Why Inflation REALLY Matters to Investors

Further Reading:

"Don't get spooked out of the market," Steve says. Stocks recently had their worst week in more than a year. But believe it or not, this could be a good sign – for one reason... Read more here: 100% Chance of New Highs in the Next Six Months.

"We've seen these kinds of readings only 5% of the time since 1987," Brett Eversole writes. One indicator could help explain the recent pullback in stocks... And it won't kill this bull market. Learn more here: Most Investors Now Expect Higher Stock Prices.

DailyWealth Premium

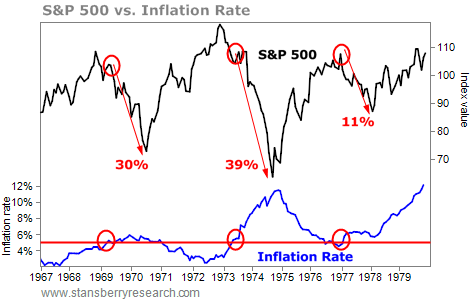

While inflation is rising, it's nowhere near the levels that should worry investors. Stocks could rally higher from here. And history says one particular sector is likely a good buy right now...

AVOID THIS TROUBLED BUSINESS

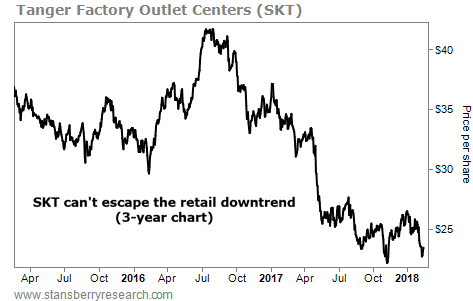

Today's chart highlights the decline of America's malls...

Regular readers know the e-commerce revolution has posed a huge challenge for brick-and-mortar retailers. Last year's online sales in the U.S. are expected to total more than $459 billion... up 17-fold from $27 billion in 2000. In the past, we've highlighted weakness in retailers like JC Penney (JCP), Signet Jewelers (SIG), and L Brands (LB). Today, we'll look at the shares of a struggling mall operator...

Tanger Factory Outlet Centers (SKT) operates 44 outlet shopping centers across the U.S. and Canada. But this company has seen better days... Last year, it "recaptured" around 201,000 square feet from its mall tenants due to bankruptcies and restructurings. (That's up from 105,000 square feet the year before.) Not only that, but the company's pile of debt is increasing – it now owes nearly $1.8 billion.

As you can see below, shares struck a new multiyear low yesterday... And they are now down more than 37% from last year's highs. With more folks shopping online each year, it's likely brick-and-mortar shopping centers will continue to struggle...