Why I think META is at an inflection point (part 1); TuSimple Stock Plummets; The Unraveling of Trevor Milton; Climbing in Red Rock Canyon for my birthday today

1) In yesterday's e-mail, I highlighted the carnage among the stocks of the tech giants – especially Meta Platforms (META), which is down more than 70% this year – and argued that their stocks are pound-the-table buys today because they're at "inflection points."

Today and tomorrow, I'd like to make the case for Meta.

As a starting point, I want to share this slide from my presentation last week at the Stansberry Conference, outlining why I have said that Meta and Google parent Alphabet (GOOGL) are two of the greatest businesses of all time:

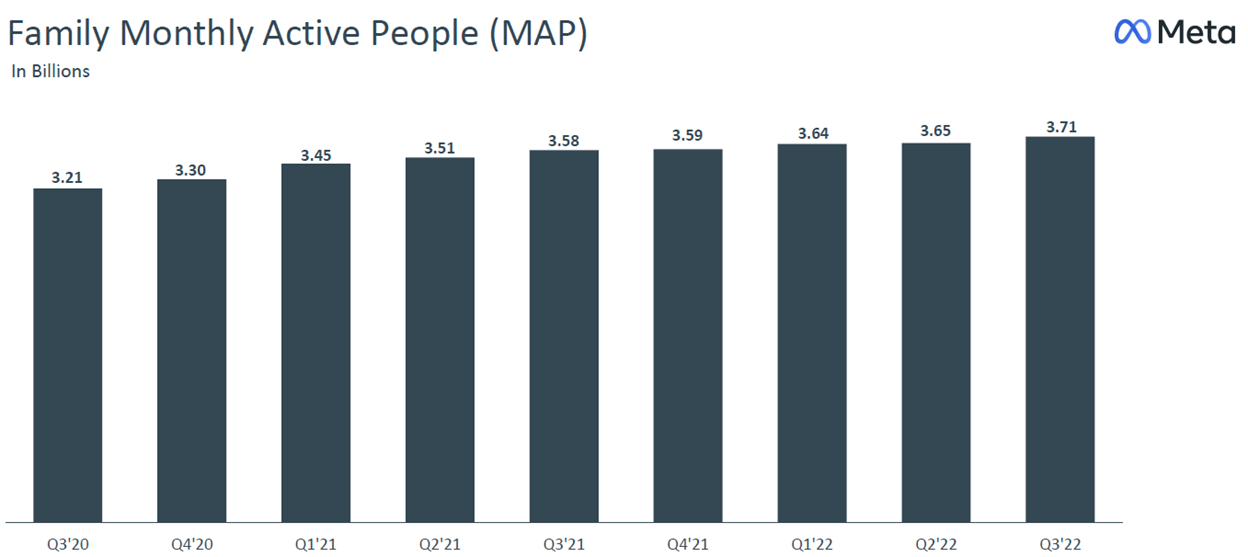

It's important to underscore that, despite the headlines about everyone defecting to TikTok, Meta is not losing users – its numbers continue to grow (albeit slowly), as this chart from the company's third-quarter earnings presentation shows:

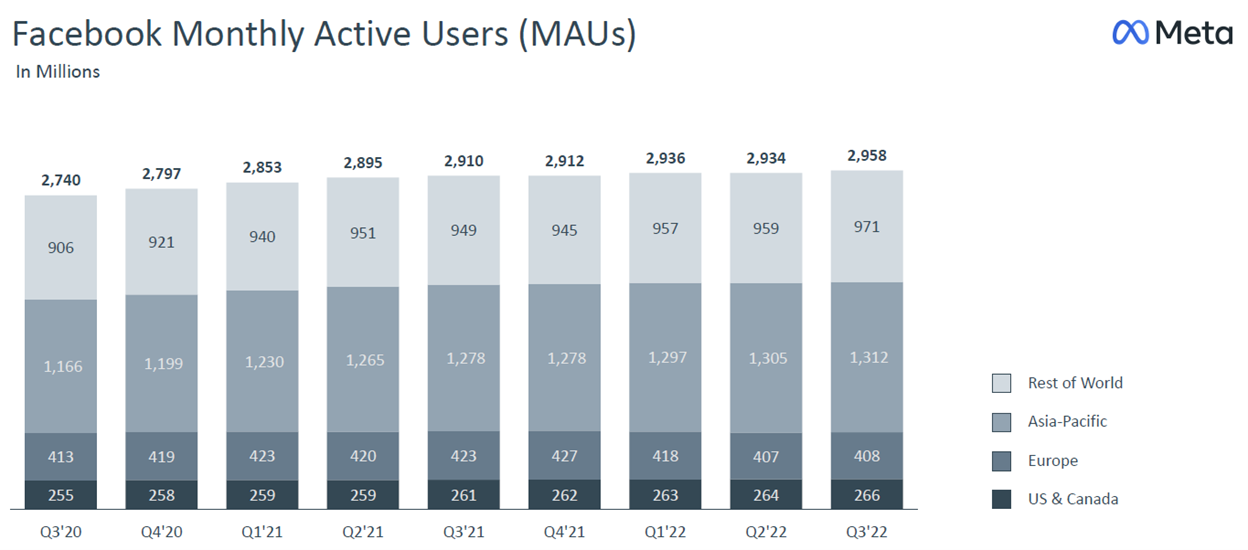

Even much-maligned Facebook is still growing, including in its most mature market of the U.S. and Canada. Here's another slide from the earnings presentation:

