Why my 'Spidey sense' is tingling again, warning me of upcoming turmoil among growth stocks

The widespread foolishness among retail investors – who are playing the short-squeeze game with worthless meme stocks – has my "Spidey sense" tingling again, warning me of upcoming turmoil among growth stocks...

I've written about Chinese scam AMTD Digital (HKD), which in my August 3 e-mail I called "one of the most stupidly overvalued, obviously fraudulent stocks... I have ever seen" after it briefly achieved a $473 billion market cap. It's down 93% from its peak (through yesterday's close of $181), but as I wrote in my August 10 e-mail, I think the stock is, at best, worth about $1 per share, so it's still more than 100 times overvalued.

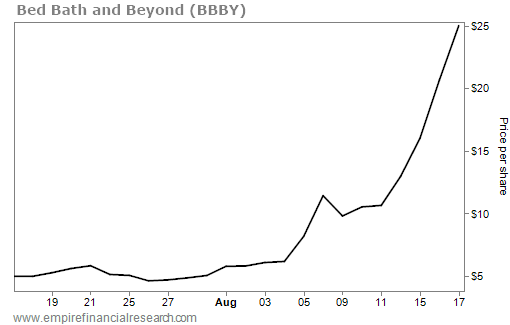

Or consider retailer Bed Bath and Beyond (BBBY), whose business is in full-scale collapse, which will likely lead to bankruptcy. It hasn't earned an annual profit since 2018, it's saddled with more than $3 billion of debt and lease obligations, and it burned nearly $500 million in cash last quarter alone.

Nevertheless, on no news, the stock has skyrocketed this month from $5 to above $25 this morning:

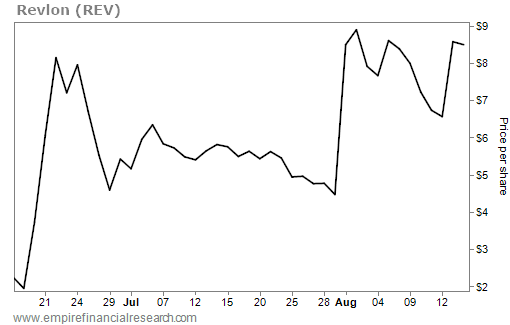

Lastly, cosmetics company Revlon (REV) has already filed for bankruptcy thanks to ongoing losses – it hasn't made an annual profit since 2015 – and a $3.3 billion debt load. The debt trades at less than ten cents on the dollar, meaning it's 99% likely that shareholders will get nothing, yet the stock is inexplicably up massively since the date of Revlon's bankruptcy filing on June 15, thanks to Reddit's WallStreetBets crowd...

I could go on, but you get the idea...

To be clear, this silliness doesn't hold a candle to the meme stock craze, led by GameStop (GME) and AMC Entertainment (AMC), at the beginning of last year. In my January 27, 2021 e-mail, within hours of the absolute peak, I called the top and put 25 stocks, with a combined market cap of $140 billion, into my "Short Squeeze Bubble Basket."

Since then, through yesterday's close, 22 of them have declined (all by double digits), and the average of all 25 is negative 49% in a market that's up 15%, as this table shows:

Note: I removed Hertz from the basket in my May 13, 2021 e-mail.

So why should the average investor, who has the good sense not to speculate in ridiculous meme stocks, care about what's going on here?

The answer is that it can be a warning sign that a wide range of stocks, especially richly valued ones – like those that have led the market rally since mid-June – may be vulnerable to a big pullback.

Take a look at what's happened to Cathie Wood's ARK Innovation Fund (ARKK) – a good proxy for high-growth stocks – since the day I called the top of the meme stock bubble on January 27, 2021:

You can see that after a brief pop, it utterly collapsed, falling at staggering 78% from peak to trough before rallying in the past two months.

In conclusion:

- I'm shifting my overall outlook for the market over the rest of this year from "moderately bullish" (as outlined in my August 2 e-mail) to "neutral,"

- I think it's a good time to bank some profits in growth names that have rallied strongly over the past two months, and

- Today's spike in BBBY smells like a blow-off top to me, and I expect the stock will be back under $10 per share very soon.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.