 personally). I've posted my write-ups from all five of these races here.

Wish me luck!

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.