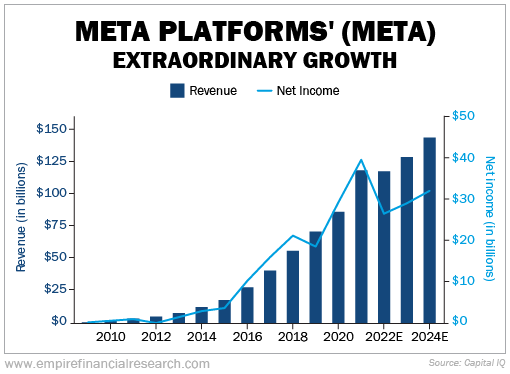

Over time, Meta's growth has been exceptional:

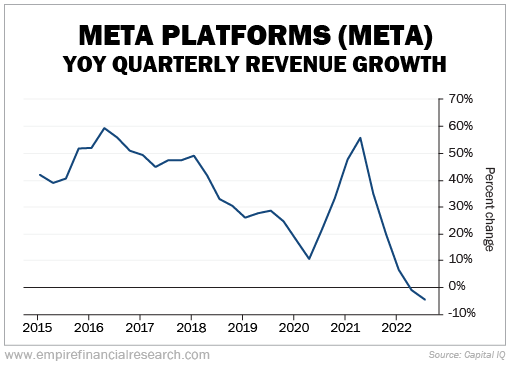

That said, revenue growth has slowed dramatically over the past year, turning negative the past two quarters:

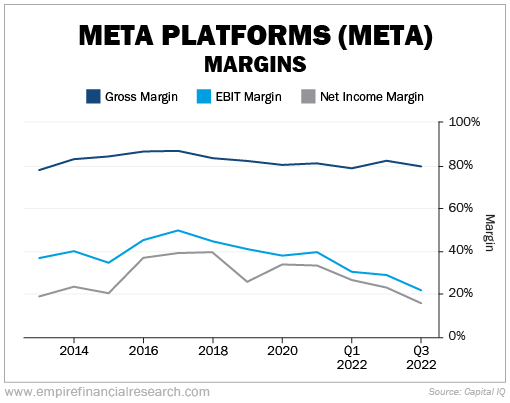

Profit margins plunged in the most recent quarter, but remain high relative to average companies – and gross margin is still exceptional:

The combination of negative 4% revenue growth and a steep drop in net margin resulted in net income dropping 52% year over year in the third quarter.

Investors – as they usually do – are projecting the recent trends indefinitely into the future, which is why the stock has sold off so much... But I think they're making the classic mistake of driving with their eyes firmly affixed in the rear-view mirror.

As I instead look through the windshield, I see a bright future for Meta, which I'll discuss in tomorrow's e-mail... Stay tuned!

2) Another day, another story of yet another China-related fraud...

Shares of the self-driving truck technology company TuSimple (TSP) crashed 46% yesterday in the wake of this Wall Street Journal exposé: TuSimple Probed by FBI, SEC Over Its Ties to a Chinese Startup. Excerpt:

TuSimple, a U.S.-based self-driving trucking company, faces federal investigations into whether it improperly financed and transferred technology to a Chinese startup, according to people with knowledge of the matter.

The people said the concurrent probes by the Federal Bureau of Investigation, Securities and Exchange Commission and Committee on Foreign Investment in the U.S., known as Cfius, are examining TuSimple's relationship with Hydron, a startup that says it is developing autonomous hydrogen-powered trucks and is led by one of TuSimple's co-founders.

Investigators at the FBI and SEC are looking at whether TuSimple and its executives – principally Chief Executive Xiaodi Hou – breached fiduciary duties and securities laws by failing to properly disclose the relationship, the people familiar with the matter said. They are also probing whether TuSimple shared with Hydron intellectual property developed in the U.S. and whether that action defrauded TuSimple investors by sending valuable technology to an overseas adversary, the people said.

Yesterday the company terminated CEO Hou: TuSimple Stock Plummets as Self-Driving Start-Up's CEO Is Removed.

I don't know anything about TuSimple, but why this company still has a market cap that exceeds $700 million is beyond me. This smells like a zero...

3) Speaking of truck frauds, I really enjoyed season two of the WSJ's Bad Bets podcast: The Unraveling of Trevor Milton. It's about a total con man, Nikola (NKLA) founder Trevor Milton, whom activist short seller Nate Anderson famously exposed. Here's a summary:

This season, we delve into the story of Nikola founder Trevor Milton. He took his company Nikola to dizzying heights on the promise of a zero-emissions semi truck. At its peak, Nikola's publicly traded stock was worth more than Ford – until a ragtag group of whistleblowers and short sellers revealed that Nikola and its truck wasn't all that it seemed. This season on Bad Bets, Journal reporter Ben Foldy will tell the inside story of Trevor Milton's rise and fall. You'll hear exclusive interviews and recordings, and details from secret documents. And we'll take you deep into Trevor Milton's federal fraud trial, where he's fighting the charges against him.

4) As you read this, my guide Paul, his wife Breezy, and I are celebrating my 56th birthday today by climbing somewhere in Red Rock Canyon, which is only a 30-minute drive from The Strip in Las Vegas.

Paul and I climbed here for 12 days in a row in October 2020 – it's some of the best in the world. It was in the middle of the pandemic, so we had it to ourselves – it was magical! Here are some pictures from that trip:

Tonight we're picking up my wife who's flying in from Newark, going to the Elton John concert, and then taking the redeye home...

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.